It was Wimbledon finals weekend and we saw Carlos Alcaraz win an epic five-setter, claiming his first Wimbledon title. Carlos Alcaraz denied Novak Djokovic a fifth successive Wimbledon title and became the first champion outside of the “Big four” of Djokovic, Federer, Nadal and Murray to win the Wimbledon men’s final since 2002. With this win, history has been made and this could be a symbolic moment for the sport with the passing on of the crown.

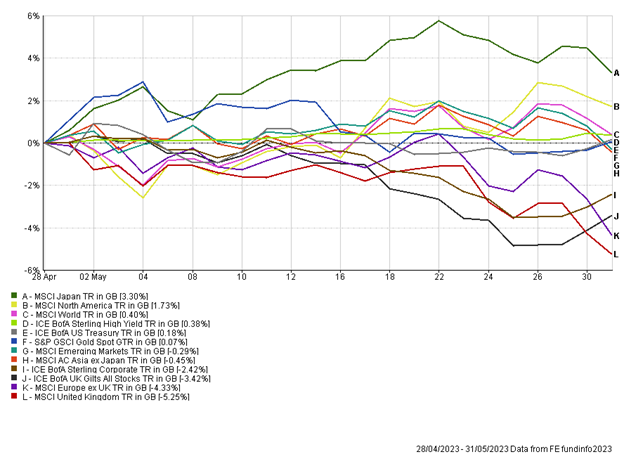

It’s felt like a long time since we were able to report on better-than-expected UK data, but we are able to do that this week. UK inflation data was released on Wednesday and came in below consensus. Headline inflation fell to 7.9% in June from the previous month’s 8.7%, with core inflation (excluding food and energy prices) falling to 6.9%, below the 7.1% expected. The data had a profound impact on UK markets, with the large cap UK index rising close to 2% on the day, while the more domestically focused mid-cap index rose over 3%. We also witnessed a big re-pricing within bond markets. Prior to the data the expected terminal rate for UK interest rates was 6.5% – this fell to 5.75% on Wednesday. This should hopefully feed into mortgage rates over the coming weeks. Chancellor of the Exchequer, Jeremy Hunt, as ever doubled down that the government and Bank of England (BoE) have had to make tough decisions on inflation in recent months and there is still a way to go to reach the inflation target of 2%.

We have also seen the release of UK retail sales this week, another key measure on the health of the economy. Month-on-month, consumer spending was 0.7% greater in June, coming in ahead of expectations. There was a bounce up in food sales, department stores and furniture stores.

Tata group are an Indian conglomerate that own Jaguar Land Rover and this week they announced a deal to build an electric vehicle battery plant in Britain, a major boost for the UK car industry that currently lags the US and EU in the green space. It will become the first Tata gigafactory outside of India, potentially creating up to 4,000 jobs at a total investment of £4bn. The factory has plans to scaleup and provide almost half of the battery production needed in the UK by 2030, in line with Britain’s plans to ban the sales of new petrol and diesel cars from the same year.

US retail sales gave a different story this week as they rose 0.2% (month-on-month) in June, lower than the 0.5% expected. Sales at supermarkets and service stations fell and spending at restaurants and bars slowed. Online sales led the way and surged 1.9%, the most over the last six months, and we are likely to see further gains next month due to Amazon hosting their Prime day promotion – the biggest one to date. With retail sales still rising albeit not as strong as before, the US Fed is still likely to increase interest rates next week following on from a ‘skip’ at their last meeting.

Japan inflation was released this morning and will certainly catch investors eyes as core inflation came in at 3.3% for the month of June (year-on-year). This was in line with expectations, but it is now the 15th consecutive month core inflation has been above the 2% target. An increase in utility bills in addition to increases in food prices is diminishing households disposable income and this data will be closely analysed by the Bank of Japan (BoJ). Sustained inflation for such a period of time has investors debating whether the BoJ will phase out their controversial yield curve control.

