The Month In Markets - August 2023

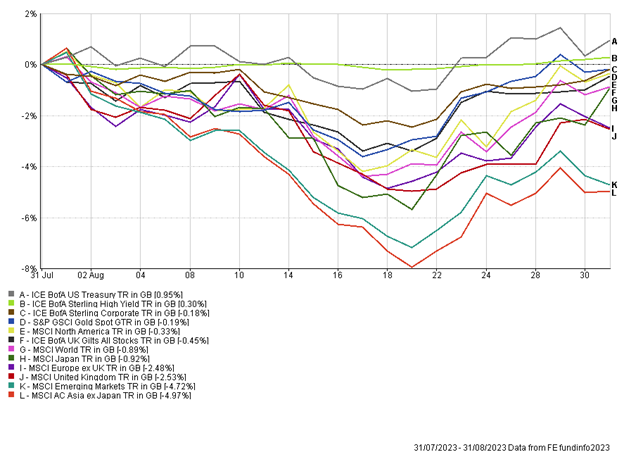

August was a tale of two halves, with the start of the month proving extremely challenging, before a mini rebound was staged towards the end of August. Most equity markets posted negative returns for the month, while bond markets were fairly flat over August.

As reported last month, China is the largest constituent of most emerging markets and Asian benchmarks. After a strong rally in July, Chinese equities suffered in August, falling over 7% in sterling terms. This had the effect of dragging down the emerging markets and Asian indices.

Concerns surrounding Chinese growth have been growing over recent months. It is not just lower- than-expected growth that is plaguing the country, but also concerns around their real estate sector. Chinese property developer Evergrande, which faced a liquidity crisis in 2021, filed for chapter 15 bankruptcy protection in New York during August. Another property developer behemoth, Country Garden, did not pay two dollar bond payments, calling into question the state of the company, its liquidity and its balance sheet position. While the market has been aware of potential issues in the Chinese property market, there was an expectation that the Chinese government would step in with meaningful support and reform. However, to date, policy response has largely disappointed, with the lowering of interest and mortgage rates not viewed as significant enough to help the troubled sector recover.

Elsewhere, the weakness in equity markets at the start of the month was not driven by concerns of faulting economic growth; on the contrary, the continued surprising strength of developed economies led to a re-pricing of interest rates and inflation expectations. The higher-for-longer mantra led to equities de-rating. The good news for the economy was bad news for equity (and bond) markets. We view the good news being interpreted badly by equity markets as a short-term trend; we believe that healthy consumers and businesses should support company earnings and growth over time.

Following strong US Q2 GDP data, released at the end of July, the Atlanta Federal Reserve’s GDP Now forecast model estimated Q3 GDP to be running at a 5.8% annualised pace, fueled by strong industrial production and housing sales. This much stronger data showed the strength of the US economy, even in the face of higher rates. The market digested the news by increasing long-term inflation expectations due to a stronger economy, which would lead to higher demand, and also lowered the number of rate cuts it expects in 2024. It was the longer-dated (more interest rate sensitive) parts of the bond market that were hit hardest, with the yield curve steepening. Although GDP data from the UK was not as strong, we did see month-on-month GDP increase by 0.5%. This had a similar effect on UK markets; long-run inflation expectations rose, the yield curve steepened and bonds, alongside equities sold off. UK wage data put further upward pressure on bond yields, with average earnings including bonuses coming in at 8.2%, much higher than consensus. However, there were some positives with such strong wage growth; consumers are now experiencing real wage growth, given inflation fell to 6.9% in July (data released in August). The same is true in the US where wage growth is now rising faster than inflation.

While economic data for the first 20 days of August was strong, there was a clear deterioration in data towards the end of the month. Services and manufacturing Purchasing Managers’ Index (PMI) across Europe, the UK and US all made for dismal reading, showing most areas to be in contraction and falling more than expected. Durable goods orders from the US along with consumer confidence was also disappointing. This led to a reversal in some of the optimism about economic growth and led to lower bond yields (higher prices) while equities rose on the back of lower yields and interest rate expectations. The market was further supported by commentary from US Fed Chair, Jerome Powell, who spoke at the annual Jackson Hole Symposium. He appeared to be fairly dovish in his message, lowering the likelihood of significant interest rate rises going forward.

Over recent months markets have yo-yo-d up and down with little direction or clear trend. There seems to be extreme short-term thinking with most market participants currently, with every key data point moving markets. While it can be frustrating, this short-term viewpoint of the market is likely to create excellent opportunities for investors who can take a longer-term time horizon, look through the noise and exploit the short-term volatility. We have been attempting to do just this in recent months, across both bond and equity markets. We continue to see highly attractive long-term value across both bonds and equities. We want portfolios that can take advantage of the opportunities, but carry sufficient diversification, acknowledging the uncertainty the economy faces as we head into 2024.

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Appendix

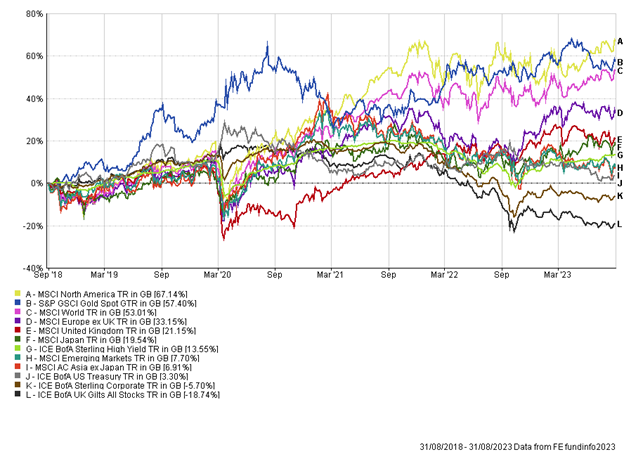

5-year performance chart