The Month In Markets - May 2023

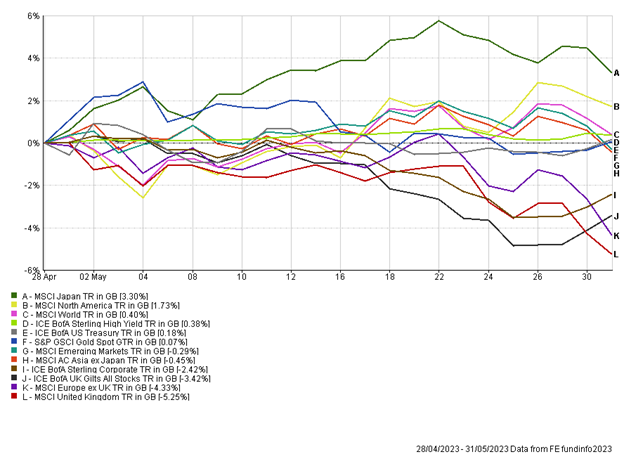

May proved a very tricky month for UK assets, with both equities and bonds suffering meaningful drawdowns in the second half of the month. Elevated inflation data appeared to be the main driver of the UK underperformance, with markets now pricing in UK interest rates to peak at 5.5% in 2023.

On the surface the UK inflation data looked ok; headline inflation fell to 8.7%, the first time the year-on-year figure had been below 10% since August 2022. However, the fall in inflation was less than had been expected and importantly core inflation (which strips out volatile items such as food and energy) came in at 6.8% – the highest reading since 1992. The worry is that high inflation expectations are becoming embedded in consumers’ minds and as such wage demands will be elevated, which in turn will force businesses to raise prices to protect their profit margins – a vicious inflation loop is created. In order to ‘break’ this inflation psyche, the Bank of England (BoE) may be forced to raise rates to such a level that it leads to rising unemployment, which should in theory reduce the upward pressure on wages and lower demand for goods and services in the economy – all of which should lower inflation.

The market now expects UK interest rates to peak at 5.5% later this year. Interestingly, interest rates are only expected to fall to 4.8% by the end of 2024. This is now quite different to the outlook in both the US and Eurozone, where interest rates are expected to fall much further by the end of 2024.

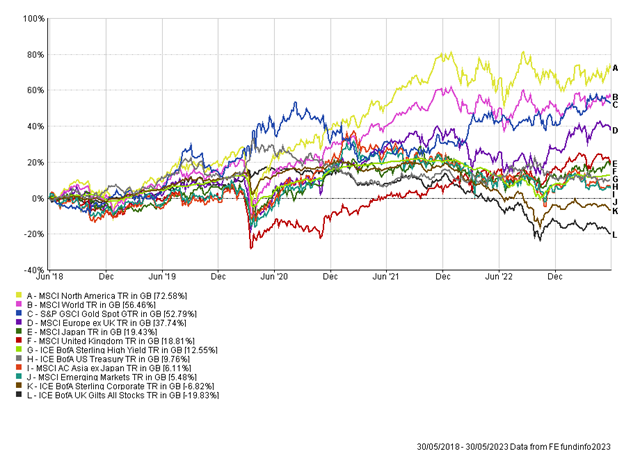

As we have written about previously, there is often an inverse correlation between interest rates and fixed-income prices. We witnessed both UK government bonds (gilts) and UK corporate bonds fall in value in May on the expectation of higher rates. UK equities were also hit hard, most likely driven by concerns higher rates may limit consumption and spending, which would be bad for corporate earnings.

The excitement around artificial intelligence (AI) reached new heights this month. The main beneficiaries have been the largest US technology focused companies, with Nvidia the poster child of this hype. During the month Nvidia released their Q1 earnings and were very positive about their future, expecting strong demand for their products (microchips) on the back of an AI revolution. In the immediacy after the results, the company added around 25% to its market cap, a staggering $220 billion! At one point the company market cap rose above $1 trillion. The strength of the largest companies in the US stock market have masked what has been pretty anaemic share price performance from the average US company this year. The narrowness of the market has presented difficulties for diversified portfolios; however, we still believe this is a sensible approach.

There are dangers with investing purely in stories and narratives and potentially avoiding fundamental analysis. We only have to look back to 2020 and some of the ‘COVID’ beneficiary stocks such as Zoom and Peloton. Share prices advanced so much and became disconnected from fundamentals, and the outcome was that share prices subsequently came crashing down in a magnitude of approximately 90% from the highs. The thesis was correct in many ways – remote working was a positive for Zoom and more and more people are likely to exercise from home, benefitting Peloton, however, expectations were just too high and as a result share prices disappointed following the initial large rally. We saw a similar case with Beyond Meat – a company that produces plant-based meat. Shortly after listing on the stock exchange the share price rose above $220 a share in 2019 as investors became attracted to the potential for huge growth as consumers shifted to more plant-based diets. Once again, the thesis is broadly correct, however, investors overpaid for the story and the current share price is around $12.50 – a fall of over 90% from highs. Now we are not necessarily predicting this for some of the AI beneficiaries; however, we are mindful of being overly exposed to this part of the market at these valuations.

Japanese equities have been strong in 2023 and this continued in May. The country remained in lockdown longer than many of its developed peers, which held back the economy. However, after fully reopening in the second half of 2022 economic growth has modestly picked up. There continues to be reform in the Japanese stock market too, which places a greater emphasis on governance, engagement and shareholder value creation. All this has made Japanese equities more attractive to investors and helped boost share prices. It’s worth noting alongside this Japanese equity valuations are low by historical standards which may have also contributed to the moves.

In terms of global economic outlook, the anticipated recession is still not materialising and economists are either giving up on this view or pushing out the start date to 2024. Economic data continues to be conflicted, with the labour market remaining healthy and business surveys picking up. This is offset by the tightening of lending standards by banks and a cooling of housing markets, driven by much higher mortgage costs. This friction in economic data can make it challenging to have a strong conviction in positioning. In this environment we believe diversification continues to be a sensible approach, while also paying attention to valuations across asset classes. It’s pleasing that we are finding opportunities selectively across bonds and equities, which offer good value over the medium-long term.

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Andy Triggs

Head of Investments, Raymond James, Barbican