This week we entered the month of August, with the Olympics up and running! Team GB have made a good start with 25 medals so far, including nine golds, and sit fourth in the medals table. In what has been a hectic week in markets it has been government bonds that have won the gold, with rate cuts and increasing concerns about a slowing global economy supporting the asset class.

The US Federal Reserve and the Bank of England (BoE) both met in what would be a busy week for markets. Let’s start with the BoE who announced the first interest cut since March 2020. Governor Andrew Bailey and the eight other members were split on the decision of lowering interest rates, with five members voting for a cut, and four voting to hold rates. In the press conference Mr Bailey noted that “inflationary pressures have eased enough to cut rates”. Inflation fell to target of 2% in May and has remained there over the month of June, although market expectation is that inflation will spike to 2.75% due to energy prices before falling again to target in 2025. The BoE has also upgraded economic growth expectations for the year from 0.5% to 1.25%, highlighting the resilience of the UK economy.

The US Fed met the day before the BoE, but the outcome was different as they decided to hold interest rates firm at 5.5%. Investors are however increasingly optimistic on the Fed cutting rates as soon as September with Fed Chair, Jerome Powell, stating “we are getting closer to the point”. US weekly jobless claims increased by 14,000 to 249,000 and exceeded market expectation of 236,000 suggesting some softening in the labour market. The Fed will certainly be cautious to ensure the labour market does not deteriorate from here.

US Non-farm payrolls are in this Friday afternoon as 114,000 jobs were created in July. Market expectation was 175,000, much greater than the result and will certainly drive worries about the current health of the economy following May and June’s strong results. Unemployment rate has also come in above forecasts of 4.1%, rising to 4.3%.

The Bank of Japan (BoJ) surprised markets with their second rate-hike of the year and suggested they may go further later in the year. The hawkish rhetoric from the BoJ continued to support the currency, which has strengthened significantly against the USD over the last fortnight. The big rotation in the currency has impacted the stock market, with the index suffering big falls over the last 48 hours.

UK junior doctors have striked for a total of 44 days since they first began in March 2023. They have been holding out for a 35% pay rise but this week have been offered a compromise of 22.3%. The union has agreed to present the deal to the tens of thousands of doctors and if accepted the strikes will cease. These strikes have hurt the NHS significantly and are estimated to have cost around £1.7bn of taxpayer money with the postponements of appointments, procedures and operations.

UK Chancellor Rachel Reeves spoke this week and announced she will deliver her first Budget on 30th October. She outlined that certain taxes would have to rise given the uncovering of a £22bn black hole in the public finances. She also announced the scrapping of a range of infrastructure projects as well as making the winter fuel allowance for pensioners means tested.

Eurozone inflation for the month of July has surprised to the upside with headline inflation (year-on-year) rising from 2.5% to 2.6%, whilst market expectations were for a fall to 2.4%. Core inflation (excludes energy and food prices) stayed firm at 2.9%. At the start of June, the ECB cut benchmark rates to 4.25% and paused in July as they acknowledged there would be a “bumpy road” to bringing inflation down to target whilst also maintaining economic growth. Investors maintain the belief that further rate cuts will happen in September and possibly December.

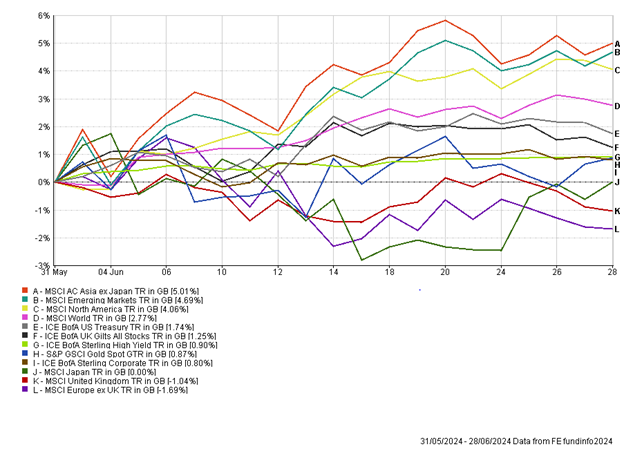

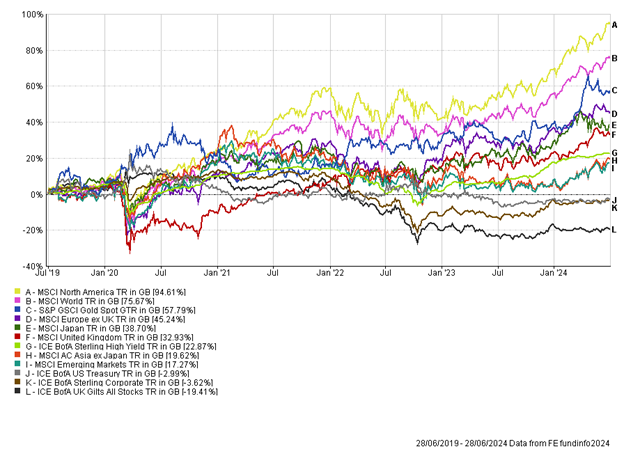

It has been a week of two halves in equity markets. There was strength at the start of the week with the UK large cap index approaching new all-time highs while other bourses rose globally. However, equity markets came under pressure in the second half of the week, most likely driven by concerns of a slowing economy following weak data out of the US. Nvidia’s recent volatility continued throughout the week. The company lost nearly $1 trillion in value in a month, before rebounding on Wednesday by around 10%. Elsewhere in the tech/artificial intelligence space there were positive results from Meta (Facebook) while Microsoft’s results showed disappointing cloud growth.

While equities have struggled government bonds have rallied significantly on the hopes of interest rate cuts from the US and Europe. It’s been pleasing to see the non-equity part of the portfolio perform well as equities have faded and highlights the benefit of diversification.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.