There has been further M&A activity this week in the UK market, with US private equity firm Searchlight Capital agreeing to buy the UK listed asset manager Gresham House in a £470m deal. Given the relative cheapness of UK assets currently it is no surprise to see firms swooping in and picking off UK businesses and we would expect this trend to continue if we don’t see a re-rate of UK equities.

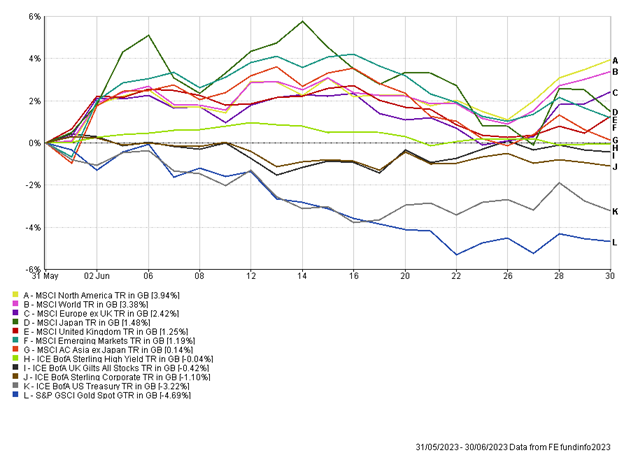

It has been a positive week for portfolios, boosted by strong performance from UK assets, while sterling weakening has also been a driver of returns. US mega-cap growth stocks have seen big swings this week, with Microsoft reaching a new all-time high earlier in the week, although this was offset with large falls in Tesla, Netflix and Nvidia on Thursday.

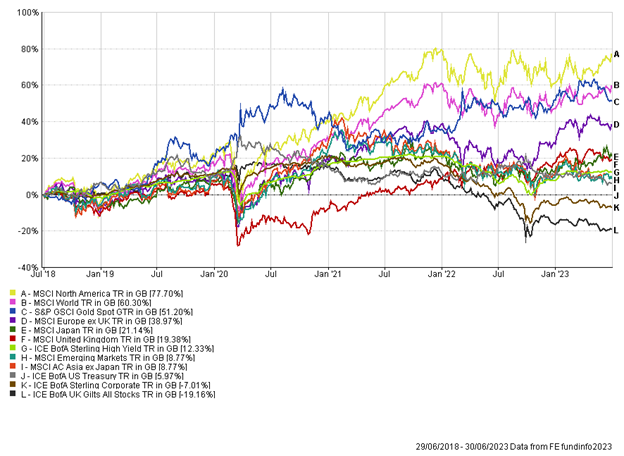

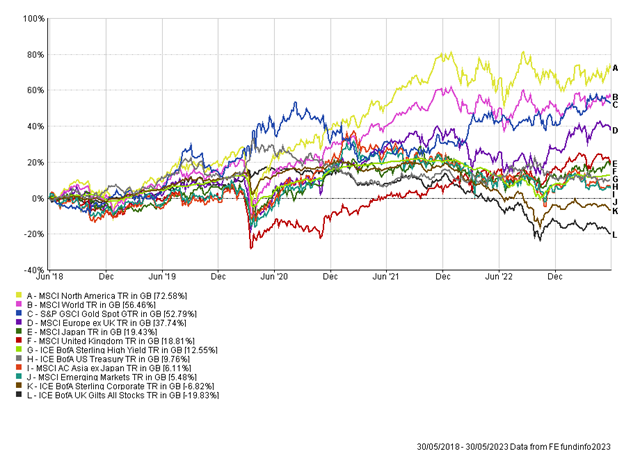

To round up the weekly, I refer to Carlos Alcaraz’s historic performance again. Alcaraz was certainly the underdog heading into the final and underdogs can undoubtedly be overlooked in the investment world. We maintain the message that it is important to have diversification within portfolios and certainly include underdogs, such as UK equities, alongside the fan-favourites, such as US technology.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.