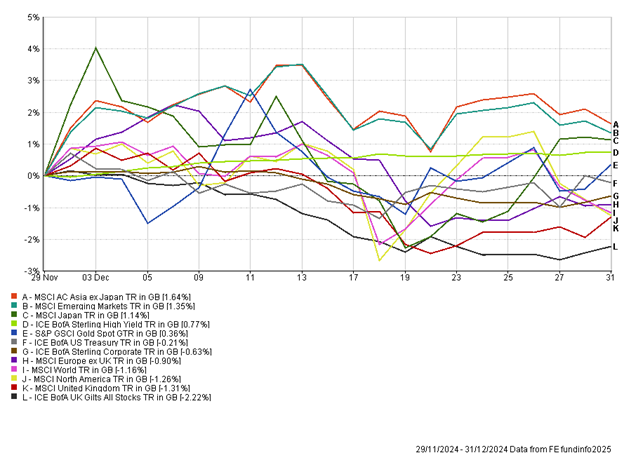

The Month In Markets - December 2024

The ‘Santa Rally’ phenomenon failed to ignite this year, despite much optimism that November’s market strength would continue into the year-end. Despite a weaker month, it has generally been a positive 2024 for risk assets.

One asset class that has struggled this year is government bonds, and December was no different. During the month we saw many prominent central banks meet for one final time in 2024 to set interest rate policy. While the interest rate decision was important, just as pertinent was commentary around the outlook for next year and hints about the likely path for interest rates.

Starting with the US Fed, as expected the committee voted to reduce rates by 25bps (0.25%). This was the third rate cut this year, bringing the total reduction to 1%. Despite lowering interest rates, it soon became clear that the US Fed is still nervous around inflation, with potential Trump tariffs and a strong economy likely to put upward pressure on prices. The US Fed now only expect to reduce interest rates by 0.5% in 2025. The hawkish commentary from Fed Chair Powell led to US government bond yields rising (prices falling). Some investors have questioned whether the US economy really needs any interest rate cuts given its strong economic growth, and as such there are concerns that inflation could rear its head again due to loose policy.

It wasn’t just the US Fed cutting rates in December, with a raft of other central banks lowering their headline interest rates. The European Central Bank (ECB) delivered their fourth cut of the year, while the Bank of Canada delivered a bumper 0.5% reduction, bringing their headline rate to 3.25%. Another central bank that decided on a jumbo cut was Switzerland, which now means their interest rate is only 0.5%. Interestingly, the Swiss Central Bank hasn’t ruled out the possibility of negative interest rates. Overall, 2024 has seen a shift away from interest rate hikes towards cuts and this is expected to continue into 2025.

One nation that bucked the trend in December was the UK. The Bank of England (BoE) met and decided to pause their recent cutting cycle, leaving headline interest rates at 4.75%. Six committee members voted to maintain the current level of rates, while three members voted for a 0.25% reduction. The decision seems to have been influenced by a range of factors, including the latest inflation data, which showed headline inflation at 2.6%, up from the lows of 1.7% in September. UK wage growth came in at 5.2%, higher than expected which also influenced the BoE’s decision.

On a forward-looking basis, there is the expectation that many UK companies will raise prices in 2025 to offset the recent National Insurance tax increases introduced in the October budget, which will be inflationary. One factor that might prompt the BoE to cut rates more aggressively in 2025 is the state of the economy. The latest economic data has been disappointing and pointed towards a sluggish economic backdrop. GDP data for Q3 was revised down to zero, and the economy is expected to have shrunk in the October (data released in December). This will make for grim reading for the Labour government, who pushed hard on a narrative of economic growth. It is still early days, and it will be interesting to see how data unfolds in 2025.

Over the course of December, UK government bond yields rose, with longer-dated bond yields rising above 5%. This now means that long-term UK borrowing costs are at the highest level in 26 years.

There was a different trend in China, where the yield on the sovereign one-year bond fell below 1% for the first time since 2009. The falling bond yields reflect concerns around China’s economic growth outlook, coupled with the expectation of a significant policy response in effort to kickstart their economy and boost consumption. Inflation in China fell to 0.2%, which was lower than expected and driven in part by a weak consumer and domestic demand. Retail sales were up only 0.16% for the month of November and a range of PMI data was soft. It’s clear the Chinese authorities have a huge task on their hands in turning round the fortunes of the world’s second- largest economy.

At a stock market level there were some interesting dynamics at play. In the US, growth- orientated companies led the way, while some of the cheaper, unloved companies lagged. One of the main US equity indices, which has limited exposure to technology companies, closed down for 11 consecutive days, something we have not witnessed since 1974. There was significant dispersion in the US market, with the tech sector performing strongly, while areas such as infrastructure lagged.

At a currency level we saw Sterling weaken by around 2.5% versus the US Dollar. The trend for the month was one of US Dollar strength. With Trump’s inauguration in January and no sign of a cut to the huge budget deficit there could be potential headwinds for the greenback currency as we head into 2025.

The narrowness of the market in December made it a challenging month for diversified multi-asset portfolios. However, we continue to believe a genuinely global approach, diversified across asset classes, sectors and investment styles is a sensible approach in order to manage risk, smooth returns and preserve and grow capital over the long-term.

Andy Triggs

Head Of Investments, Raymond James, Barbican

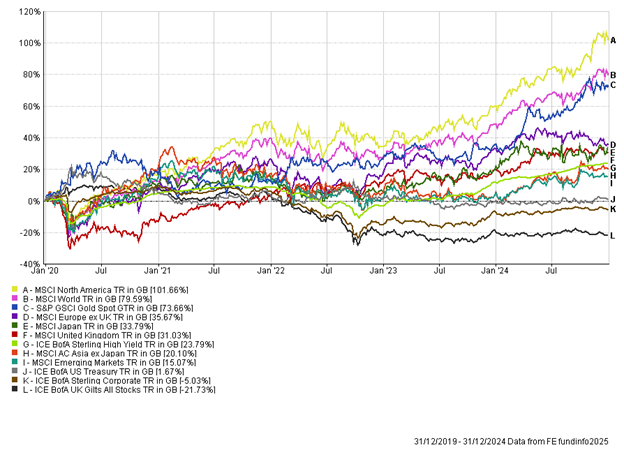

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.