April is certainly a month full of history as the 60th anniversary of the first Ford Mustang looms. Another piece of history was created this afternoon as the European Space Agency successfully launched a satellite from French Guiana destined for Jupiter. The spacecraft is on an 8-year journey with its mission clear, to explore whether Jupiter’s Ocean bearing moons can support life!

After the UK’s third bank holiday on Monday, tens of thousands of junior doctors began a four-day strike. The strike is a continuation of various public sector strikes over the past 11 months, with workers continuing to fight for pay rises in line with inflation. Over 350,000 healthcare appointments over the four days have been rescheduled adding considerable disruption to the NHS system.

On Thursday we saw the release of UK GDP for the month of February. Month-on-month GDP was flat, falling just behind the expectation of 0.1%, with year-on-year GDP coming in at 0.5%. The impact of the public sector strikes was more significant than expected as they weighed on output, coupled with uncommon mild weather leading to a fall in the use of electricity and gas. This data release will be another factor for the Bank of England to consider in next month’s monetary policy meeting as the prospect of continuing to raise interest rates may harm growth prospects.

US inflation data for March was released on Wednesday coming in at 5%, lower than February’s 6% and a continuing decline since the peak of 9.1% inflation back in June 2022. Core inflation (excluding energy and food prices) is a different story however, coming in at 5.6%, slightly greater than the previous month. Russia’s invasion of Ukraine last year led to soaring energy prices, but we have since seen prices cool significantly contributing to the overall fall in inflation. Despite the downward trend in inflation, the US Fed are still expected to stay stubborn and continue to raise the base rate. If we remember back to 22nd of March, they raised the base rate by 25bps despite the failure of Silicon Valley Bank, showing their intent on taming inflation.

Twitter is an interesting case study as this week the CEO Elon Musk discussed the social media firm’s status. Since the $44 billion acquisition last October, Twitter has been clouded by commotion and uncertainty, with major layoffs and Mr Musk’s unpredictable leadership driving this. Twitter now has approximately 1500 employees, a sharp decline from the 8000 employees 6 months ago. However, Mr Musk is confident these layoffs have been essential in order to turn around the £3billion negative cash flow position and is confident Twitter can deliver positive revenue growth this quarter as advertising on the platform has boomed again on the back of Twitter reaching new highs in terms of user numbers.

Chinese inflation data showed consumer inflation had hit an 18-month low, in stark contrast to the western world. There is a real danger that China may fall short of their inflation targets, and it has opened the door to further monetary policy easing and stimulus within the world’s second largest economy. Such support should be a boost for not only the domestic Chinese economy, but the global economy as well.

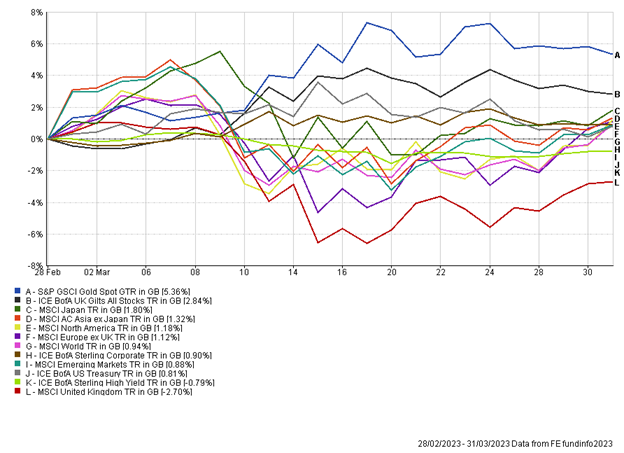

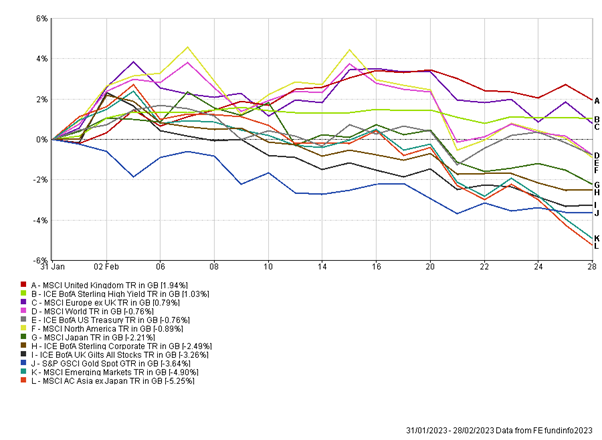

It’s been a strong week for equities, with most major indices grinding higher, supported by falling inflation and receding concern around the banking sector. Lower interest rate expectations from the US has led to the US dollar falling in 2023, and this week sterling hit a 10-month high versus the US dollar. We’ve spoken about the prospect for a pickup in M&A activity within the UK market, given the low valuations and historically low value of the currency. On Friday Dechra Pharmaceuticals, a UK veterinary medicine group, confirmed it was in talks to be sold to a foreign private equity firm. The shares jumped 40% on the news.

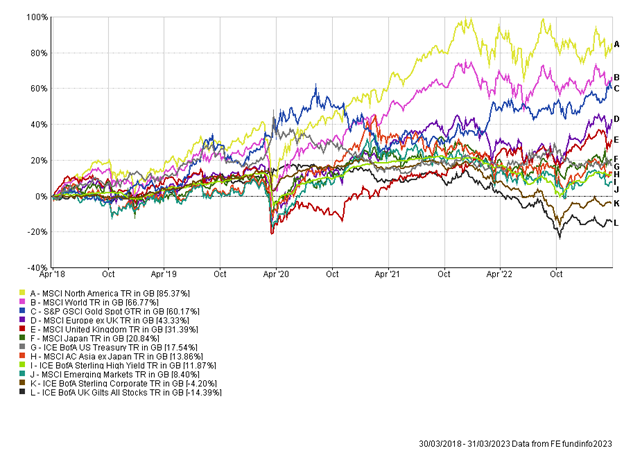

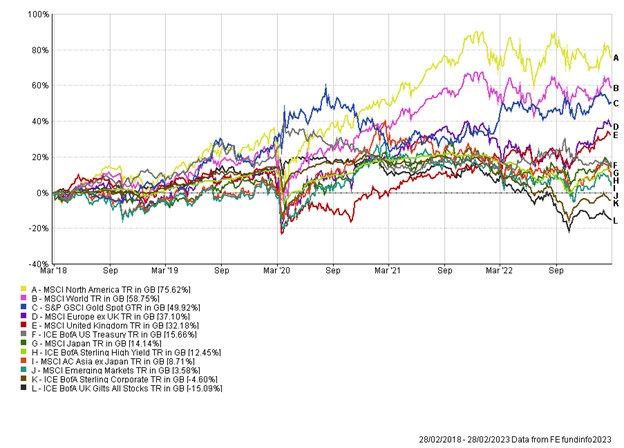

The roundup of the weekly is always consistent, even though last week’s football analogies were painful to read for some! We continue to blend asset classes in portfolios to diversify risk(s) and smooth the overall return profile. Our key message is to maintain a long-term investment mindset in order to best take advantage of the short-term instability.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.