The Month In Markets - June 2023

June’s monthly note could very easily read “See May monthly note”. The key themes of elevated UK inflation and excitement around artificial intelligence (AI) that were discussed in May have dominated markets in June as well.

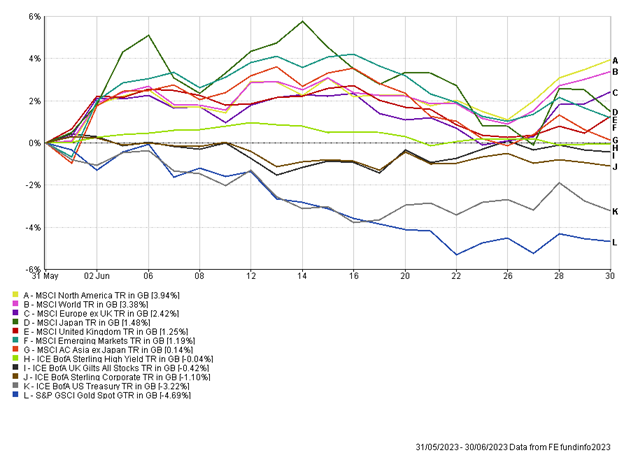

As can be seen from the chart it was generally a good month for equities, and a bad month for anything non-equity. It appears the equity market is taking the glass half full approach, shrugging off higher interest rates, instead focusing on the prospect of the global economy avoiding a recession and companies being able to deliver strong earnings growth over the coming years. This is most evident within the US equity market, which, after a weak 2022 has rebounded very strongly in both the month of June, and 2023 more generally. Non-equity assets had a more disappointing June, and fixed income assets have had a lackluster 2023. They have adopted a more glass half empty mantra, with persistent inflation and higher interest rates plaguing the asset class in 2023.

Let’s dig a little deeper into the US equity market, which continued to rally in June. We have written about the strength of the AI focused stocks in recent notes, which have almost single handedly propelled the US equity market higher. Although not covered in the charts, it was pleasing to see increased breadth in the US market – the equal weighted S&P 500 index actually outperformed the S&P 500 index (market cap weighted) in June. Over the course of 2023 the equal weighted index is still lagging by circa. 10%, despite the recent rally. Stronger economic data coming out of the US in June was likely a driver for the broader rally. We witnessed Q1 GDP come in at 2%, a big rise from the 1.3% estimate, showing the US economy is still growing at moderate levels, despite many commentators expecting a recession to be upon us already.

The theme of AI has certainly not retreated, and we have seen companies such as Nvidia and Apple continue to do well. In May, Nvidia’s market cap hit $1 trillion on the back of a huge AI driven rally. Not to be outdone, Apple closed on 30th June with a market cap of $3 trillion, a new closing-high for the stock.

The technology sector, and Nasdaq index more broadly, were hit hard in 2022, with higher rates negatively impacting valuations. Many commentators had suggested that high valuations were valid in a world of ultra-low interest rates, however, with higher rates, lower valuations were appropriate – we witnessed a de-rating of valuations in 2022. Interestingly, this year we have seen interest rates and bond yields (at the short-end of the curve) continue to rise – if the playbook of 2022 was in play, one would expect the technology sector to have continued to struggle this year. The opposite has been the case, and we have seen technology and other growth stocks re-rate (become more expensive) in spite of rising interest rates. It will be interesting to see if this strength can continue.

The UK equity market was the weakest developed market during the month (in sterling terms). As noted at the beginning of the article, elevated inflation has been a burden for the UK and June was no different. Headline inflation was reported at 8.7% once again, when it was expected to fall, while wage growth and core inflation for the month of May (reported in June) were both higher than expected. The result of this saw the Bank of England (BoE) raise interest rates by 0.5%, taking the rate to 5%, it’s highest level in 15 years. It’s worth noting that the US Fed did not raise interest rates at their previous meeting, while the BoE in fact increased their pace of hikes from 0.25% to 0.5%, highlighting the UK’s continued fight against inflation. With the market now pricing in peak UK rates at around 6%, there has been increased scrutiny on the UK economy, and question marks over whether the economy can handle that level of rate without a recession ensuing. The UK mid-cap index, which is seen as more domestically exposed, has significantly underperformed the UK large cap index, which has more international exposure, by revenue. The gap was around 2.5% in June, however if we look back over the last 18 months when inflation expectations began to increase, the gap is around 30%!

