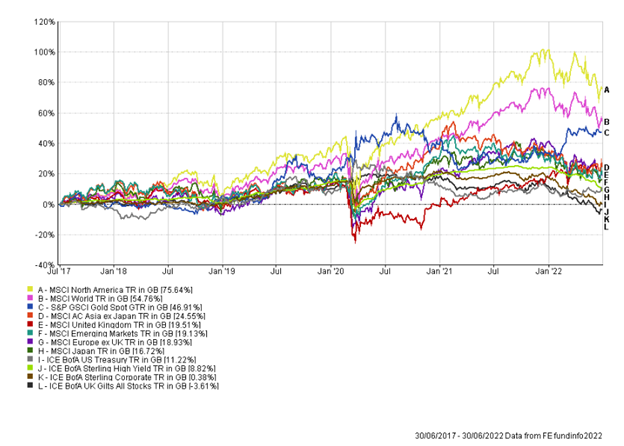

At a headline level June was yet another tough month, in what has been a difficult first half of 2022. However, the chart below does not provide the full picture of what occurred during the month, where key market changes could have implications for asset prices going forward.

For the majority of 2022 the market’s focus has been on inflation. More specifically it has been on the fact that central banks around the developed world were behind the curve on inflation and would have to raise interest rates more than they were telling us, in order to help cool inflation.

That provided a very difficult backdrop for both bonds and equities, which largely sold off in lockstep and in turn provided a very difficult backdrop for multi-asset investors. We typically hold assets such as government bonds to act as a hedge to equities; that clearly hasn’t worked this year.

However, during the month of June there were signs of a shift in the market’s focus. The market has now become nervous that in reacting to inflation, central banks, and in particular the US Fed, could now tip economies into recession. Their efforts to cool demand will effectively go too far (something referred to as a “hard landing”), destroy too much demand and ultimately lead to a recession. Now this is by no means a given, however, the probability of this occurring has increased. In effect, a risk that was not on investors’ minds six months ago, has now appeared.

The shift from inflation concerns to growth concerns resulted in some changes in market leadership. Commodities, which have been on a tear this year, and are seen as economically sensitive, nose-dived from mid-June. High-yield bonds, which react negatively to growth concerns also went south during the month. On the flip-side, government bonds, which have been moving downwards this year, appeared to buck that trend and held firm while equities fell during the second half of June. The UK market, which has been very resilient this year, had a more challenging month. The index has significant exposures to sectors such as energy and mining which were dragged down by falling commodity prices.

Concerns around an economic slowdown or even recession would make most people run for the hills. However, things are rarely that straight forward, and its important to think through the various scenarios that could play out.

In a slowing environment, where demand is weaker and commodity prices fall, inflationary pressures could ease. If inflationary pressures were to ease, the need for higher interest rates would diminish. Now if most of the problems this year have been because of higher inflation and higher interest rates, then falling inflation and slower interest rate rises could in theory be supportive for a wide range of assets.

This is now being referred to as the “Fed pivot”, and there are considerable amounts of column inches being dedicated to this subject matter currently. The view is that the actions of central banks (and markets) so far have now been enough to slow the economy and cool future demand which will bring down inflation. In this environment the US Fed will not need to be as aggressive going forward and could pause, or even pivot and shift away from their tightening interest rate policy. Parallels here can be drawn from 2018. The US Fed were raising interest rates, which led to a very volatile final quarter of 2018, with equities falling significantly and bond markets also struggling. However, by the end of the year, the hiking cycle stopped, and indeed pivoted, and 2019 was a very strong year for both equity and bond markets.

As is often the case, trying to call the bottom in markets is a difficult and dangerous game. The low in markets in the financial crisis was in March 2009 and the bottom for Covid-19 was in March 2020. This was prior to the jobs data announcement that showed 20 million people lost their jobs in one month! These turning points still felt extremely uncomfortable and there seemed little improvement in the situation. Yet markets are forward looking, and they behave in ways that is often not reflective of the here-and-now, but more reflective of where we will be in the next 12-24 months.

Portfolio activity in June within our bond element of the portfolio saw us reduce exposure to some of the more economically sensitive areas (such as high yield) and add in more US government bonds (unhedged). Overall, we continue to make portfolios more resilient to economic downturns, but are also mindful that risk assets, such as equities, have fallen considerably this year and that central bank policy could change in the coming months.

Andy Triggs

Head of Investments, Raymond James, Barbican

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.