The Month In Markets - August 2024

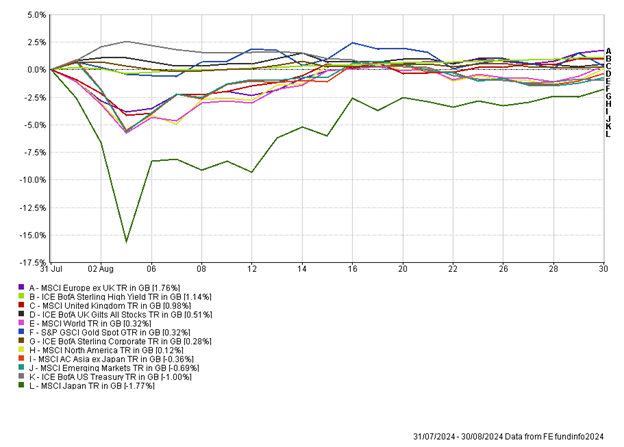

If you don’t check markets daily, August could have seemed like a benign month, with only marginal movements from start to finish. However, intraday, there was significant volatility, with Japanese equities suffering its second worst day in history, falling over 12%.

The volatility in Japan seems to have been triggered by a rapid appreciation of their currency, which then prompted a huge unwind in positioning particularly from hedge funds, alongside heightened concerns around a slowdown in the US economy. The speed and severity of the movements led to the Japanese market falling nearly 20% in three trading days, culminating in 12% falls on 5 August. While this was extremely uncomfortable, the market very quickly rebounded, rising 10% on 6 August and by the end of the month had nearly regained all earlier losses. Given the drops were largely driven by technical reasons as opposed to a fundamental deterioration in outlook, we remained comfortable with our positioning and didn’t react to the volatility. Doing nothing is not always easy but is often the best course of action.

The turbulence in Japan did spread to global markets, with circa 5% drops in most global stock exchanges. Again, while this felt uncomfortable at the time, these levels of drawdowns in equities are common and part and parcel of investing in risky assets. Once again, global equities rebounded after the falls, with some investors using the pullback as an opportunity to increase exposure to markets.

One of the major concerns that surfaced during August was the increasing expectation of a US recession. While this is still low probability, the odds moved higher following weak non-farm payrolls (jobs) data on 2 August. We’ve witnessed US unemployment nudge higher to 4.3%, which is now up 0.9% from recent lows. While the jobs data was disappointing, other more real-time jobs data, such as weekly unemployment claims, repeatedly came in better than expected in August. This helped provide confidence that although the labour market is slowing there are currently no major cracks.

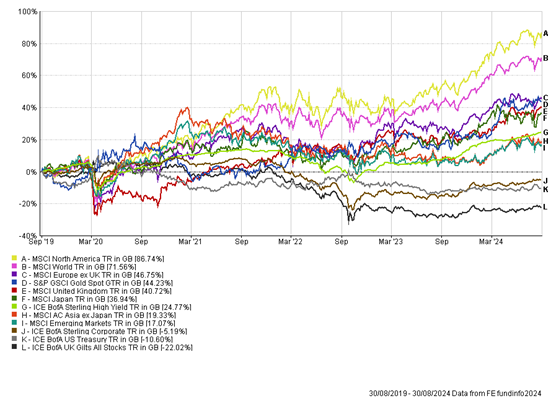

Inflation data coming from the UK and US provided further positive signals that inflation is more contained. It was expected that UK inflation would nudge higher to 2.3%, but it came in at 2.2%. US inflation fell to 2.9%, the first time it has been below 3% since 2021. The data helped solidify expectations that the US Fed will imminently begin cutting interest rates and increased the probability of another 0.25% cut from the Bank of England in September. Weaker jobs data and softer inflation led to government bond prices nudging higher during August. The mood music around inflation and government bonds has changed dramatically since last lastsummer. Only 12 months ago there were genuine concerns that UK interest rates could reach as high as 6-7% as inflation seemed out of control. As a result, there was a reluctance to hold assets such as government bonds. Fast forward 12 months and the Bank of England has now embarked on cutting interest rates, with UK inflation now below US inflation and close to target. Given the shift in inflation and interest rates, UK government bonds have performed strongly over the last 12 months, delivering high single-digit returns.

The Jackson Hole Symposium, an annual event, took place at the end of August. Over the course of three days central bank leaders from around the world presented and discussed world events and financial trends. All eyes were on US Fed chair Jerome Powell, who delivered a keynote speech on Friday 23 August. The clear takeaway from his presentation was that the US Fed is now ready to act and reduce interest rates. He stated, “the time has come for Fed policy to adjust,” and in recognition of a slowing jobs market said the Fed “will do everything” to support a strong labour market. This speech was the clearest indication that the Fed pivot is now in play and we are entering a period of policy easing as inflationary pressures subside and the US economy slows. In theory, this can be an extremely attractive backdrop for risk assets; falling inflation, moderate growth and lower interest rates should support company earnings and valuations. The risk is that the US economy cools too much and tips into recession, although that is not the current base case for the majority of investors. Looking out into 2025, the bond market is pricing in around 2% of interest rate cuts over the next 12 months. Whether or not the US Fed will commit to such aggressive moves is unclear, especially if the US economy continues to advance.

Asian markets were slightly disappointing over August. There continues to be major concerns around the world’s second largest economy, China. The property market remains in the doldrums and stimulus measures to date haven’t been bold enough to support the housing market. Weaker house prices have weighed on the Chinese consumer and had ripple effects across the globe. Luxury goods companies, even those outside of China, have frequently relied on the Chinese consumer for growth. We’ve seen Burberry and LVMH issue profits warnings recently, linked to a weakening Chinese consumer market.

Economic data in August looks to have been pivotal and has ushered in an imminent easing cycle from the US. At the same time, the deterioration in labour market data has increased risks to the global economy. As a result, we continue to be balanced in our portfolio positioning, recognising the opportunities from rate cuts, but acknowledging the risks of a slowing US (and therefore global) economy. Our non-equity bucket is well positioned to deliver if growth slows, while our equity exposure remains highly diversified, with exposure to a range of sectors and geographies.

Andy Triggs

Head of Investments, Raymond James, Barbican

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.