So much for a quiet summer! From markets to politics a lot went on over the last month and we will try and unpack it all here.

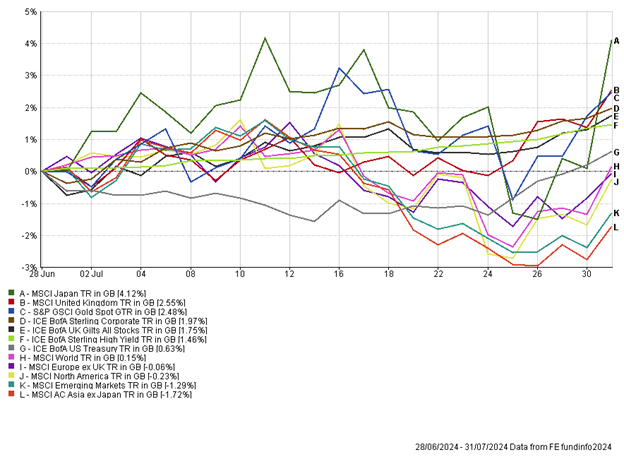

There were significant political changes during July. Here in the UK, Labour, as expected, took power following a landslide election result. While changes of government can have big implications for asset markets, Labour had long been expected to win the election and as such the result was largely priced in already. This Labour government has been viewed by many as pro-growth, and with relative political stability compared to our European and US counterparts, UK equites have actually come back on to the radar for international investors this month.

The final round of French elections led to the New Popular Front winning the most seats, although there was no majority. The inconclusive result could lead to gridlock in French politics over the coming months and years.

In the US there was a failed assassination attempt on Donald Trump at one of his rallies. The assassin came very close, with a bullet skimming his ear. The attempt on his life has not stopped Trump from continuing with his election campaign. President Joe Biden did however withdraw his candidacy for another term in the White House. He has been under mounting pressure following a series of well publicised slip ups and decided it was in “the best interest” of his party and country.

Aside from politics there were some interesting dynamics playing out in markets, which isn’t really reflected in the performance chart. Mid-month there was a huge leadership change in the market. The trigger for this rotation was a period of softer US economic data, with the US inflation data acting as the final catalyst to kickstart the rotation. With US inflation coming in lower than expected, the market once again began to price in a higher number of rate cuts. Much like the end of 2023, this hope of interest rate cuts spurred on small cap stocks, at the expense of large cap stocks. Alongside this there were the first whispers of doubt around the artificial intelligence (AI) investment narrative. Investors have begun to question if and when all the investment in AI will generate a return on that investment, and at what profit margin. Companies such as Microsoft, Meta and Apple are piling billions of dollars into AI capital expenditure, but the return from this expenditure is yet to be fully understood. The AI darling stock Nvidia, which is selling chips to companies such as Microsoft, has delivered exceptional earnings and share price growth over recent quarters. However, in the month of July the market cap of Nvidia fell by around $1 trillion – roughly four times the size of the largest UK listed business! Investors appeared to take profits on their AI trades and re-allocate to small cap stocks, which are typically more interest rate sensitive, and should see prospects improve if we have lower interest rates but a robust economy. Over the course of July, the US small cap index outperformed the main US index by over 8%.

The rotation wasn’t just in the US, it happened on a global scale, with some of the laggers of 2024 starting to deliver, while the market leaders begun to falter. We do often witness short-sharp rotations, and it will be interesting to see if this rotation plays out over August. One of the best ways to insulate portfolios from these rotations in markets is to have diversification within equities. This ensures all your eggs are not in one basket. Increasingly, we are seeing global equity indices as not being well diversified, by either country representation or equity style. Passive investors in global equity benchmarks are now taking on significant US equity exposure, and within that a considerable amount of technology exposure. For those investors, the month of July was most likely painful.

As already mentioned, Labour taking power in the UK was seen as creating a level of stability in UK politics, something that has not been in place in recent years. This coupled with increasing political tensions in parts of Europe and the US has made the UK a more attractive destination for investors. Alongside this, we have seen UK economic growth forecasts upgraded, along with inflation being maintained at 2%. This was enough to provide good support for UK assets in July, with equities and bonds performing well.

At the end of the month the Bank of Japan surprised the markets by increasing interest rates for the second time this year. The news helped to strengthen the currency, which is trading at multi-year lows versus a basket of currencies. The strength of the Japanese Yen more than offset some weakness in the larger cap Japanese stocks to lead to a positive month.

Away from equities, areas of the fixed income market showed positive signs during July. Momentum grew around the possibility of an increasing number of interest rate cuts later in this year, fuelled by some softer US economic data, including inflation that came in lower than expected at 3%. While the US Fed resisted cutting interest rates on the last day of the month, commentary from Fed Chair Jerome Powell pointed towards a cut at their last meeting.

The month of July favoured many funds in the portfolios which had struggled to date in 2024. It was pleasing to see that as the market rotated, we were able to still perform well, which was enabled by the portfolios being well diversified.

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Appendix

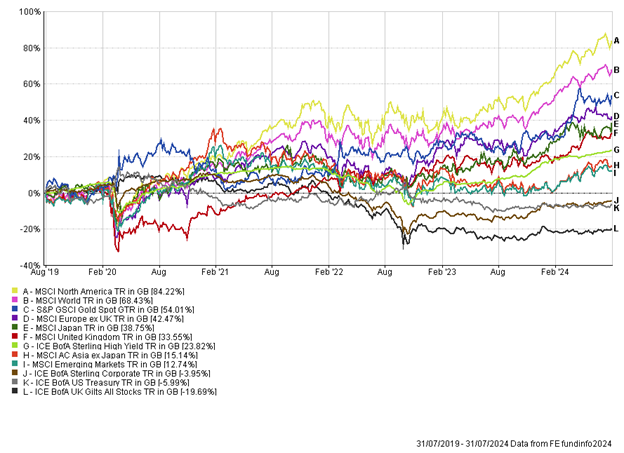

5-year performance chart