The Month In Markets - May 2024

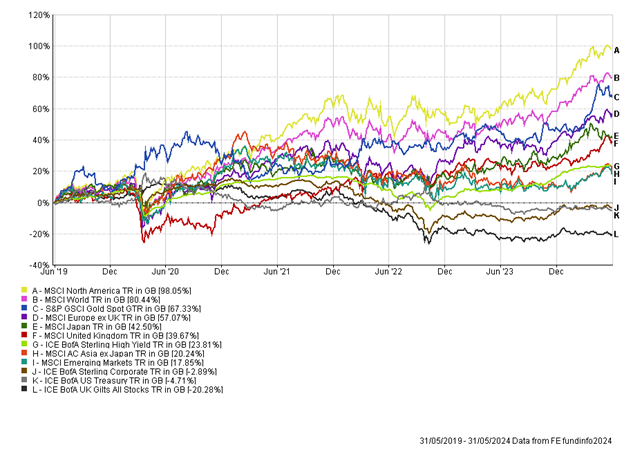

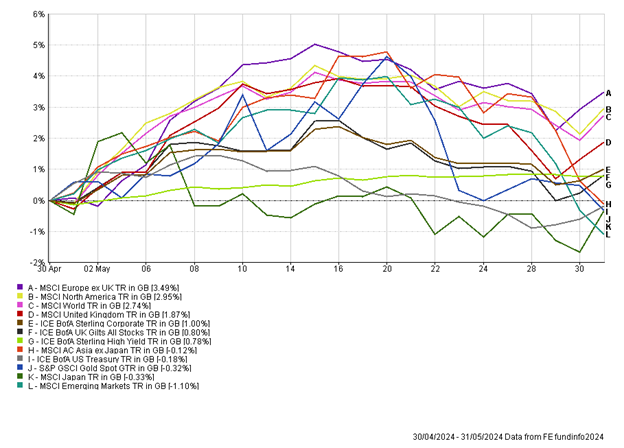

May was a choppy month, with a positive first half turning slightly sour towards the end of the month. The market’s fixation on short-term interest rates and inflation was once again the driving force for asset prices.

Starting with the UK there were two major events during the month, the scheduled release of inflation data and the unscheduled announcement that a general election would take place on 4th July 2024. While most expected an election in the autumn, Sunak surprised many by standing in the rain, calling for a general election in the summer. The Prime Minister may have felt that with stronger than expected economic growth, falling inflation and positive real wage growth, now may be an opportune moment to reverse the polls and try and retain power. While elections can have a big impact on equity, bond and currency markets, this election has not yet caused any wobbles in markets. The broad view seems to be that there will be a Labour victory, but any plans for aggressive spending will be curtailed by what happened to Liz Truss and the infamous mini budget of September 2022. As such it’s seen that Labour will have to play it safe, and that under Starmer they may become a pro-business party.

UK inflation data led to a sell-off in both UK equities and bonds. Despite headline inflation falling to 2.3%, the lowest reading in nearly three years, it was higher than the expected 2.1%. There were also higher than expected readings for core inflation and services inflation, leading to the prospects of a June interest rate cut being removed. The market is now viewing an August cut, post the election, as the most likely outcome.

The theme of takeovers continued in the UK equity market in May. There is a wide range of UK businesses trading at low valuations but performing well at a corporate level, which is making it very attractive for private equity and corporates to acquire firms. While much of the activity has been focused on the lower end of the market, deal sizes are increasing. Keyword Studios was bid for at a 73% premium to the closing price, for £2bn. The company was held in size in our UK smaller companies fund, which benefited from the immediate uplift to the share price on the bid news. Hargreaves Lansdown reported that they had rejected an offer from a consortium of private equity bidders who offered £5bn for the investment platform business. There is every possibility that a further bid could emerge for the company in June.

Over in the US, it was once again Nvidia that grabbed headlines. During the month they announced Q1 results which beat expectations and provided another big boost to the share price. The meteoric rise of the company, driven by artificial intelligence excitement, has helped propel the US equity market higher over the last 12-18 months.

Inflation in the US has proved to be sticky with many of the data readings above expectations in 2024. During May, headline inflation (for the month of April) came in at 3.4%, in line with consensus. US inflation is now considerably above UK inflation, a reversal of 12 months ago and something that many commentators did not expect last summer. The shelter component (rent) of the inflation basket has not fallen as many economists had expected and this has been one of the driving forces behind US inflation remaining considerably above target. Sticky inflation coupled with an economy that is performing well has led to the possibility that the US may not even cut rates this year, a far cry from the 6-7 cuts priced in in January. We think it likely that there will be one or two cuts made by the US Fed this year, although with the US election looming in November, they may need to act soon.

The buoyant US labour market showed signs of easing with Non-Farm Payroll data confirming less jobs had been added to the economy than anticipated. The current tightness in the labour market is leading to elevated wage inflation – the US Fed are keen to see evidence that the jobs market is cooling, and that wage growth is slowing before they pull the trigger and cut interest rates. Despite a period of slightly weaker US data, the overall picture of the US economy is still fairly strong, which should continue to support earnings growth in the near term. The positive news around Nvidia’s earnings helped advance the overall US index, with positive sentiment sweeping across the board.

Government bonds, across the developed world, have been disappointing in 2024. The sector did face headwinds once again in May, particularly the UK, where above consensus inflation data pushed back hopes for interest rate cuts. The backdrop for government bonds has been very challenged this year; lower interest rates typically favour government bond pricing, and this year has seen a huge reversal in expected rate cuts, from 6-7 cuts to now 1-2 rate cuts. We continue to view the asset class positively in terms of the prospect for positive real returns, with many of our government bonds maturing in the near term (at £100) and trading considerably below these levels, which will lead to above-inflation capital growth from now until maturity. To us, the day-to-day noise, is purely this, and won’t impact our strategy of holding these bonds to maturity. We also see government bonds as a potential hedge against any negative economic growth shock. While that is not our base case, we need to position portfolios for a wide range of outcomes. While inflation is the enemy of government bonds, commodities typically thrive in this environment; we have exposure here through holdings such as gold and commodity equities.

The Raymond James, Barbican portfolios nudged higher over the month, with UK equities and infrastructure producing strong returns during May. Japanese equities lagged, dragged down by the currency, which has continued to weaken. The Japanese Yen now looks very cheap on a wide range of metrics, and we believe there is a high likelihood the currency will mean-revert over the medium term, and as such we are comfortable with our exposure.

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.