The Month In Markets - June 2024

June was an eventful month, with political events dominating headlines. This was alongside the news of Nvidia becoming the world’s largest listed company (even if just for a few days) and UK inflation falling to the target of 2%.

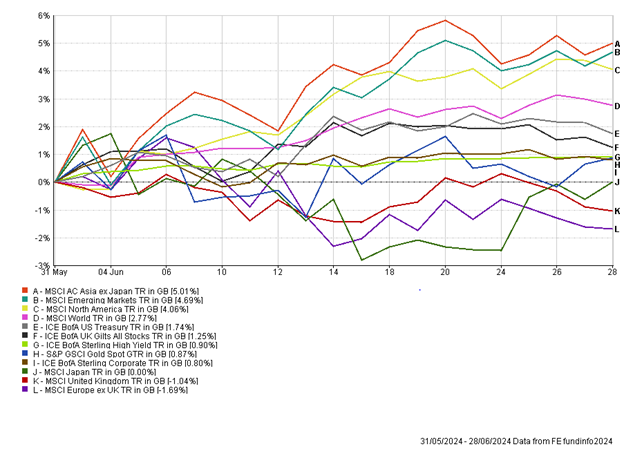

Following on from a poor showing in the EU elections, French President Macron called a surprise snap election, with the first round of voting taking place at the end of June. There was no need for Macron to send the French citizens to the voting booths, however, he felt it was the right thing to do after Le Pen’s National Rally (NR) party received more than double the votes compared to Macron’s Renaissance party. French markets were negatively impacted on the news of the elections, with both equities and bonds falling in price. The Euro also suffered on the election news, with GBP reaching a 22-month high against the Euro.

The first round of the election, which took place on the last day of the month, was won by Le Pen. The second vote will now see if Le Pen can secure an absolute majority. The polls suggest this is unlikely, although not impossible. The pain for French equities and the Euro meant European equity markets were the laggard in the month of June.

The build-up to the US election ramped up in June, with President Biden and Republican candidate Trump going head-to-head in a live debate. There was broad consensus that Trump came out on top, and the market quickly priced in a higher probability of Trump returning to the White House. Interestingly, equity markets responded favourably to the news. While there are concerns about Trump, he is seen as being pro-business and pro-consumer. When he last took power, he introduced sweeping tax cuts that are due to expire in 2025. He is seen as the most likely to extend these tax cuts. While there are negative implications for government debt levels, through lower tax receipts, it should help business profits and consumer expenditure.

It feels slightly strange to write, but the UK political backdrop appears relatively calm compared to many of our peers! With the election due to take place on 4th July, it is assumed that Labour will take power, with a majority, and this will lead to a level of relative stability for the country.

Staying with the UK, inflation data (for the month of May) was released, which showed that headline inflation had fallen to 2%, the Bank of England’s (BoE) official target. This was the lowest level of inflation since July 2021. While the BoE maintained interest rates, evidence that inflation is at target could encourage them to reduce interest rates in the coming months. UK wage growth is now running comfortably above inflation, which should help support the consumer and encourage spending. The one fly in the ointment regarding the labour market was that unemployment had risen to 4.3% and has been trending higher over recent months.

Over in the US, headline inflation came in at 3.3%, broadly in line with expectations. The US Fed’s preferred measure of inflation is the Personal Consumption Expenditure (PCE) index, which was flat month-on-month, the lowest reading since April 2020. The yearly figure of 2.6% was encouraging to see, and potentially opens the door to a rate cut in September for the US. While there was progress for the UK and US in their battle against inflation, Canada, Australia and the Eurozone saw mild rises in inflation, which will certainly keep central bankers on their toes. Japan saw inflation come in ahead of consensus at 2.1%. This country remains the outlier, as the central bank is trying to stoke inflation, as opposed to tame it. There is early evidence that inflation expectations are becoming more entrenched in Japan which should be a positive, and lead to a pickup in spending from consumers and businesses, who sit on large cash piles. The Bank of Japan (BoJ) have continued to take their time over raising interest rates in Japan, which has negatively impacted their currency. The yen, which looks extremely cheap on a range of metrics, continued to trend lower in June, reaching 38-year lows versus the USD. The currency also slid against GBP and is down over 10% for the first half of 2024. This has been painful for the Japanese holdings in portfolios (in GBP terms).

At a company level, Nvidia breached the $3 trillion market cap level and briefly surpassed Microsoft as the world’s largest listed company. The moves in the semiconductor company share price have been staggering, with the company adding $1 trillion of value in 32 trading days. Towards the end of the month the share price did sell-off, falling around 15% at one point, allowing Microsoft and Apple to rise above it, in terms of market cap. Apple, after a weak start to the year, saw its share price rally significantly in June on the back of an artificial intelligence (AI) announcement around “Apple Intelligence”. The big hope here is that the introduction of AI into new devices will trigger an upgrade cycle, with consumers replacing old iPhones and iMacs in order to access Apple Intelligence.

Technology excitement extended to the emerging markets over June, with companies such as Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung seeing strong moves in share prices. These two companies helped buoy the Asia pacific ex Japan and emerging market indices.

There were two notable corporate bids during June in the UK, with the consortium of private equity bidders returning with a higher offer for Hargreaves Lansdown, as well as Carlsberg having a bid rejected for Britvic. Given the improving outlook for the UK economy, potential for political stability and cheap valuations we expect corporate activity to remain elevated throughout the year.

It was a mixed month in general, with the equity market being led higher by a narrow range of sectors. This made it difficult for genuinely diversified approaches, with concentration and high stock specific risk being rewarded. Our approach aims to reduce these risks, particularly at times when valuations and expectations are elevated. We will continue to tread a careful path through markets, maintaining diversification and taking a sensible approach to valuations, where we believe that the price you pay for an asset will have a big impact on long-term returns. While the geopolitical backdrop is challenging, economies are continuing to grow and company profits remain healthy. Yields on fixed income assets are now at attractive levels and there continues to be a range of opportunities for long-term investors.

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

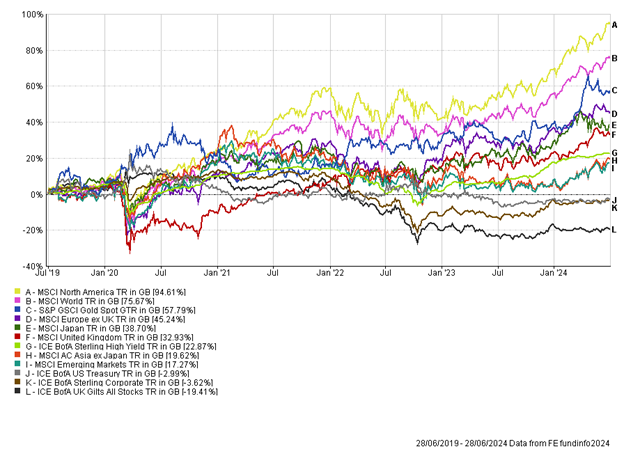

Appendix

5-year performance chart