“Upside Down” was a hit single for Diana Ross in 1980. There does seem to be parallels with the song and the current global economy, which was highlighted again this week through global central bank action.

Over the last 20 years or so inflation has been a problem for emerging markets, who have had to raise interest rates to contain inflation, while developed markets have typically experienced benign inflation. This year has been upside down and inside-out with developed markets plagued by high inflation and having to tighten policy, while emerging markets, having already begun hiking interest rates last year, have been in a much better position. The New Zealand central bank raised interest rates by 0.50% at the start of the week and indicated there was more to come. At the same time, the Russian central bank cut interest rates by 3%, citing a slowing inflation outlook and strong currency as the driver. Russia’s huge cut followed a surprise interest rate cut from China last week, a nation that is currently experiencing inflation levels of just over 2%.

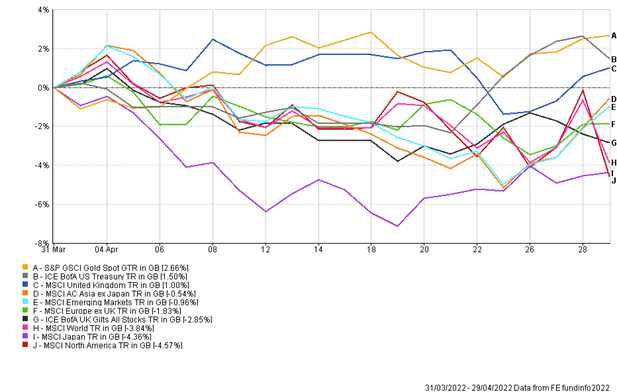

Thankfully equity markets turned upside down this week, with the US equity market looking like ending an eight-week losing streak to end the week higher. Gains have extended across most regions this week with European equities on course for their best week in over two months. One of the major headwinds for global equities has been the inflation story and response from developed world central banks. It was interesting to see this week that Atlanta Fed President Raphael Bostic suggested a pause may be required in US interest rate rises in September. Investors are beginning to question whether the economy can withstand such aggressive Fed policy.

It wasn’t all rosy with the US equity market, as social media company Snap fell almost 40% after issuing a profit warning. The stock now trades below its IPO price in 2017. It’s another example of the market severely punishing companies for missing targets. We think this backdrop lends itself to active managers, who can carry out deep, fundamental research into a company’s financial statements and outlook.

In the UK the big news was saved for Thursday, with Chancellor Rishi Sunak announcing a windfall tax on energy firms, using this tax to help households with soaring living costs. Oil majors Shell and BP saw their share prices actually rise on the day, potentially driven by a 3% rise in the price of oil, which likely more than offsets their increased tax burden. The brent oil price pushed through $115 a barrel this week with continued concerns around supply. With sky high hydrocarbon prices and Europe’s desire to move away from Russian energy dependence there is a huge need for investment into renewable energy and this is likely to provide good investment opportunities going forward. Interestingly, some of the traditional energy companies are looking to utilise their high profit levels to pivot more into renewable energy. This was highlighted through Total’s proposed acquisition of the 5th largest renewable player in the US on Wednesday.

Economic data has been mixed over the past seven days. There were bright spots in the UK, with retail sale rising month-on-month. Wage data showed that employers raised wages by around 4% over the three months to April. While this is higher compared to recent years, it is still below the current inflation levels. US Durable goods orders, which measures industrial activity and is used as an economic indicator by many investors, came in slightly below expectations. US Q1 GDP was revised down to -1.5%, showing the economy contracted slightly more than previously thought.

Despite what appears to be disappointing data, the US equity market has been strong this week, and hints to what was alluded to in last week’s note – that bad news may actually be good news – that it prevents central banks from tightening policy too much or too quickly and allows the global economy to operate in a low-rate environment for longer.

Andy Triggs, Head of Investments & Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.i