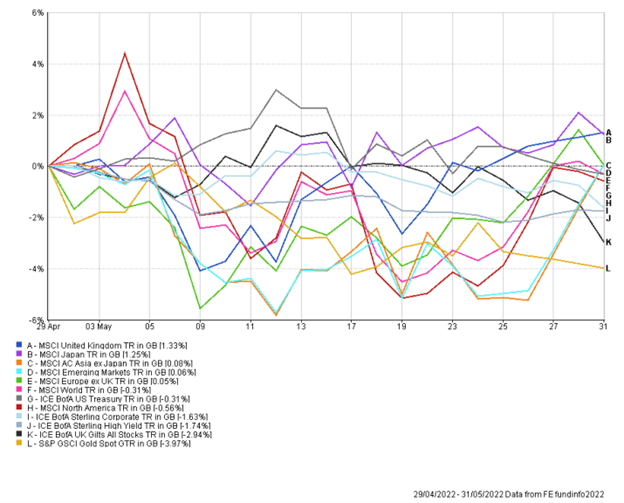

The Month In Markets - May

Markets stayed jumpy in May, although after several months of turmoil, the swings in market direction aren’t causing quite the stir they were as the year began. Having plunged, but then rebounded, global equity markets ended up making a small loss for the month – a blessed relief compared to the steeper falls that have plagued investors for much of the year.

The UK stock market was May’s standout performer, as it has been for most of 2022. It would be lovely to put this down to some kind of jubilee-inspired rush of goodwill, but the unromantic truth is that it’s caused by the UK market’s heavy exposure to energy and mining companies.

The twin shocks of inflation and the war in Ukraine continue to drive most natural resource prices higher, with the latter having thrown fuel onto what was already a decent-sized inflationary fire – originally caused by pent-up post-COVID demand colliding with supply-chain bottlenecks. This has boosted the share prices of the UK market’s large oil and resource companies.

Very little of this has much to do with the British economy. Instead, it’s a reflection of which behemoth global energy and mining titans choose to list themselves on the London Stock Exchange (as well as the absence of any global technology titans).

To get a truer feel for what’s happening to our economy, it’s more telling to look elsewhere, such as the fortunes of the pound and of smaller UK-listed companies (as these tend to be more reliant on the UK economy, although not exclusively so). On this front, 2022 has been less rosy: While the multinational-dominated UK large-cap index has made positive returns, UK-listed smaller companies are down by around 10% for the year.

Sterling has also had a tough time of it: If you’re taking a trip to the States in the next few weeks then, assuming you make it through the airport, you’ll be spending almost 8% more to buy a burger than if you’d flown on New Year’s Day (and that’s only on the currency move – food price inflation will leave a mark too).

But if the month provided any glimmer of hope for us Brits, it’s that markets seemed to calm down and improve over the second half of the month. So smaller companies made up some lost ground, while the pound clawed back a cent or two against the dollar.

The relief wasn’t confined to the UK though. Many other markets that had been under the cosh were given some respite. For us investors, perhaps the most noteworthy was the improvement in the share prices of ‘growth’ companies, in particular tech firms.

We’ve written about this at length over the past year or so. But to recap; after a decade and more of trashing everything else, the tech share hares have collapsed this year, dragging many markets – such as the US and China – down with them.

The cause of this is the return of inflation, and with it, rising interest rates: Higher interest rates impact the way investors value fast-growing companies, and not in a good way. With so much invested in these parts of the market, investors are frantically trying to work out if the last fortnight of kinder price trends mean the worst is over, or if they’re simply a resting point on a far longer descent.

The cause of this respite was tentative signs that inflation may have peaked, and that interest rate hikes might be less severe than previously thought. The emphasis is on ‘tentative’ here, as while some data has pointed to a slight moderation in the pace at which inflation is accelerating, there isn’t much of that data to go on, and other data has suggested otherwise. It’s finely balanced, and further releases over the coming days and weeks will provide more colour, potentially tipping the market either way.

But perhaps the most emphatic bounce-back over the month came from Chinese shares. These benefited from the same factors as mentioned above, but had a further boost from indications that the country’s zero-Covid policy, which still has the country on hard lockdown, may be eased.

Indeed, this news may itself have played into the hopes of easing inflation, as China’s lockdown has caused many of the bottlenecks that are spiking prices in certain products across the planet. If those bottlenecks are removed, price rises may begin to lighten up, and potentially even reverse.

It all adds up to a highly complex picture for global markets and economies, and trying to predict precisely what will happen next is difficult at best. We maintain that diversification is the best policy because the alternative requires knowing exactly which path the world will take, and when it will take it. And that requires a crystal ball. Or a time machine. If you have access to either, please let us know.

Simon Evan-Cook

On behalf of Raymond James Barbican

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.