The Month In Markets - October 2024

After 16 weeks of anticipation, Chancellor Rachel Reeves delivered Labour’s first budget in nearly 15 years. This budget included significant tax increases amounting to £40bn, the largest hike since 1993. In addition to the tax rises, there were substantial increases to spending and borrowing, which are expected to provide a short-term boost to growth.

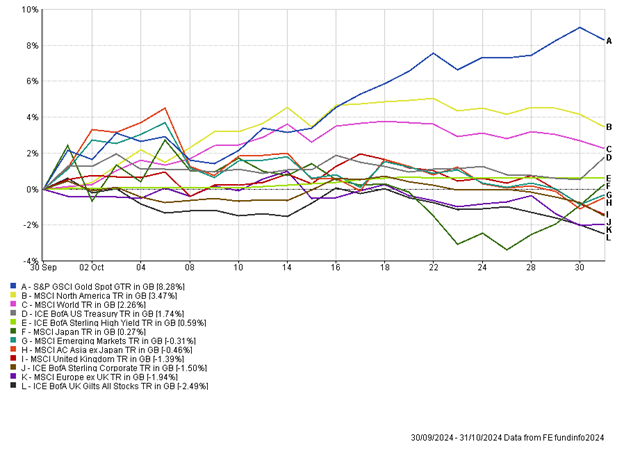

There have already been many column inches dedicated to covering the budget. As such, I will just touch on the market impact. In terms of government bonds, after an initial rally, UK government bonds sold off following the budget and continued to sell-off on the final day of October. This means UK borrowing costs are going up, not ideal given Labour’s need to increase borrowing to fund their spending plans. With the Office for Budget Responsibility (OBR) stating they expect inflation in the UK to be higher post-budget, the market has priced out some of the expected interest rate cuts. There has been a trend of developed market government bonds selling off in October, so the movement may not be fully attributable to the budget. Equity markets had a mixed response to the budget. The winner on the day was the UK AIM market, which rallied over 4%. This part of the market had sold off into the budget, with concerns around the removal of certain inheritance tax benefits. However, the changes announced were less punitive than expected, leading to an immediate relief rally. The mid-cap focused UK index marginally advanced on the budget day, while the large-cap index closed lower.

Staying with the UK, earlier in the month there was positive inflation data. Headline inflation dropped to 1.7%, lower than expected, while services inflation fell from an annual rate of 5.6% to 4.9%. The positive shift in both headline and services inflation has opened the door to UK interest rate cuts in both the November and December Bank of England (BoE) meetings. The fly in the ointment now is whether the inflationary budget will cause the BoE to pause its rate-cutting journey.

Over in the US, the presidential election (5th November) dominated headlines. Despite the uncertainty surrounding the election outcome, US equities powered on, reaching a 47th all-time high during October. After a summer lull, the mega cap technology and artificial intelligence focused companies regained their poise to post a strong month. The star performer from the so called “Magnificent Seven” stocks was Tesla, which rallied over 20%, after a strong earnings report. Founder and largest individual shareholder, Elon Musk, saw his net wealth rise by over $30bn in two days because of the rally, taking his overall wealth to $277bn, cementing his place as the world’s richest person.

There was positive inflation data in the US, with headline inflation coming in at 2.4%, the lowest reading since February 2021. The continued decline in inflation helps make the case for further interest rate cuts from the US Federal Reserve. Two central banks that are further on in their rate cutting journey are the Bank of Canada (BoC) and European Central Bank (ECB). The BoC delivered a 0.5% cut in October, meaning they have already reduced interest rates by 1.25% over a matter of months. The ECB delivered their third cut of 2024, lowering rates by 0.25% for the second meeting in a row. The market is currently pricing in cuts from both the US Federal Reserve and the Bank of England in November.

After the excitement of September, emerging market and Asian equities were much more subdued. There have been concerns about the Chinese authorities’ abilities to deliver on their planned stimulus measures and even if they do, the market is unsure whether it is enough to turn round a flagging property market and struggling economy, hamstrung by poor demographics. As a result, Chinese equities fell during the second half of the month as investors pared back their bets on the world’s second-largest economy. We have seen companies that rely on China as an end market struggle of late. Within the luxury goods sector, companies such as Burberry have blamed Chinese weakness for poor results. UK-listed medical technology company Smith & Nephew also pointed to China as a reason for disappointing Q3 results.

Gold had another impressive month, making new all-time highs during October, with the price approaching $2,800 an ounce. The price of the precious metal has outperformed most equity and bond markets, rallying approximately 30% in 2024. Although not covered in the chart, silver has outperformed gold this year, and while the gold price is at all time-highs, silver is still close to 50% off its all-time high. Silver is often seen as more cyclical than gold, due to its more commercial use, and doesn’t offer the same diversification properties within a typical multi-asset portfolio.

At a currency level, we saw a resurgent US dollar after a few months of weakness against a basket of currencies. Against sterling, this meant it moved from around 1.34 to 1.30. Given the large fiscal deficit currently being run by the US, one could argue that the US dollar might weaken going forward. However, as the world’s reserve currency, and with no viable alternative, there is always likely to be demand for the greenback currency.

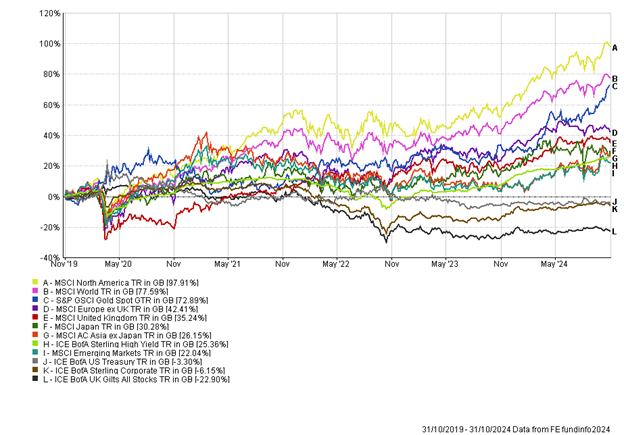

The end of October 2023 kickstarted a strong rally into the end of the year, with nearly all gains made during the year, occurring in the final two months. It was a reminder that patience is needed when investing, and that returns can be lumpy, but substantial at times. With events like the budget now over, and the US election soon to pass, some of the uncertainty looking over markets will be fully removed, which could support risk-taking once more.

Andy Triggs

Head of Investments, Raymond James, Barbican

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.