With the current US administration seemingly taking a sledgehammer to established norms, our European Strategist, Jeremy Batstone-Carr considers the potential effects of tariffs, changing international relations, domestic increases in defence spending and more, on investments.

The Week In Markets – 1st February – 7th February 2025

Twin Peaks

Jeremy Batstone-Carr, Raymond James European Strategist, takes a deep dive into some of last month’s destabilizing activities including the potential ramifications of the new US administration’s campaign promises and the recent upset in the technology sector generated by China’s norm-busting AI model, DeepSeek.

Investment Strategy Quarterly – January 2025

Our first Investment Strategy Quarterly of 2025 brings insight and opinion including 10 themes to watch out for in the US this year, what we think we might expect from Trump 2.0, potential effects on the energy market as focus moves from geopolitics to the electric grid, what we know (and don’t know) about uncertainty, plus where (and how) there may be economic growth this year.

Read all this and more in Investment Strategy Quarterly: 2025 Outlook

Will Syria trouble markets?

“Seismic”

Our European Strategist, Jeremy Batstone-Carr considers the potentially seismic effect of the US election result on global markets, and China in particular, including some possible effects of the much-touted trade tariffs that have been promised for the coming year. And as the effects of the UK Budget become clearer, what is the potential for domestic inflation?

Silver Blaze

With the long-awaited UK Budget and the US election now upon us, Raymond James’ European Strategist, Jeremy Batstone-Carr, considers the potential effects of tax rises and increased public investment (as well as an increase in borrowing), along with some thoughts on the direction of the markets post-election.

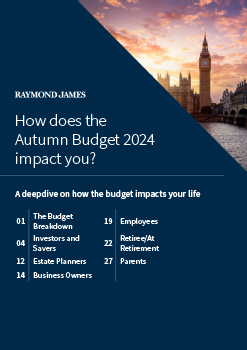

Autumn Budget Newsletter 2024

Investment Strategy Quarterly – October 2024

Our latest Investment Strategy Quarterly gives you informed insights on what we might expect from the recent change in UK government, options to consider in the run-up to the US election, the cost of tariffs and the reliability of the inverted yield curve.

Read all this and more in Investment Strategy Quarterly: The Great American Road Trip.