In this month’s Market Commentary, European Strategist, Jeremy Batstone-Carr, discusses inflation and affordability in the UK, debt ceiling negotiations and compromise in the US, plus how enthusiasm for artificial intelligence has shifted into overdrive, and more.

The Week In Markets – 27th May – 2nd June 2023

Five weeks ago, we spoke about the luxury brand Moet Hennessey Louis Vuitton (LVMH) becoming the first European brand to achieve the $500bn market cap value. However, the luxury goods market has been hit over the last two weeks. With the rally initially being driven by demand from China there has been a cooldown in sales, with LVMH shares falling -5.55% over the last month, down to a market cap value of $412bn.

House prices in the UK have fallen at their fastest annual pace in 14 years, as Nationwide reported a 3.4% drop in house prices in May. This fall in house prices is the largest (year-on-year) drop since July 2009, which will be welcomed by potential first time buyers, however rising mortgage rates are still a factor in play. With the UK’s inflation rate slowing less than expected to 8.7% and core inflation rising, the Bank of England are still expected to hold rates higher for longer and this in turn will drive up mortgage interest rates. For first time buyers or home owners whose fixed rate terms will be ending soon, a two-year fixed rate mortgage is around 5.49%, significantly greater than the 3.25% it was a year ago.

Wednesday was the last day of May with inflation results for many of European countries released. German inflation fell to 6.1%, its lowest level in over a year, with headline inflation also falling in France, Spain and Italy. With greater than expected falls in price growth, the next ECB meeting on 15th June in Frankfurt will be interesting to watch as investors had hoped for greater caution on further rate hikes. On Thursday, ECB President Christine Lagarde, acknowledged rate hikes are working but as ever maintained a strong tone stating the hiking cycle needs to continue “until we are sufficiently confident inflation is back on track to return to target”, referring to the inflation target of 2%.

Another hot topic this week has been the story of Artificial intelligence (AI). Nvidia are the world’s largest semiconductor company, who seemingly are the biggest winners of the AI boom as on Tuesday they briefly hit the $1trillion market cap mark. Nvidia are responsible for creating around 80% of the chips (graphic processing units) that power AI. Only Apple, Alphabet (Google), Microsoft and Amazon have reached this $1trillion milestone, with Nvidia’s stock value tripling in under eight months reflecting the rush in interest. Despite the sky-high valuations, investors seem to believe Nvidia’s business has room for growth as AI is still in its early stages and has not yet seen mass adoption.

US Non-farm payrolls were released this afternoon, with a staggering 339k jobs added in May beating the market expectation of 190k. This is a rise to April’s revised figure of 294k. With the strong labour market and inflation in the country falling, the expectations of the US falling into a recession dampens, however it may prove that the next US Fed meeting is not the turning point for rates.

Early this week, Turkey’s president Mr Erdogan was re-elected, winning another five years in power in a decision that has split the country. President Erdogan, who has led the country for the last 20 years, secured 52% of votes in a narrow win, the closest the president has come to being unseated. Notoriously known for harsh levels of intimidation and jailing opposition politicians and journalists, the population are torn over the president’s use of state resources and control of media to influence the result. With the dust settling, a spiralling economy, rampant inflation of 43% and significant Syrian migration commotion within the country are tasks the President will have to face immediately.

Continued signs of rate hikes, imminent recession fears and political unrest are just some of the issues challenging investors currently. Despite this we continue to focus on long-term opportunities, while ensuring there is sufficient diversification in portfolios to help protect against short term unease. To quote Simon Evan-Cook, who sits on our investment committee, with long-term investing it’s best to “keep your hands in the car at all times”.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 20th May – 26th May 2023

It has been a busy week in markets and for the team at Raymond James Barbican. On Thursday, the team participated in an industry wide football tournament that was organised to help raise funds for a cancer research trust, Sarcoma UK. After impressing in the group stages and winning the group the team were knocked out in the quarter finals on penalties.

