The Month In Markets - March 2022

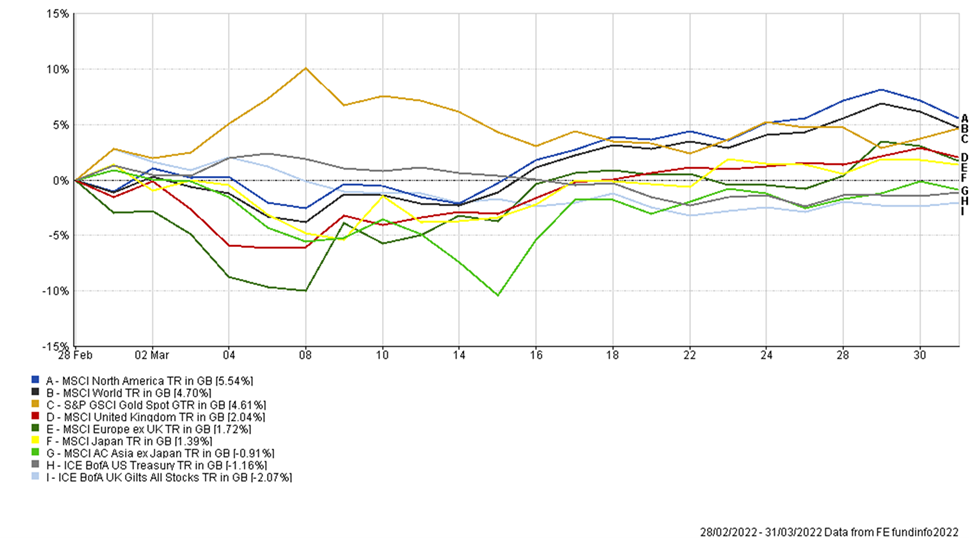

Given what’s happening in the world today, you’d be forgiven for wanting to read this month’s market rundown from behind the sofa. But, true to their history, markets have marched to their own beat again: Despite the depressing backdrop, global equities made a positive return of almost 5% in March, while gilts, which are typically billed as safe havens that perform well in times of stress, fell by more than 2%.

This apparent disconnect is something we’ve touched on a few times already. At the risk of repeating ourselves, markets tend to react to investors’ perception of future events, while – genuine out-of-the-blue shocks aside – often not appearing fussed by what’s in today’s newspaper.

On this basis, maybe what we’ve seen this month is good news: Markets tend to be better at working out what’s actually going on in the world than any one individual (a phenomenon well described in James Surowiecki’s “The Wisdom of Crowds” – worth a read if you’re interested in this type of thing). The fact that they’ve rallied suggests the situation in Ukraine may be improving, at least by more than the relentlessly upsetting newsflow suggests, anyway.

But note that I’ve caveated that statement with words like “suggests” and “may”. We investors like to pepper our reports with terms like this; if we later turn out to be wrong (which we often do), we can always point to these couched terms as a get-out. And it’s right to do that here: Markets have a good record of predicting events before they make the news, but they’re very far from perfect at it. The world is always unpredictable, often taking turns that wrongfoot even “wise” markets.

This is one reason we don’t tamper with your portfolios on a daily basis. Like a defender facing a mazy Jack Grealish run*, you can end up being sent one way, then another, then back again, and ultimately end up on your backside, wondering what just happened.

Instead of chasing our tails by trying to “time” markets, we expend most of our mental energy finding good managers, each an expert in their own corner of the market, to run your money. That way, when times turn hard, they are well prepared for the unexpected. And so, as a consequence, are you.

We’ve had calls with many of the managers running pockets of your money over the last few weeks, and have been reassured by their confidence in their own portfolios (and that, in many cases, they were seizing the opportunity to invest more of their own personal money into their funds).

Outside of your portfolios, meanwhile, there are a fair few fund managers looking dazed and confused right now: As March began, the unsettling events in Ukraine pulled equity markets lower, particularly as the word “nuclear” began to crop up in the conversation.

This caused some to sell some of their equities. But, as you can see from the chart above, since that early-March low point, global equities have rebounded by almost 9%. So, as we stand, their snap decision to sell was a costly mistake.

Of course, it may still turn out to be the right decision. There’s nothing to say events can’t take a darker turn from here, taking markets lower with them. But, for now, the pressure will be on those who sold: Do they stick to their original decision and wait for a fall? Or buy back in at higher prices in case markets keep rising? And if they do buy back in, and markets then crash? Ouch. The whole process can take on a Basil Fawltyesque tone, desperately trying to correct one mistake after another, all the while digging themselves deeper into a hole.

Away from the Ukrainian tragedy, the month also saw a renewed focus on one of our other regular talking points of the last few months: Rising inflation and interest rates. Inflation numbers have continued to come in higher than experts were expecting. The situation in Ukraine and Russia has only added to this, disrupting energy and food supplies, exacerbating what was already a delicate situation on the back of the COVID-19 pandemic.

Central banks, meanwhile, carried on raising rates during the month, with the Bank of England taking the Base Rate to 0.75%, and the US Federal Reserve finally entering the fray with its first quarter-point hike since 2018.

This has kept the downward pressure on government bond prices. Save for a brief interlude after the Ukraine invasion, these assets have had a terrible 2022 so far. UK gilts, which are usually held for defensive purposes, have fallen by more than 7% this year – illustrating how inflation really is their Achilles heel.

That said, and returning to the earlier thoughts about the Wisdom of Crowds, the last week of March did see “growth” equities rally hard (faster-growing businesses, most closely associated with tech firms of late). These parts of the stock market don’t typically respond well to inflation, and had endured a poor year up until last week. But do they know something we don’t? Could it be that, while inflation feels like it’s back with a vengeance, markets have sniffed out an end to the current surge, and a return to the lower-inflation conditions we saw for most of the last decade?

It’s impossible to say, particularly as other markets – government bonds – are simultaneously suggesting the opposite. So we continue to make sure your portfolios aren’t betting on one outcome over the other. Instead we remain, as before, positioned so that either outcome shouldn’t prove damaging to you in the long run.

*Jack Grealish is a fan favourite in the Manchester City and England football teams. For readers of different vintages and affiliations, you can replace his name with, among others, Cristiano Ronaldo, David Ginola, Paul Gascoigne, Maradona or George Best.

Simon Evan-Cook

(On Behalf of Raymond James, Barbican)

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person