The Month In Markets - January 2024

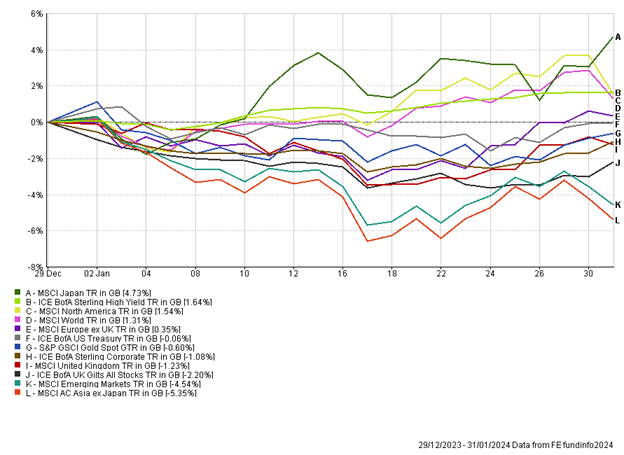

Strong gains in November and December across almost all asset classes did not extend into January. The month was characterised by mixed performance in the stock market, with major indices experiencing fluctuations amid a variety of factors.

Economic indicators pointed to continued expansion, although concerns about inflation and the potential for central bank tightening measures persisted. It was these concerns that weighed on fixed income markets, pushing yields higher (and prices lower). During the month of January, inflation data from the US and UK came in higher than expected. US headline inflation rose from 3.1% to 3.4% (year-on-year), while UK inflation rose for the first time in 10 months, from 3.9% to 4%. This data knocked the wind out of the ‘inflation is defeated’ sails and led investors to question whether the optimism of November and December was merited. The short-termism of markets currently leads to heightened volatility and market movements around key data releases, such as inflation. While these inflation prints in January were higher than expected it is worth remembering that inflation in January 2023 was 10.1% in the UK and 6.4% in the US – the trend has very clearly been towards lower inflation.

Equity performance in January was more varied, with countries such as Japan and the US performing well, while China was a clear laggard. We witnessed Japanese equities hit their highest levels since 1990, driven by the large cap exporters which have benefitted from significant weakness in the Japanese Yen. The more domestically focused mid and small cap stocks in Japan didn’t keep pace, although it is possible that the rally will broaden out which will benefit these smaller companies. At a domestic level inflation seems to be under control while interest rates remain in negative territory – a complete outlier in developed markets! Valuations continue to look compelling in many parts of the Japanese equity market and more shareholder friendly management teams has led to an improvement in profitability and dividends. Japan has also benefitted from investor flows which are now diverting from China and going to the other large, liquid markets in Asia such as Japan and India.

US equity markets hit fresh all-time highs towards the end of the month, two years after the previous highs. US economic data continued to highlight the resilience of the economy, with Q4 GDP reported at 3.3%, higher than the 2% expected growth. The labour market continued to add jobs at a pace, with the government and healthcare sectors two of the biggest contributors to hiring. The US government continues to spend spend spend, running aggressive budget deficits. Quite how sustainable this is remains to be seen, but in the short-term it is helping offset the negative impacts from higher interest rates. Unlike 2022, when sectors such as technology were hit extremely hard due to rising interest rates and bond yields, the technology sector so far helped power on the US market.

The artificial intelligence trend is gathering momentum, with investors pouring money into the perceived beneficiaries, such as Nvidia and Microsoft. We’ve now witnessed Microsoft become a $3 trillion company and surpass Apple as the largest US listed company. The concentrated US market, with a handful of the largest companies accountable for the lion’s share of market gains makes it difficult for a diversified approach. By its very nature diversification sees risk spread across a whole range of stocks, while with hindsight the best approach would have been to hold a few companies in size and nothing else. This is an inherently risky strategy and over the long-term would likely provide significant volatility and difficult periods. The excitement around the “magnificent seven” tech-focused stocks continue to grow, which is likely to lead to more capital inflows into them in the near-term. However, it is important to keep discipline and structure in approach to these companies and be wary of both the investment opportunity, but also valuation risk. History has shown us countless times that overpaying for investments is a punishing strategy. We have exposure to all of the aforementioned stocks but blend these companies with a wide range of other equity investments across the globe.

The weak spot in the US market in January was the regional banks, which fell significantly. There continues to be concerns over their exposure to commercial real estate, particularly the office sector, which is seemingly going through the same struggles the retail sector went through a decade ago, with office valuations falling by around 25% in 2023.

China’s woes continued in January, with the equity market suffering steep declines. The property sector has been under pressure and there seems to be little sign of improving. Sentiment was further knocked towards the end of the month with Chinese property developer Evergrande being ordered to liquidate, the company had more than $300bn of liabilities. The weakness in the stock market is likely to cause serious issues for Xi Jinping and we did witness the government step in to try and stimulate the market with various policies including limiting short-selling and allowing their wealth fund to increase purchases of Chinese equity ETFs.

The general outlook for the global economy has been trending up, with the market assigning a higher probability for a so-called soft landing. Companies are expected to grow earnings at meaningful rates in 2024 and 2025, while inflation should trend lower. The easing of interest rates should, in theory, be supportive for a range of asset classes. We continue to tread a careful path, mindful of risks, but equally seeing opportunities across a broad range of investments. Areas such as short-dated corporate and government bonds should offer positive real returns with limited interest rate sensitivity, while areas of the equity market trade on low valuations, which is historically very positive for long-term returns.

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

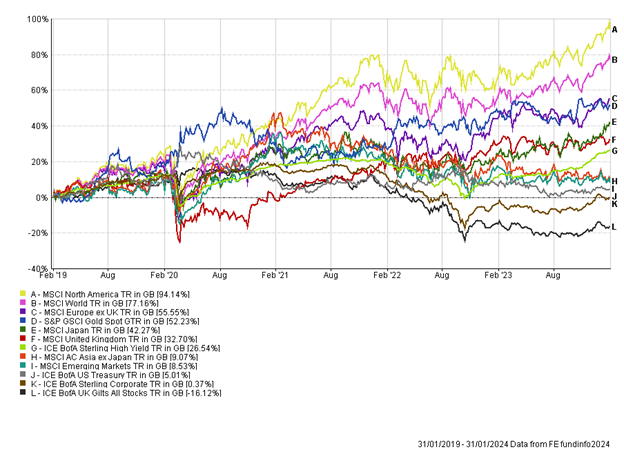

Appendix

5-year performance chart