One of the biggest shocks this week was the release of the UK’s inflation rate. Headline inflation (year-on-year) for April was 8.7%, the first time it has fallen below 10% since August 2022. However, the drop in inflation was less than anticipated and core inflation (excludes the price of food and energy) was the main cause of concern as it rose from the previous month to 6.8% in April. UK government bond prices have fallen (yields rise) on the back of the data with the 2yr government bond yield rising above 4.5% as investors are now expecting further interest rate rises from the Bank of England (BoE). Rising inflation is also a key worry for the Prime Minister Rishi Sunak, who promised to halve inflation by the end of this year, requiring it to fall to 5%. It may have been too great of a promise as the Conservative party have lost seats in local elections and are under pressure heading into the national election next year.

Rising bond yields (falling prices) have been a theme this week with US government bonds also suffering following the release of US Fed meeting minutes. While there was acknowledgement that the need for further interest rate rises “had become less certain” it also wasn’t ruled out and this was enough to cause a sell-off in bonds.

UK Retail sales surprised this morning, rising 0.5% in April (month-on-month). This is up from the -0.9% in March which the Office for National Statistics believe were hindered by unusually heavy rain, keeping shoppers at home. This rise certainly suggests there has been little impact from the surge in inflation at this moment in time. Pound sterling has risen against USD to 1.235 since the news, following weakness earlier in the week. Households have been resilient, however it’s evident the squeeze will begin as 1.5m households face an increase in mortgage interest payments this year.

Ryanair, Europe’s largest airline by passenger numbers, have released a report stating they expect 10% traffic growth this year as they posted better than expected net profits of €1.43bn. Robust demand for airlines tickets show travel has not been affected despite rising interest rates and Ryanair plan to operate almost 25% more flights than pre-Covid levels this summer. CEO Michael O’Leary had a bearish tone on the future, however, as he believes demand for European short haul flights could drop this winter and early 2024 as consumer spending becomes strained.

The German economy is the largest in Europe and the fourth largest in the world after the United States, China and Japan. However, after revised figures, GDP in the country fell by -0.3% in Q1 2023. This follows the -0.5% in Q4 2022 meaning they are in a technical recession. The warm winter weather eased the pain felt from their over reliance on Russian energy but even a rebound in industrial activity and the easing of supply side issues were not enough to help the Germans avoid recession. The German Chancellor, Mr Scholz, appeared to be more optimistic about future growth in the economy stating the massive expansion of clean energy “would unleash the strengths of the economy” coupled with investments in semiconductor and battery factories.

The recent artificial intelligence (AI) excitement has led to a very narrow market rally, led by some of the mega-cap US growth stocks. Nvidia is one of the stocks that represents the AI rush. On Wednesday it released better-than-expected results and saw its share price rally around 25%, adding around $200bn to its market cap, which is now approaching $1 trillion. The company now trades at an eye-watering valuation and while the narrative is certainly compelling, we only need to look back a few years to see how it can be dangerous to get too carried away with powerful stories. During COVID-19, stocks such as Zoom and Peloton saw their share prices rise by significant amounts on the back of the work-from-home story, only to see falls of 80% or more since reaching highs.

The current market conditions have been challenging for portfolios this week, with bonds struggling while equity markets in general have also been weak. The bright spots have come from the technology sector and areas of Japan. We continue to be mindful around the lagged effects of rising interest rates and acknowledge the inflation and interest rate outlook could look very different in the coming months.

Andy Triggs, Head of Investments & Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 13th May – 19th May 2023

Artificial Intelligence (AI) is likely to play an increasing role in the future. What exactly is AI? Simply put, it is a machines ability to perform traits of human intelligence, such as learning, problem solving and perception. Why is it the future? On Thursday, BT Group, Britain’s biggest broadband and mobile provider announced plans to cut up to 55,000 jobs by 2030 and adapt to new technologies such as AI. BT Group CEO, Phillip Jansen, believes after completing its fibre roll out and simplifying its structure with AI, the business will gain significant profits whilst delivering better customer service.

AI is certainly a concept investors are warming to but there are still concerns around the rules and guidelines it needs. CEO of Open AI, Mr Sam Altman, was called to Congress this week along with other top technology CEOs to touch on the risks AI could potentially pose to society, how it would affect the jobs market and why regulations for the technology was mandatory. “If this technology goes wrong, it can go quite wrong” were the words Altman shared before suggesting a federal agency be created in order to review AI programmes before they are released to the world. It is evident that AI may eliminate some jobs, but it is also likely we see job creation as training and education is introduced in the future.

