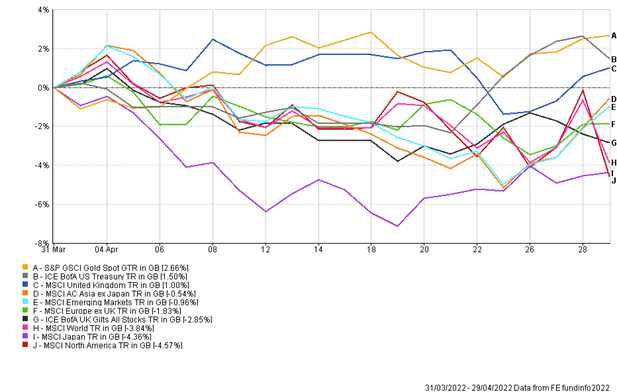

The Month In Markets - April 2022

It’s striking just how volatile markets have become. If I’d written this note a day before the month end (always tempting to knock off early before a bank holiday), then it would describe an unremarkable run for markets. But US equities fell by 4.6% on April’s final day of trading, dragging the global average with them, changing the tone of the month entirely.

The causes of this choppiness are the same we’ve been talking about all year: Inflation is the main culprit, along with the interest rate rises deemed necessary to tame it; and the events that are feeding that inflation, such as Asian COVID shutdowns, supply bottlenecks, and disruption to food and energy supplies caused by the war in Ukraine.

These are all adding to the other big feature of markets in 2022: the rotation. By rotation, we mean that everything that had been winning has started losing, while the losers have started winning.

One of those stumbling winners is the bond market. Save for the odd interlude, this has had the wind at its back for the best part of forty years. As a rule of thumb, bonds hate inflation. So, the fact that the double-digit inflation of the 1970s and 1980s gradually fell to the subdued levels we had (until recently) got used to, gave these assets an almighty helping hand.

One of the things that makes inflation so pernicious is that it can cause stock markets to fall while dragging down bonds too. Bonds – particularly gilts and treasuries – are held as a counterweight to the equities in a portfolio – part of their job is to go up as equities head lower, which brings balance to a portfolio. But this year they’ve dropped together, lessening their defensive impact.

And April was no exception. You can see from the chart that UK government bonds (gilts) dropped by almost 3% over the month, which puts them close to a 10% loss for the year. US Treasuries appeared to have a better month, but that’s only from your perspective as a UK investor: Sterling dropped sharply against the dollar over the month, and that’s where all the return for British holders of Treasuries came from. For a US investor, the losses in Treasuries were even worse than for a Brit holding gilts.

Tech shares and other high ‘growth’ companies are the other big stumbling winners. Many of these companies love the low interest rates that go hand in hand with low inflation. Partly because low borrowing costs help them to cheaply fund that growth, but also due to a quirk of how investors work out the value of such companies. So, like bonds, they too had enjoyed a great run, particularly following the financial crisis, which ushered in a decade of low interest rates.

But with interest rates rising fast, technology shares have had a tough time of it. Initially it was the more speculative firms that were hit – those companies that weren’t yet making profits, and whose success lay in an imagined future, not the reality of today. But more recently some of the tech titans have been dragged into the fray.

Netflix was the highest-profile casualty. News that its previously unstoppable growth in subscriber numbers hadn’t just halted, but reversed, shocked markets. Netflix, as it turns out, is more of a ‘nice to have’ than a ‘must have’ for its subscribers. That simple category shift caused its share price to halve in April.

It also led investors to question just how resilient business models are to the relentless rise in the cost of living. Google (AKA Alphabet) sank by almost 18% over the month, as investors worried about the revenue it receives from advertisers, who are themselves under the cosh from inflation.

Thankfully, as the word ‘rotation’ implies, some assets have fared a little better. Natural resources are an obvious example. These are on the right side of the recent disruptions, and their prices are rising with inflation. Likewise, listed infrastructure equities are also faring well. Their defensive properties, combined with inflation-linked contracts, make them stock market favourites in the new world. We’re pleased to report you have exposure to both in your portfolio.

Meanwhile, the Sharks to growth investors’ Jets are ‘value’ investors. This gang are generally more concerned about avoiding high share prices than finding the best or fastest growing companies, and after a decade in which their style consistently failed to work, their portfolios are bucking the falling trend. And it’s certainly been the value funds in our portfolios that have provided the best returns so far this year.

So, you will ask, how long will inflation last? And how high will it go?

We know better than to try to answer those questions. There were plenty last year who were quick to label inflation “transitory”, many of whom are now hastily recanting their forecasts (and counting their sizable losses). The trouble is, events like Putin’s invasion of Ukraine are inherently unpredictable, and yet they can have a deep impact on inflation. This simple fact alone should be enough to put us all off predictions for life. But, just as a hangover should put us off drinking alcohol, it’s all too easy to forget the pain they can cause, and be drawn back into the easy, albeit false, sense of certainty they offer.

With our ears closed to the siren song of economists’ predictions, we rely instead on considered diversification. This means we are always balancing your portfolios. That’s with a view to them withstanding prolonged inflation if we go down that path, but also not being damaged if the economy is taken in a different direction. It’s not an easy balancing act, but in a dramatically unpredictable world, we believe it’s the best approach.

Simon Evan-Cook

(On behalf of Raymond James, Barbican)

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.