The Month In Markets - December 2023

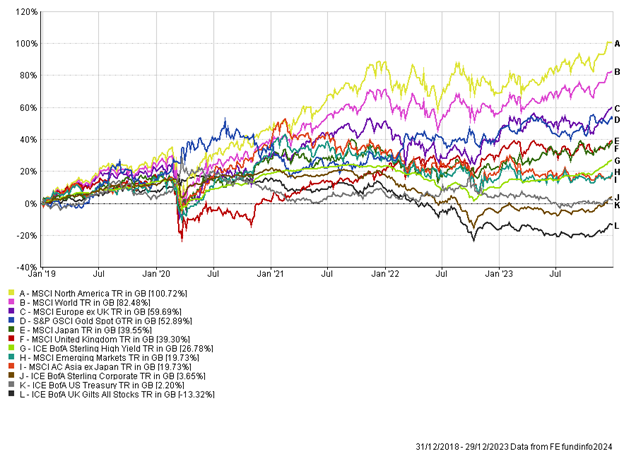

Markets resembled a see-saw for much of 2023, rising up one month, only to fall back down the following month. However, after strong moves upwards in November, markets did not see-saw down to earth, but extended gains to finish the year off strongly.

Stock market gains in December are often referred to as the “Santa Rally”. Investors had clearly been well behaved this year and avoided being on the naughty list; they were rewarded with handsome returns across equity and bond markets this December.

The rally in markets appears to have been driven by continuing conviction in the view that inflation is fast approaching target in developed markets and soon central banks will be able to cut interest rates which should help support the consumer and corporates alike. The key has been the change in expectation – over the summer months, bond and equity markets were pricing in a much more challenging environment; one of high interest rates and stubborn inflation. A combination of economic data and central bank rhetoric has helped changed the narrative recently.

Markets were supported by pleasing inflation data from developed markets during December (data covers November). Here in the UK, inflation came in at 3.9%, much lower than expected. The UK has closed the gap in recent months with its peers, after being a clear outlier with elevated inflation. Across the pond, US headline inflation was 3.1%, while Eurozone inflation was 2.4%, only marginally above the 2% target. Within the Eurozone, countries such as Italy are now flirting with deflation. This data will make it challenging for the European Central Bank to persist with holding interest rates in restrictive territory as we head into 2024.

Alongside inflation data, the US Federal Reserve, Bank of England (BoE) and European Central Bank (ECB) all met to set interest rate policy with all three central banks continuing to hold rates at current levels. Accompanying the meetings were press conferences, with US Fed Chair Jerome Powell appearing particularly dovish, mentioning the prospect of the first interest rate cut. His contemporaries, Andrew Bailey (BoE) and Christine Lagarde (ECB), attempted to deliver a much firmer message that their fight with inflation was not yet over, and the prospect of rate cuts was premature, however, the market did not take note and continued to believe the data would dictate rates cuts in the first half of 2024.

The labour market continued to paint a rosy picture, with unemployment remaining low across developed markets while wage growth is now outpacing inflation in most major markets.

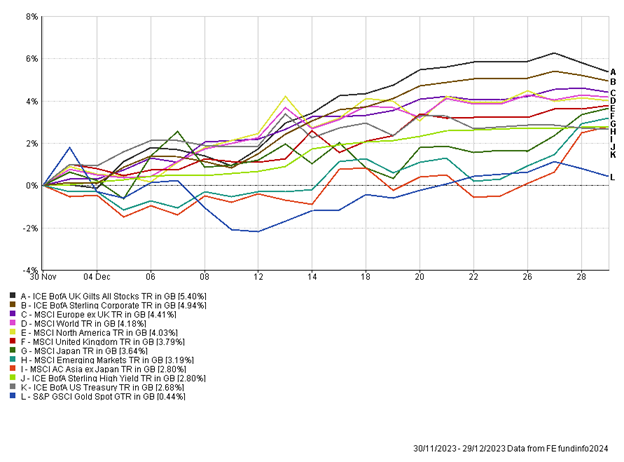

This cocktail of data helped provide markets with the sense of a dramatically improving picture for 2024; low probability of recession, falling inflation and falling interest rates. It was enough for asset prices to continue their march up from November, with almost all assets advancing, a complete reversal of 2022 when assets all fell together.

UK fixed income assets, including government bonds and corporate bonds performed exceptionally well in December. This was driven by falling interest rate expectations, with the more interest rate sensitive (typically longer-maturity) bonds seeing the biggest gains. Global bond markets in general continued to make handsome gains following positive moves in November. The major global bond index had its best two-month period since 1990.

Most major equity markets made gains during the month, with small and mid-cap stocks generally leading markets higher. Within the UK, the large cap equity index delivered circa 4%, while the more domestically focused mid-cap index advanced over 9%. Small and mid-cap equities are viewed as more interest rate sensitive; these stocks struggled in 2022 and for much of 2023, but the big shift in inflation and rate expectations led to large gains towards the end of the year. The same was true in the US, with the Russell 2000 (US small cap index) following up a strong November with a stellar December, making it one of the best two-month periods on record.

It’s interesting to note that most of the equity gains were driven by a ‘re-rating’, that is stocks becoming more expensive, as opposed to expectations of higher profits and earnings in 2024. We still see continued value in many equity markets, with the potential to re-rate further, but are also mindful of pockets of the equity market which are now looking expensive.

The rally in Q4 was broad-based with equities and bonds advancing together. While much of 2023 was bumpy, by year-end most asset markets were at year-to-date highs. The same was true for our portfolios, which rallied strongly towards the end of 2023. While cash rates have been at their highest levels for many years, our portfolios still managed to outperform a typical one-year fixed rate deposit. History has repeatedly shown that over the long-term cash as an investment lag both bonds and equities and we continue to believe this will be the case going forward.

We would like to thank everyone for their support in 2023 and wish you all a Happy New Year!

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Appendix

5-year performance chart