The UK equity market is now trading on a discount to its own history and a significant discount to the rest of the world. While the outlook is indeed challenging, and not being made easier by higher interest rates, the economy at present is performing ahead of where most CEOs and economists expected. We’ve seen consistent upgrades to economic growth forecasts throughout the year and in the month of June saw profits upgrades from key retailers Next and ABF (Primark owner), not something one typically associates with a troubled consumer. The market is clearly pricing in much tougher days ahead for consumers, but right now, the consumer is standing strong. One of the reasons for this is likely to be the delayed response to higher interest rates – indeed many people have enjoyed significant wage increases, but are yet to see debt payments, such as mortgage costs increase yet. Savers are also benefitting from greater returns on their savings, and this is propelling the ability to spend.

And so to bond markets (fixed income). US and UK government bonds and high-quality corporate bonds fell in price during the month. This was largely driven by increasing interest rate expectations in both countries. Typically, bonds have an inverse relationship to interest rates. While US inflation was reported at 4% during the month, the US Fed struck a hawkish tone at the press conference, highlighting their willingness to resume interest rate hikes to tackle inflation. As touched upon already, the UK BoE didn’t’ just talk tough, they acted, by raising rates by 0.5%. We have seen yields on UK government bonds with short maturity (1-3 years) rise to above 5%. With inflation expected to fall towards 5% by the end of the year, government bonds are starting to offer positive real returns once more.

Emerging markets and Asia continued their struggles, once again partly driven by China. During the month, China cut interest rates on short-term borrowing in an effort to help kickstart the economy. With an inflation rate of just 0.2%, there is little concern that reducing interest rates will lead to problematic inflation levels.

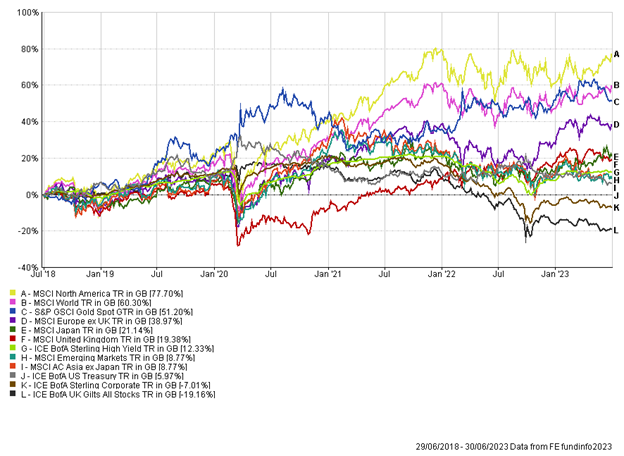

The end of the month also brings an end to the first half of the year. Within equity markets last year’s losers (US growth stocks) have become this year’s winners, while the winners of 2022 (such as banks and oil) have become this year’s laggards. Developed market government bonds are yet to catch a bid, and have continued to suffer, albeit to a much lesser extent than 2022. We do believe these bonds are offering a lot of value on a forward-looking basis, while also likely providing good diversification benefit to equities. The short-term outlook for the global economy has a high degree of uncertainty at present, however most equity markets have discounted some of this uncertainty into prices. With such uncertainty and much of the interest rate pain yet to be felt, we do think one needs to tread a more cautious path. With high expected nominal returns on assets such as cash and government bonds investors can now be compensated without taking excess equity risk at this stage in the cycle.

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Andy Triggs

Head of Investments, Raymond James, Barbican