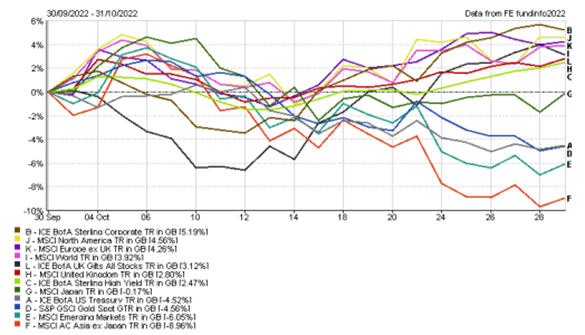

This week we entered the seventh month of a year that has certainly been full of surprises. We haven’t been bombarded with a multitude of data releases like previous weeks, however, we’ve seen markets respond significantly to the data, creating a challenging week for both equities and bonds.

This week saw the high street lender Halifax release housing data which showed UK house prices fell 2.6% on a year-on-year basis. This is the biggest annual decline since June 2011 and with continued elevated interest rates we could see further weakness in the housing market. In reaction to the Bank of England (BoE) raising interest rates to 5%, banks will have to adjust mortgage rates to reflect this. The average five-year fixed rate mortgage has now risen to above 6% – we last saw these levels in November 2022 following the reaction to then Prime Minister Liz Truss’ “mini” budget. High street bank bosses, just like investors, are expecting further interest rate hikes by the BoE this year in an effort to tackle inflation, with concerns that fixed rate mortgages could reach 7% by the end of summer. While this may not be an immediate problem, given the high proportion of households on either a fixed-mortgage, or no mortgage at all, if rates are held at these high levels for an extended period of time, more and more consumers will be negatively impacted. It is estimated there are around 2.4 million fixed mortgages that will need to be refinanced between now and the end of 2024.

Staying within Europe, Germany, which is Europe’s largest economy, recently fell into a technical recession. This week we saw the release of the nation’s manufacturing Purchasing Managers Index (PMI), an index that calculates the expansion or contraction in the manufacturing sector. For the month of June, we saw the Manufacturing PMI revised down to 40.6, down from 43.2 the previous month. A PMI figure below 50 highlights a contraction, with Germany’s PMI now contracting at its fastest pace in over three years. There was better news for Germany’s services sectors, which continues to expand, albeit at a slowing pace. The data came in at 54.1, down from 57.2 for May.

On Wednesday the latest US Fed meeting minutes were released, as well as a press conference from the US Fed member John Williams. Both the meeting minutes and Williams’s comments were seen as hawkish with the Fed member stating “we still have more work to do”. US government bonds sold off on the news, with further interest rate hikes now expected this year.

Bond markets continued to weaken on Thursday following the release of very strong private payrolls data, which pointed to 497,000 private payrolls added in the month of June. This was considerably ahead of expectations and highlights the strength of the private labour market. It wasn’t just US government bonds which sold off, UK and European bonds resumed their recent slump as a ‘higher-for-longer’ mantra was adopted by investors. We are now witnessing higher yields in the UK than compared to the aftermath of the mini-budget last year.

Staying with US labour data, this afternoon has seen the release of the closely watched US Non-Farm Payrolls data. For the first time this year, the data came in slightly lower than consensus, with 209k jobs added against an expected 230k. However, the data still points to a healthy labour market, while wages grew at 4.4% year-on-year, which is now real wage growth in the US given inflation is at 4% currently. The data has re-affirmed the belief that there will be further interest rate hikes from the US Fed.

It has been a difficult week in markets with positive correlations between equities and bonds resuming, driven by concerns around inflation and further interest rate hikes. With yields at the highest levels since the financial crisis and valuations in most equity markets trading at discounts to history, it feels as though patience and time are two characteristics that investors need to focus on.

Andy Triggs, Head of Investments & Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.