This week saw the appointment of Rishi Sunak as the leader of the Conservative Party and the first Indian-heritage UK Prime Minister. He is the third UK Prime Minister this year and the fifth in six years; the Conservative party will be keen for some stability to return and put an end to the revolving door at No. 10.

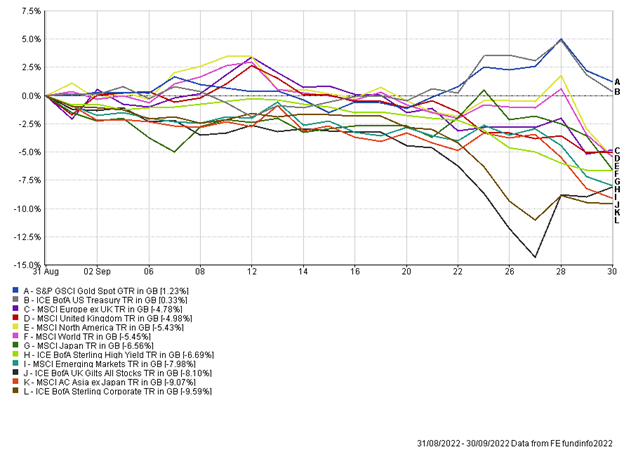

Penny Mordaunt once again declared she would run for the UK’s top seat however the endorsement Mr. Sunak received was so significant that Ms. Mordaunt didn’t stand a chance. Britain is facing an economically toxic combination of high inflation and rising interest rates. Mr. Sunak’s first task was to restore the UK’s financial credibility after previous PM Liz Truss shocked the bond market with plans for unfunded tax cuts and an extended energy price guarantee, forcing the BoE to intervene. Sunak’s focus on financial stability has been well received by markets so far – we have since seen a reversal in government bond yields, with borrowing costs for the UK government now back at pre mini budget levels. We have also seen a recovery in the Sterling, closing Thursday night at $1.16.

Jeremy Hunt has stayed as Chancellor and earlier this week announced he would be delaying the Autumn statement. It was originally due to be published on 31st of October but will now be unveiled on the 17th of November.

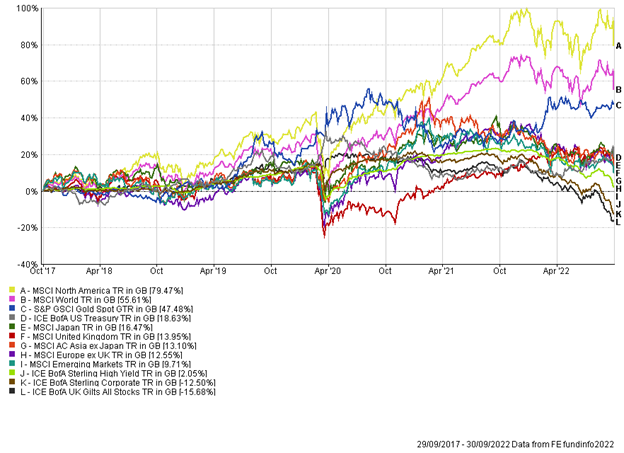

This week saw Q3 earnings releases from a range of the mega-cap behemoths in the US. The results have been disappointing, and we have seen big declines in their share prices. Meta (formerly facebook) fell 20% after another quarter of disappointing results. The share price has now fallen around 65% in 12 months, and it is estimated that CEO Mark Zuckerberg’s wealth has declined by a staggering $100 billion over that period. There has also been weakness in Microsoft and Google this week, with results showing their growth rates are slowing. Amazon does not appear immune from the challenging conditions, their results last night were underwhelming, with the share price expected to open 14% down today. Rising costs for these companies, coupled with a weakening outlook for consumers and businesses has impacted consumer and advertising spending.

With the news of weaker earnings and an economic slowdown, this could be a reason that central banks may begin to slow rate hikes. It may be premature to call it a ‘pivot’, but we saw the Bank of Canada hike by 50bps rather than the 75bps expected by markets. The European Central Bank (ECB) did hike rates by 75bps, but Christine Lagarde, President of the ECB, spoke at a press conference after the interest rate hike and appeared very dovish, giving investors confidence a pause in their hiking cycle could be round the corner. Investors have now set alarms for the next US Fed meeting next week. While a 75bps hike is almost guaranteed, weaker economic data may allow the Fed to begin to slow, or even pause the hiking cycle going forward.

We can conclude this weekly once again discussing Twitter – Elon Musk has completed his takeover of the social media platform. He has begun his reign with ruthless efficiency, firing many top executives claiming, ‘the bird is freed’. The CEO of Tesla has outlined his plans for Twitter as a free speech platform but preventing hate and division, this includes scraping permanent bans on users. An innovation that Twitter could also see is it becoming a “super app”, this offers everything from money transfers to shopping.

Markets may continue to be choppy given the uncertainty in the global economy. However, there is long term value appearing in asset classes, while bond markets have stabilised. Government bonds, once a sleepy asset class, are now offering yields we have not seen for 15 years. As Michael Gove returned to government this week, he joked that after months of turbulence “boring is back” – let’s hope the same is true for government bond markets!

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.