On Wednesday we saw a slight rise in the unemployment rate to 3.9% from January to March, signalling weakening in the labour market. This is an indicator that the Bank of England (BoE) will consider before their next rate meeting on the 22nd of June. There has been an increase in the amount of people that are looking to join the labour force again and this helped alter the unemployment figure. We must highlight that over 2.5m workers have been out of work due to poor health since the pandemic, with the blame pointed at record-long NHS waiting lists. UK Chancellor, Jeremy Hunt, has recently provided greater funding for childcare costs in an effort to encourage more workers to return to the labour force.

Businesses owned by Mr Elon Musk are rarely side-lined in the news and this week is no exception. Twitter, the social media platform, has a new CEO taking the place of Mr Musk, and this is Linda Yaccarino, who has developed the nickname “Velvet Hammer”. Having previously run NBCUniversal, the ad’s sales business, her main objective has been identified; to bring back advertisers to the business. Since the $44bn takeover by Mr Musk, ad sales have halved to $2.5bn as brands were conflicted with the significant moves made by the previous CEO. Will Mr Musk give Ms Yaccarino enough room to operate and convince brands that they can operate in a less controversial environment? This question can only be answered in time.

Japan’s headline inflation for April (year-on-year) was higher than expected at 3.5%, with core inflation (which excludes the cost of fuel and energy) rising to 3.4% from the previous 3.1%. This is now a fresh four-decade high of inflation in the world’s third largest economy and investors are increasingly wary that Bank Governor Uedo will stray from his previous dovish stance and tighten policy in order to reach the 2% inflation target. Japan’s GDP for the first quarter of 2023 was stronger than expected at 1.6%, driven mostly by increasing tourism and strong corporate earnings.

News in markets is ever flowing and can be perceived in good or bad light. In these times we as always maintain our message on diversification and ensuring portfolios are not overly exposed to market narratives. It is important to focus on the long-term opportunities that are created in markets.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

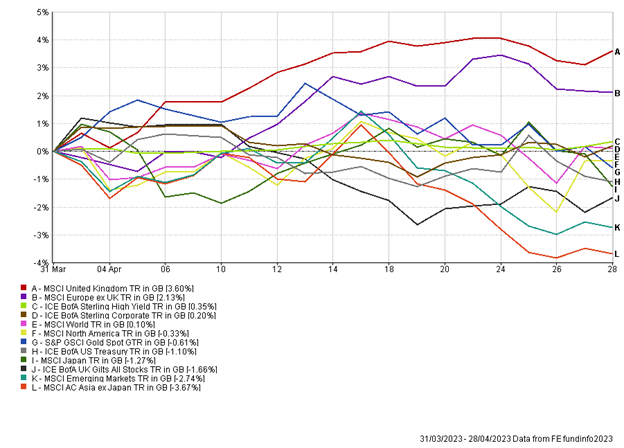

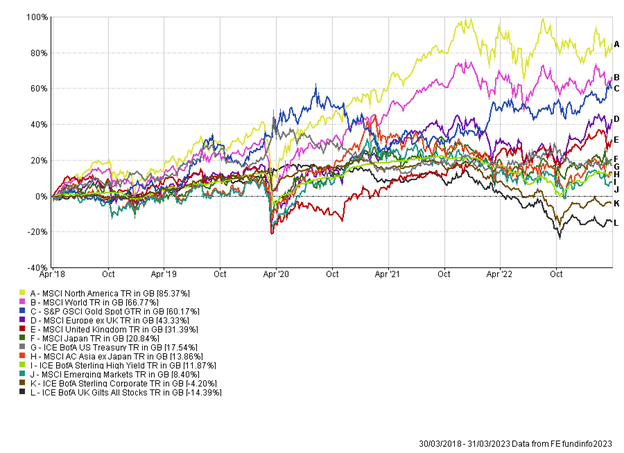

The Month In Markets – April 2023

The Week In Markets – 6th May – 12th May 2023

Heading into this week UK investors were focused on the outcome of the Bank of England’s meeting. Following the 25bps (0.25%) moves made by the US Fed and European Central Bank (ECB) last week there was a strong feeling that UK policymakers would mirror their counterparts.

