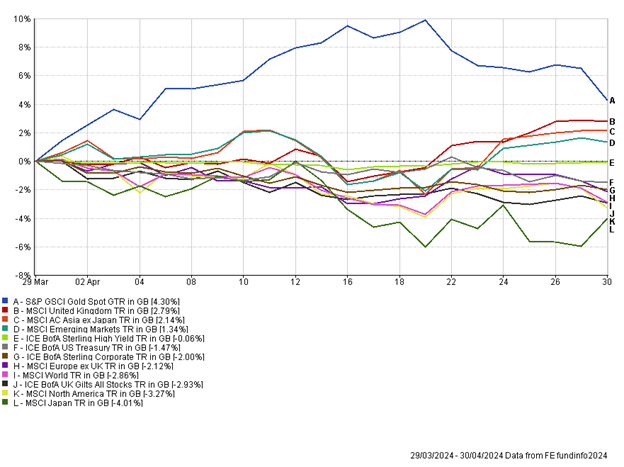

The Month In Markets - April 2024

UK equities produced another strong month, backing up robust performance in March, while gold led the way, as it had done a month earlier. Fixed income assets came under pressure in April as the reflation trade gained momentum.

Trading conditions in April felt similar to 2022 when inflation really began to bite. During that year the UK equity index was one of the limited bright spots in the year, while growth focused equities and fixed income fell on rising inflation expectations.

Economic data in the month did little to dampen the spirits of the reflation bulls. US Jobs data smashed expectations, highlighting continued strength in the labour market, which should support wages and the consumer. US inflation accelerated for the second successive month, coming in at 3.5%, which was the highest reading since September 2023. On a month-by-month basis inflation rose by 0.4%, which was again above forecasts. US inflation has consistently been higher than expectations in 2024. The result has been a dramatic shift in interest rate pricing. Only four months ago the market was convinced inflation would continue to fall and allow the US Fed to cut interest rates 6-7 times this year. However, we have witnessed a complete reversal on this thinking and now the consensus view is for only one interest cut this year in the US. One of the reasons for inflation not falling as far or fast as expected has been shelter (rent) inflation.

Here in the UK inflation fell to 3.2% for the month of March. While the fall continues a positive trend in the fight against inflation, 3.2% was slightly higher than expected and caused a sell-off in UK government bonds. However, UK inflation is now below US inflation, and the nation is no longer the inflation outlier versus its peers. The next inflation print is likely to be lower still, given the new energy price caps which kicked in on 1st April. The prospects of lower inflation, which let’s not forget hit 11% in October 2022, has boosted confidence amongst consumers and businesses, with UK consumer confidence hitting fresh two-year highs in April.

The reflation trade which has been in play for two months typically benefits sectors such as financials, resources and oil & gas. Given their large weighting in the UK market, UK equities posted another strong month to back up March. On the flip side within the US index there is very little exposure to miners and oil companies, which acted as a headwind for the US. There was a severe rotation in equity leadership midway through April, with artificial intelligence (AI) darling Nvidia falling over 10% in a single day, despite no company specific news. The fall wiped off over $200bn of value from the company, which is a staggering one-day move. Meta, another stock turbocharged by the AI theme, also saw a big daily decline on the back of Q1 results. While the headline numbers appeared positive, it’s clear that the AI focused companies are needing to invest heavily and Meta’s elevated capital expenditure (capex) surprised markets. It’s a trend we are seeing across tech companies, which for many years were seen as capital light businesses, however, they are now increasing capex at a high rate.

It is once again necessary to comment on UK mergers and acquisitions (M&A) activity given a few notable deals during April. Hipgnosis, the music back catalogues company looks set to be bought by Blackstone for $1.6bn, after a bidding war emerged. Another UK mid-cap stock, Tyman, a 186-year-old company, agreed to a US takeover for just shy of £800m. These mid-sized deals were eclipsed by a £4.3bn bid for cybersecurity company Darktrace, the bid once again coming from US private equity. At the end of the month, we saw BHP Billiton offer £31bn for Anglo American, in a bid to create the world’s largest copper company. While the bid was rejected, it highlights that foreign investors continue to see value in small, mid and large UK listed firms.

Japanese equities had a very strong start to the year, however a combination of a stalling equity market and sustained weakness in their currency led to a difficult month. The Bank of Japan recently hiked interest rates for the first time in 17 years, however, it is unclear if further hikes will materialise. There is still significant reform at a corporate level which should reward shareholders and over the medium term there is potential for the currency to mean-revert given it is trading at 34-year lows versus the US Dollar.

Gold hit new all-time highs during April, although towards the end of the month sold off, potentially on profit taking. We’ve previously commented on some potential drivers of the gold price, including increased buying from central banks and the Chinese consumer, which likely continued in April. Other commodities, such as copper continued its ascent higher, driven by increased demand expectations from AI power needs and the energy transition.

After a strong Q1 opening, April proved to be a more challenging month. Markets begun to digest the prospect of a “higher for longer” interest rate environment which put pressure on large parts of the equity market and fixed income asset class. While the expectation for 6-7 interest rate cuts in the US was likely to be too optimistic, it’s entirely possible the pendulum has lurched too far in the other direction, once again overshooting. The short-term noise creates volatility and importantly opportunity, while for a long-term investor, patience is a required skill to look through this short-term noise. Fixed income holdings in portfolios have come under pressure this year, however, we continue to see value in the asset class, with many of the buy-and-hold government bonds in portfolios offering attractive positive real returns at maturity.

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Appendix

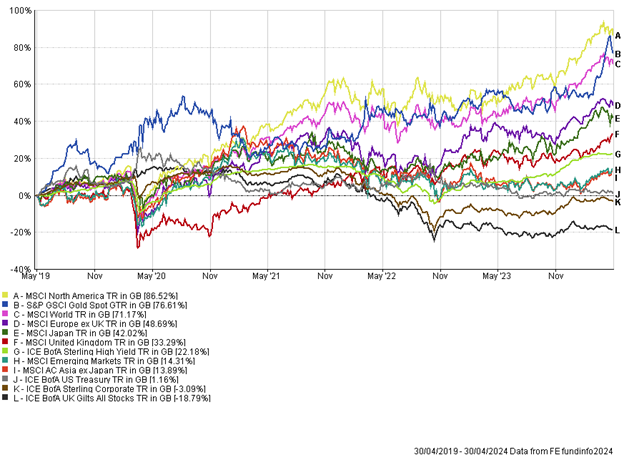

5-year performance chart