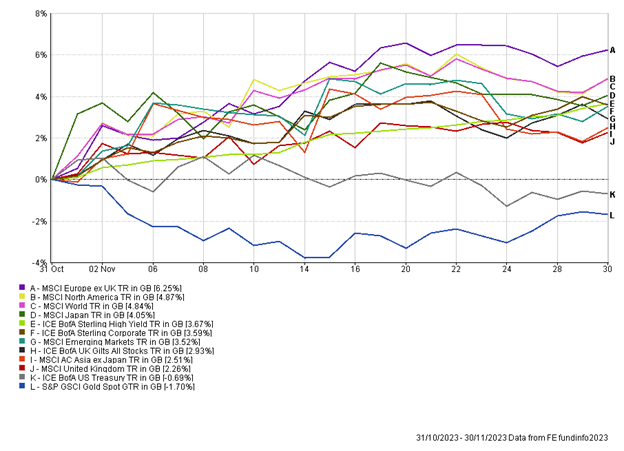

The Month In Markets - November 2023

Just as night follows day, it turns out that in 2023 a good month in markets follows on from a bad month! While asset markets struggled in October, we saw a widespread rebound in November.

In aggregate, it was a strong month for equities and bonds. The apparent catalyst for the rally was a drop-in interest rate expectations across most major economies. In 2022, both bonds and equities struggled as markets were caught out by inflation and the subsequent interest rate rises required to tackle inflation. It makes sense, therefore, that a fall in inflation along with the expectation of deeper interest rate cuts in 2024 would lead to a recovery in bond and equity markets.

At the very start of November, the US Fed and Bank of England (BoE) had their latest monetary policy meetings. At both meetings, interest rates were held at current levels, with central bankers resisting taking interest rates any higher at this juncture. This was the second meeting in succession that both the Fed and BoE had held interest rates steady and was enough for the market to believe that we may now have reached peak interest rates for this cycle. The prospect of the end of rate rises gave markets a much-needed boost after a difficult October.

There was a second boost to markets in mid-November when inflation data suggested the Fed and BoE had been correct in rejecting the chance to take interest rates higher. Inflation data from the US and UK showed promising signs as it continued to fall closer to the 2% target. While there is a way to go, the improvement from 12 months ago is stark. Headline inflation for the US came in below expectations at 3.2%. Shelter (rent) is the largest component of the US inflation basket, and this is still driving US inflation, however forward-looking data indicates this should begin to fall in 2024 and should help the US Fed get inflation closer to the 2% target. Here in the UK, we saw headline inflation fall to 4.6%, from the previous month of 6.7%. This was the biggest drop since 1992, which was, in part, driven by lower price caps on energy coming into play on the 1st October. The fall in inflation was much needed for Prime Minister Sunak, who vowed to halve inflation by the end of 2023, a target he now looks like achieving. The impact of lower inflation on asset prices was dramatic. Small and mid-cap equities, which are often seen as more interest rate sensitive, rallied significantly. The UK mid-cap index rallied over 6% during November, outperforming the large-cap index by more than 4%.

Labour markets continue to prove resilient with the most recent US jobs data showing a further 150,000 jobs were created. While the speed of growth is declining, we are yet to see any major cracks in the labour market. If people are staying employed, they will likely continue to spend and keep the economy going – remember consumption typically accounts for around 2/3 of GDP in most developed markets. While employment levels remain low, we are now witnessing real wage growth for employees, where the average wage is increasing above the level of inflation. Here in the UK wages grew on average by 7.7% (inflation 4.6%) and in the US wages grew by 5.2% (inflation 3.2%). Positive real wage growth should be a boost to consumption. For much of 2022 and parts of 2023 inflation was outstripping wage growth, contributing to the cost-of-living crisis, hopefully, we are now at a sustained inflection point.

There were differing outcomes for gold and oil during the month. By month end gold was knocking on the door of all-time highs (in USD). The same cannot be said for oil, where the price of a barrel has fallen from $95 in October to $75 in November. This is despite elevated geo-political tensions in the Middle East. It appears concerns around demand going forward, as economies are expected to slow in 2024, are weighing on the price. Inventory data highlighted higher than expected levels of oil inventory in the US, pointing towards weaker demand. Lower oil prices, while bad for oil producers, should act as an effective tax cut on most consumers and corporates and be a net positive to the overall economy, while further easing inflationary pressures.

The Autumn Statement ‘for growth’ was a bit of a non-event for markets, with no major policy changes at this stage. There were some positives for workers, with cuts to National Insurance, and at the margin, this should support consumption. On the day markets were fairly benign.

After months of back and forth between inflation and interest rates, November felt like a big month where the consensus very clearly shifted to developed markets now being at peak rates, and confidence that the battle against inflation has largely been won. This shift and easing of financial conditions were enough to lead to a rally across most asset classes. It was once again a timely reminder about the dangers of being out of the markets, with equities delivering in one month what one might currently expect from cash over one year. With many investors still sat on the sidelines, there is a wall of money which could re-position into risk assets should sentiment pick up. While this would be a short-term boost, we are drawn to the potential for long-term returns from equities with low valuations and bonds with high all-in yields.

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Appendix

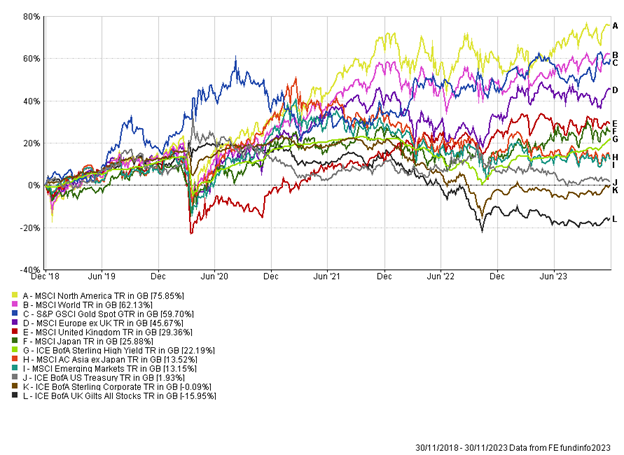

5-year performance chart