The BoE meeting took place on Thursday morning and concluded with a 25bps rise, setting interest rates at 4.5 %. This is now the 12th consecutive rate hike with rates reaching a level last seen in 2008. Analysing the MPC votes, 7 out of 9 of the committee voted for a hike with only two members voting for no change. The strength in belief of the decision falls hand in hand with Governor Andrew Bailey’s comments, stating “We must stay the course to make sure inflation falls back to the 2% target”. It is unclear whether this will be the peak in interest rates as UK inflation still remains high, driven by rising food prices and a resilient labour market, factors the BoE consider before decisions. Will we reach the 5% mark before the end of the year? We will have to wait and see. Following the meeting the BoE released their growth forecasts for the UK. After a very bleak outlook at their February 2023 meeting, UK growth was significantly upgraded by the BoE in what Governor Bailey said, “may be the biggest upgrade we’ve ever done”. Despite the outlook for the UK not looking great, the news that the country is expected to avoid recession is positive.

The BoE’s comments on UK GDP looked a little foolish this morning, as GDP data came in showing the UK unexpectedly declined by 0.3% in March, lower than expectations.

US inflation data was released on Wednesday, coming in at 4.9% (year-on-year) for April, slightly below the 5% in March. Month-on-month inflation was 0.4%, in line with forecasts. Inflation has remained persistently high and although this is the 10th consecutive month inflation has dropped, it is still running over double the 2% target the US Fed have set. Shelter (rent) once again was the key contributor to the monthly increase. Despite inflation being above target, there is a lag between policy action and effect, which is acknowledged by the US Fed. Therefore, there is potential for the Fed to pause rate rises and assess the impact on the economy.

Inflation continues to dominate the weekly as German inflation for April was also released on Wednesday. Headline inflation was 7.2%, falling slightly from the 7.4% in March. Food price inflation was the major driver of German inflation, it remains elevated but has slowed from 22.3% to 17.2% this month.

China has been an under discussed topic this week as investor minds were elsewhere, however economic activity in the country seems to be slowing. Imports in April (year-on-year) collapsed by -7.9%, a sharp fall from the previous month of -1.4%. This data came as a surprise given the recent re-opening of China and pent-up demand and excess savings of consumers. Exports slowed to 8.5% (year-on-year) from 14.8% in March. Higher interest rates and recession risks for many of China’s global trading partners have a part to play showing that the post pandemic recovery will be slower than expected. Market expectations for China’s GDP growth of around 5.5% – 6% will certainly be revised.

Apple, the world’s largest company has decided to delve deeper into the emerging markets (EM) and has announced the opening of their first online store in Vietnam. The company most known for the iPhone has focused on driving growth in other EM countries with first stores opened in Mumbai and Delhi amid the slowing sales in China. Younger populations, scope for better infrastructure and less product competition are just a few reasons Apple are betting on the EM space.

To round up the weekly, I am going to echo the words of Governor Andrew Bailey. “We must stay the course” is a leading approach and this is consistent with our internal investment philosophy and process. We identify exceptional fund managers that can operate in a variety of market environments, while maintaining a long-term approach.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 29th April – 5th May

This week we entered the fifth month of the year. It has already been a significant start to the month with various data releases including the conclusions of the US Fed and European Central Bank (ECB) meetings. Both policymakers decided to increase base rates by 25 bps, despite differences in opinions from investors. We will discuss this in more detail shortly.

Firstly, it’s important we cover First Republic, which is the latest US regional bank to collapse, and it was slightly larger than Silicon Valley Bank (SVB), which made the headlines in March. On Monday, US regulators seized First Republic bank and JPMorgan were successful in the government auction, acquiring the bank. First Republic was subject to the same doom as SVB, as interest rates rose, the large loans on First Republic’s books dropped in value. They also planned to sell off unprofitable assets such as low interest mortgages that were provided to clients, as well as plans to lay off up to a quarter of its workforce but this proved to be too little too late. Once SVB went under and knocked confidence in the regional banking system, clients pulled over $100bn of deposits from First Republic in a few days with ease via the use of mobile devices. The US Fed stressed that the resolution of First Republic was “an important step to drawing a line” under a period of stress in the banking system.

