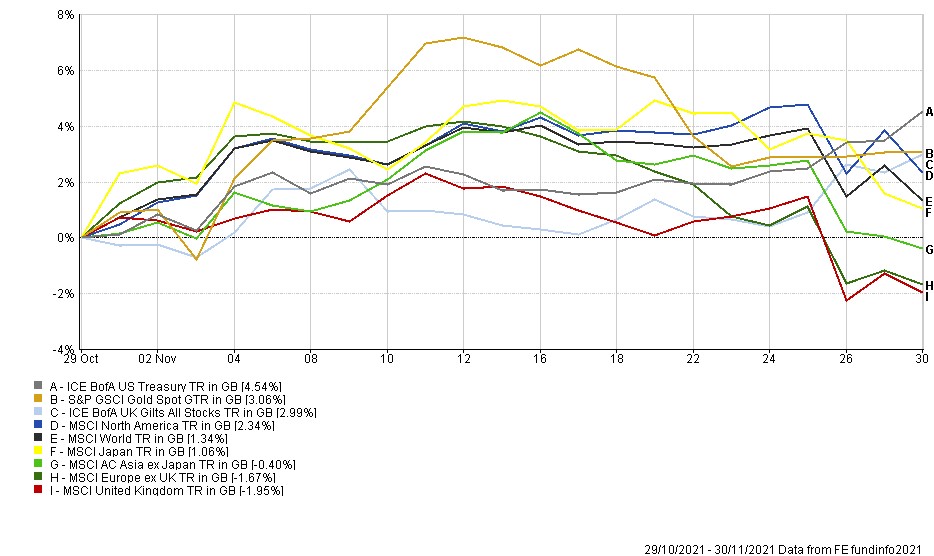

The Month In Markets - November 2021

We were on course for a decent November until Covid released Omicron; its latest update. Unsurprisingly, this caused stock markets to sell off, with money flowing into government bonds – which are perceived as a safe haven – instead. These movements, particularly the reactions from individual stocks and industries, provided an unwelcome reminder of the shock conditions we experienced in the first wave of Covid last year.

At the market level, it’s obvious why markets should take this news badly: If this variant were to resend us to square one in our fight against Covid, the return to rolling lockdowns would apply a heavy brake to economic activity and corporate profits. However, there are many unknowns about Omicron, which perhaps explains why the sell-off we’ve seen so far hasn’t been too severe.

These unknowns range from the grim back-to-square-one scenario outlined above, through the more neutral outcome of this variant being controllable through existing vaccines, to an outright positive result; that this more virulent strain turns out to be far less harmful than earlier variants. Positive because, as it passes through the population, it might act like a natural vaccine, giving us immunity against its more harmful predecessors. If this were the case, you could even imagine authorities compelling us to go out in the world to mix with other people. Good news for restaurants, nightclubs and cruise liners.

That last line hints at some of the market sub-trends that were revived this month. In our world of investing, never a day goes by without some comment on the tug-of-war between ‘value’ and ‘growth’. You’ll certainly hear us mention them in meetings with you, so a quick run-through might help.

The following is oversimplified to the point of being wrong, but to briefly explain: ‘Value’ is an investment approach that means buying companies that have become unpopular with the market, but the value investor thinks all that is about to change. If they’re right, share prices will bounce as the companies recover, or the market starts to like them again.

‘Growth’, in contrast, means buying a company that’s already growing its profits well, but that its proponents think will grow faster or further than others currently expect.

These two groups of stocks tend to move in herds, and each herd can have short, medium or long periods when it’s trouncing the other. Before the financial crisis, with a notable interlude for the late-nineties tech bubble, value had the upper hand. But the last decade was all about growth stocks: they consistently won.

And that was before the first Covid outbreak, which allowed growth to kick value when it was already lying prostrate on the canvas. The reason? The kind of out-of-favour stocks ‘value’ investors like had become cheap because they were mostly physical-world companies like retailers, airlines or oil companies. These had already been comprehensively outpaced by growth stocks, among which tech companies like Google, Facebook and Amazon were the obvious leaders.

So when Covid struck, forcing us off the roads and out of shops and airports, most value stocks took another hammering. While the fact we were all forced to spend more time in the digital world and had to do even more of our shopping online, gave ‘growthy’ tech companies a huge, unexpected windfall.

However, like a phoenix from the ashes (or a zombie from the grave, depending on which camp you’re in) value stocks were resurrected last November: The news of successful vaccine trials heralded the start of our return to the physical world, sparking a rally in value stocks that lasted for months.

It’s been a more even contest of late though, and although markets have generally continued to rise, they’ve see-sawed between value or growth along the way. However, this month, Omicron, and with it the threat of a return to lockdowns, hit value stocks hard again, while growth stocks held up better.

Until, that is, two days later, when the US Federal Reserve waded into the fray. Its chairman, Jerome Powell, stated their intention to taper the Fed’s Quantitative Easing (QE) program more swiftly than previously indicated. For reasons too lengthy to explain here, growth stocks have loved QE. As such, news that it’ll be disappearing more quickly was bad news for them. So, while the first leg down of the market on the 26th (see chart) was driven by value stocks, the second downdraft on the 30th (which carried on into December) was led by growth stocks.

So what we have here, in the space of just a week, is a microcosm of the big, conflicting forces that have been driving markets for years, and will likely continue to do so for some time to come. These really matter for the path of future returns generated by different investments, and therefore your wealth.

This is why we spend so long obsessing over them. Almost all of the assets that have performed well over the last decade have done so because they were well suited to the conditions we saw: Falling inflation, rolling QE and a movement-restricting pandemic. And because those assets have made great returns, it’s all too tempting to stick most of your money into them, as they look great on a glossy chart.

But clearly what matters now is the next decade, not the last one. And should that involve the opposite conditions: Rising inflation; an end to QE (then rising interest rates); and release from lockdowns, then there’s a good chance many of those winning assets will turn to losers (and vice versa).

The obvious solution is to work out what’s going to happen, and invest accordingly. But like many obvious solutions, it has a killer flaw: It requires a giant slice of luck, without which it’s impossible to forecast what economies and markets are going to do. And mistakenly believing you can predict them almost always ends in tears.

The honest and pragmatic answer is to stay well balanced. You’ll have heard us referring to both the growth and the value funds we hold. Our aim is to pick the best of both and therefore stay well clear of the worst of either.

This is a topic we’ll return to in future notes: It’s important that you understand our approach here. Our philosophy is that to aim for a good result with no risk of ruin is preferable to a stunning outcome achieved only by risking it all. Knowing you as we do, we think this is the right path to travel.

Simon Evan-Cook

(On Behalf of Raymond James Barbican)

Risk warning: Opinions constitute our judgement as of this date and are subject to change without warning. With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors. Raymond James Investment Services Ltd nor any connect company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon any information contained in this article. Past performance is not a reliable indicator of future results.