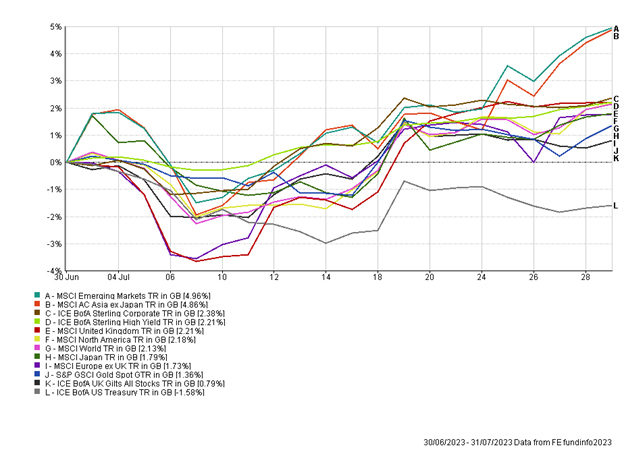

The Month In Markets - July 2023

After a shaky start, the month of July proved to be very strong for equity markets, with select fixed income markets also joining the party. This year’s equity laggards – emerging markets, Asia and UK – all saw a resurgence.

When we consider emerging markets and Asian equity indices, it’s worth remembering that the biggest constituent of both indices is China. The Chinese market was up approximately 9% (sterling terms) in July and was a key driver of returns for the indices.

So, what propelled Chinese equities in July? Well, it seems the old mantle of ‘bad news is good news’ was in play. China’s economy is stalling, and the re-opening boom has been short-lived. The country is on the brink of experiencing outright deflation, while the weakness in the global economy is negatively impacting China’s export market, which has been the economic heartbeat over the last 20 years. While this may all sound like ‘bad news’, it does, in fact, increase the likelihood of intervention and policy support to try and stimulate the economy going forward – this is the ‘good news’. It is likely that Chinese equities advanced in anticipation of government intervention. By the end of the month, China’s top policymakers had addressed the situation and pledged to step in and support domestic demand with stimulus and policy measures, that were to be implemented in a “precise and forceful manner”.

Inflation data for China made interesting reading, coming in at 0.0%, flirting with deflation. More worryingly was a 5.4% drop in producer prices compared to 12 months earlier. Producer price index (PPI) data is a good leading indicator of future inflation, and this data print points towards China tipping into deflation in the coming months. This will have an impact on the global economy as well, with China now effectively exporting deflation to the rest of the world through falling prices for many of its exports. This should be a benefit to the Western world which is continuing to grapple with inflation in their economies.

Both UK equity and bond markets were boosted by headline inflation coming in below expectations at 7.9%, a 15-month low. The past year has been characterised by UK inflation continually being higher than anticipated so it made for a refreshing change to receive some positive inflation news. The impact of the data led to a shift in market expectations that UK interest rates would peak at 6.5%, to a new peak rate of 5.75%. Lower interest rates should in theory benefit consumers and corporates alike, through lower borrowing and financing costs. As such equities caught a bid, with the mid-cap index the winner on the day, rising over 3%.

UK assets have been unloved and under-owned pretty much since the Brexit vote. Selling pressure has intensified recently as the UK has grappled with political issues alongside stubbornly high inflation. The news that the country may finally be getting a grip on inflation could help improve sentiment and potentially reverse these outflows from UK assets, which would be extremely powerful for valuations. There is clearly a long way to go, but July has offered some green shoots of hope.

Equities, in general, were buoyed by the market’s increased belief of a soft-landing scenario playing out – inflation falling close to target, without labour markets and economies cracking. US economic data backed up this narrative – their headline inflation fell to 3% and the labour market continued to exhibit strength. There are still risks to this thesis, and the full impact of aggressive interest rate hikes is still yet to be seen. However, economic growth and employment continues to highlight resilience, particularly in the US, which is the world’s largest economy.

Our approach of country diversification and focus on fundamental analysis meant portfolios had exposure to the cheaper, unloved areas of the equity markets which performed well in July. Markets are complex systems and ever-changing, so it makes sense to have an adaptable approach that recognises the world can and will look different in the future.

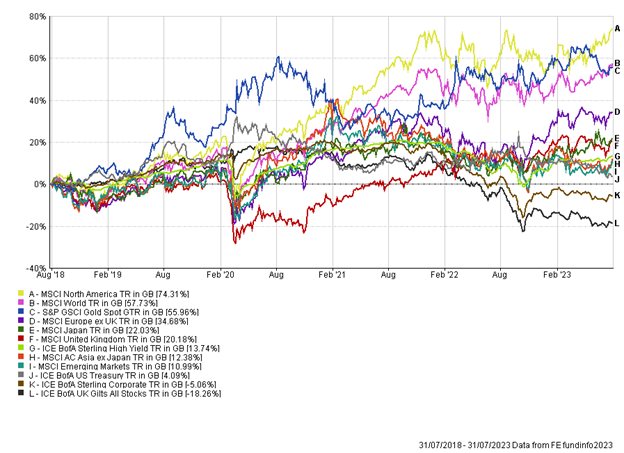

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Andy Triggs

Head of Investments, Raymond James, Barbican