On Wednesday the US Federal Reserve took further steps to battle inflation and raised rates by 25bps to 5.25%. There were many investor whispers before this was announced that the US Fed were considering a pause, however commentary from Fed Chair Jerome Powell has proved this was not even an option considered. “We are prepared to do more” is a strong tone that indicates the Fed are hell bent on reaching their inflation target of 2%. The next policy decision will be in June. Many investors consider the US Fed to have now finished their interest rate hiking cycle, however stronger than expected US Non-Fam Payroll data, released this afternoon, points to resilience in the labour market. This will likely keep upward pressure on wage inflation and consumer spending and may mean the US Fed continue in raising interest rates.

Eurozone inflation on Tuesday was a mixed bag of results as headline inflation (year-on-year) increased to 7%, however core inflation (excludes food and energy prices) fell to 5.6%. This was a big talking point ahead of the ECB meeting as external policy makers, including French central bank chiefs, suggested a more measured move was needed to allow European economies to adjust to the effect of previous hikes.

The ECB finalised a 25bps rate hike, which is a slowdown from previous 75bps and 50bps hikes since July 2022. The headline interest rate is now 3.75%, and this is likely to increase further with President Lagarde stating, “We know we have more ground to cover”. This ruthless tone shows the dedication the ECB has towards the 2% target it has set for inflation. The Bank of England is next up in line next Thursday, and if I was a betting man, I would back a 25bps hike from the current level of 4.25%.

In the UK, some headway was made with the Government and NHS coming to an agreement on a 5% pay increase for NHS staff. This move was agreed by health union GMB who have accepted the government’s “take it or leave it” offer, however this could split unions as health union Unite, rejected the deal with workers set to continue strikes. Tens of thousands of nurses are expected to stage a 28-hour strike from Sunday evening, even after being presented with a deal of a one-off payment of £1,250 – £2000, on top of a £1,400 rise in basic pay. However, unions are still concerned the pay increase is not significant enough as inflation remains high, outstripping the proposed wage increases.

In such complicated times it’s important to maintain a long-term approach to investing. Being invested doesn’t necessarily exclude you from the dangerous waters but a long-term approach and added diversification in portfolios certainly allows investors to face up to them with more success. Valuations across most equity markets continue to look compelling, while yields on fixed income assets have rarely been higher over the last decade.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

Tug of war

The Week In Markets – 22nd April – 28th April 2023

This week has seen Moet Hennessy Louis Vuitton (LVMH) market cap exceed $500bn. It is the first European name to achieve this, taking a place in the top 10 companies in the world by market value, a list dominated by US and Saudi Arabian names. This milestone also sees founder, Bernard Arnault, take the title of the world’s wealthiest man. LVMH have most recently benefited from the improving economic outlook in China, as consumers have propelled spending after the removal of the Covid restrictions.

Over the past year, the UK has been touted as a key spot for M&A, with some of the most active sectors including technology, healthcare, and consumer goods. Increased M&A can be a good thing as it helps identify how other countries view our economy and the opportunities that exist. Medica group is the latest to be snapped up by a private equity firm resulting in a share price surge of 33%. This is a company we have exposure to through our UK Smaller companies position.

We are still in earnings season and Barclays have announced stronger than expected first quarter profits at £2.6 billion. This is a 16% profit jump from this time a year ago, as its results prove that it has not been hindered by the US regional banking crisis, despite Barclays expanding its investment and retail banking overseas. Performance was driven mainly by its credit card business, rising by 47% to £1.3bn, a sign that consumers are beginning to feel the pinch of elevated inflation.

Economists this week have been trying to predict the future and envisage what the ECB are likely to do ahead of next weeks meeting. It is almost certain that we will see a 25bps rise to take the base rate to 3.25%, as inflation reports around the Euro zone are still greater than the 2% target set. ECB President, Christine Lagarde, maintains the message that the central bank “still has a way to go” with monetary policy, as core inflation appears to be more stubborn than anticipated, pushing back the timeline for the rate pause.

