Following this week’s bank holiday Monday, markets have seemingly not taken any time off. On Wednesday, Russia for a second time this year halted gas supplies via Germany’s key supply route (Nord Steam 1) raising the prospect of an incoming recession and energy rationing across Europe.

The Nord Stream 1 pipeline will be out for maintenance until Saturday 3rd September; however, it is being reported that Russia will return flows at 20% of capacity down from the 40% that was returned at the end of June. The German network regulator expects Germany to cope with the three-day stoppage as their storage tanks are currently at 83.65% capacity, not far off their 85% target ahead of the winter season. Russia has already cut supply to Bulgaria, Denmark, the Netherlands and Poland. Further restrictions would exacerbate the energy scarcity that is driving prices across Europe as wholesale prices are up almost 400% since last August. European Union energy ministers are set for an emergency meeting on 9th September to discuss a potential EU-wide energy cap.

Heading across the water to the US, last Friday’s Jackson Hole Symposium was a highly anticipated event and has certainly had a huge effect on the US Equity market this week. Fed Chairman Jerome Powell used only 8 minutes and 28 seconds of his planned 30-minute slot, stating ‘’the Fed are taking forceful and rapid steps to moderate demand, so it better aligns with supply, and to keep inflation expectations anchored. We will keep at it until confident that the job is done’’. With such hawkish commentary, it seems the FED is more than willing to risk a recession & so investor hopes of a central bank pivot were firmly crushed. This commentary fed into US equities this week with the S&P 500 down around 9% from its 16th July high. The Tech-heavy NASDAQ, which is more sensitive to FED policy has dropped nearly 11% over the same period. Mr Powell’s sharp delivery also played on European markets minds with investors now questioning the pace at which European rates will rise.

First Friday of the month sees the release of the US Non-farm Payroll jobs data. The US Economy added 315,00 jobs in August, coming in ahead of consensus, and highlighting the strength of the labour market.

In the UK, the strikes continue to come thick and fast. Over the last few months, Rail and Tube workers have led strikes with disputes over pay and working conditions. 115,000 Royal mail workers followed suit and walked out on Wednesday 31st August. It has now been reported that thousands of BT and Openreach staff will be striking this autumn as they step up their demands for better pay. Companies are reluctant to hike wages at the high rates that are being demanded as they do not want to further fuel inflation.

China is set for another lockdown as the city of Chengdu recorded 157 new covid infections. China is the last major economy wedded to the zero-Covid policy and 21 million people are now subject to mass testing and lengthy quarantines. Entertainment venues including bars and cinemas are also certain to be shut into the winter period. This will continue to stifle China’s post pandemic economic recovery, with President Xi Jinping, who is set for his third term, continuing to pump government resources to support the business sector.

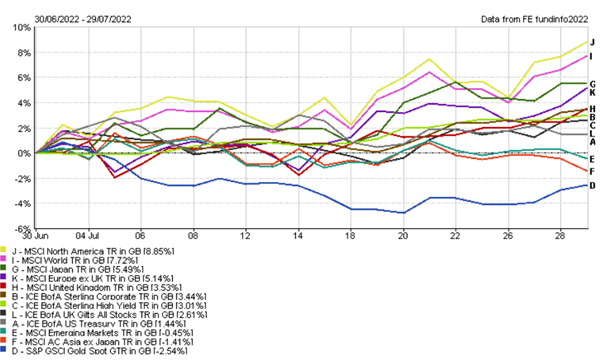

Although global news around markets continues to be lacklustre, we believe there are opportunities to be found. It is also a reminder that being diversified not only through asset class, but region and investment style is key. We will continue to maintain this thought process and are focused on the long-term strategy that can sometimes be forgotten in the short-term mist.

Nathan Amaning | Investment Analyst, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.