In the US, President Joe Biden launched his re-election bid promising to protect Americans from “extremists” connected to former president Donald Trump. It is very likely that he will face Trump again in the November 2024 election as he started his campaign video with imagery from the 6th of January 2021 attack on the US Capitol by Trump supporters. The American population have concerns over the age of Mr Biden, 80, who would be 86 by the end of a potential second term. However, his triumphs during his reign have included billions of dollars in federal funds tackling the Covid pandemic, signing a $1.2 billion infrastructure bill into law and overseeing the lowest levels of unemployment since 1969.

US GDP figures for the first quarter were released on Thursday at 1.1%, coming in lower than the forecasted 2%. There was an acceleration in consumer spending which accounts for over two-thirds of US GDP, with increased purchases of motor vehicles, visiting restaurants and hotels. This, however, was offset by falling business confidence leading to smaller inventories held in anticipation of weaker demand. The US Fed is also expected to meet next week, with investors predicting that another 25bps hike is on the cards. It is still to early to predict whether this will be the last hike of the fastest monetary policy tightening in over 40 years.

We as always maintain our message on diversification, ensuring portfolios are not overly exposed to shifts in market narratives. It is important to focus on the long-term opportunities that are created by the short-term volatility in markets.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 15th April – 21st April 2023

Last week we saw the successful launch of a satellite to Jupiter. On Thursday, Space X – run by Elon Musk, attempted to launch their Starship but to less triumph. Only four minutes into the launch, the rocket exploded. Despite the setback, Mr Musk was very positive about the event, stating “success comes from what we learn”. This is certainly a powerful quote to keep in mind.

On Thursday we received UK inflation data. Headline inflation for March was 10.1% (year-on-year), higher than the forecasted 9.8%. Core inflation (which excludes food and energy prices) came in at 6.2%, similar to the previous month of February and 20bps greater than forecast. The UK is now the only western European nation with inflation remaining in the double digits in March. The market is now pricing in higher terminal interest rates for the UK and has not ruled out the Bank of England (BoE) having to increase rates by 0.5% at the next meeting. High inflation is not only an issue for the BoE but the government also, as earlier this year Prime Minister Rishi Sunak promised to halve inflation, which would require it to fall to approximately 5% by December.

The UK unemployment rate for February was released this Tuesday, coming in at 3.8%, this is 0.1% higher than the forecasted figure and previous month. The number of job vacancies also fell for the ninth consecutive month, although it remains high at 1.1 million as companies struggle to hire staff. Firms are being encouraged to find new ways to develop talent and boost productivity, with emphasis on increased worker training, more flexible working and the expanded use of apprenticeships. The average wage growth (excluding bonuses) was 6.6% despite the rise in unemployment and decline in vacancies, however this is still being eaten into by elevated prices.

Earnings season this week in the US has got off to a strong start with 90% of companies beating expectations. The general consensus in markets is that although 90% of companies are beating expectations, the bar set to beat is low, given the uncertain outlook and recent earnings revisions. Netflix beat their earnings expectations, reporting $2.88 earnings per share over the first quarter. The company delayed plans to crack down on password sharing to Q2 and have plans to adopt a new ad-supported service in order to accelerate growth in revenue and profit. Netflix are less reliant on subscriber growth as they shift to a more advertising focused business model, but they did add 1.75m new subscribers from January to March.

China GDP for Q1 was released earlier this week at 4.5%, beating expectations of 4%. Retail sales largely drove this rise in GDP as they jumped 10.6% in March (year-on-year) as consumers are on a spending spree after three years of the zero-Covid policy was lifted. With the increase in consumer confidence and pent-up demand, there still seems to be room to run. Last year China GDP was 3%, missing the official growth target of 5.5%, however the International Monetary Fund believe this year China can get closer to the target and grow 5.2%. The resurgence of China not only benefits the domestic economy but has helped other regions and companies. China’s demand for luxury goods has benefited European listed LVMH, which has seen its share price rise around 40% since China re-opened.

As an investment team we are continually engaging with industry professionals, aiming to gain insight and challenge our own views and thoughts. During one such meeting this week we were reminded of a quote from Thomas Rowe Price Jr – “Change is the investor’s only certainty”. For us, this means being willing to accept the world can look very different in the future and ensure that portfolios are well diversified and not concentrated around one single narrow viewpoint.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.