We missed the opportunity to begin the weekly round-up with a fact last week, so we will start this week with one! In 2024, France was the most visited country in the world, attracting 100 million visitors. It wasn’t skiing or the Olympics that drew people to France this week, but an artificial intelligence (AI) summit led by French President Emmanuel Macron.

The summit lasted two days and was attended by various global leaders, including US Vice President JD Vance. It concluded with a declaration outlining six main priorities, including promoting AI accessibility, encouraging AI development and ensuring AI is “open, ethical and transparent”. A total of sixty countries including China, France and India signed the declaration. The UK and US stood side by side in refusing to sign the declaration, with Mr Vance stating, “excessive regulation of the AI Sector could kill a transformative industry”. Prime Minster Sir Keir Starmer was not present at the summit but mentioned the UK are open to future revisions of the declaration.

Sir Kier Starmer will certainly be celebrating the small wins, including positive economic growth figures for Q4 2024. GDP rose from 0% in Q3 to 0.1% in Q4 2024, beating market expectations of a contraction of -0.1%. When we break down the data it was the services and construction sectors that provided the much-needed boost to the economy. It has not been smooth sailing for Chancellor Rachel Reeves since her fiscal plans to increase tax burdens on businesses were highly criticised, and she was not satisfied with the current level of economic growth, which is why she is “determined to go further and faster in delivering growth and improving living standards”.

It was just last week that the Bank of England (BoE) met and reduced rates due to sluggish growth and a recent drop in inflation. Policymaker Catherine Mann, who was one of two who voted for a larger 50bps (0.5%) cut to rates, spoke this week. Despite being viewed by markets as an “uber-hawk”, she believes that there was sufficient evidence of softer consumer demand and the risk of a deterioration in the labour market. This caused her to signal to markets that she had dropped her previous stance of opposition to cutting rates. However, she noted that “50 now does not mean 50 next time” as she maintains an active view on the direction of rates.

Unilever, the parent company of Ben & Jerry’s, dealt a blow to both the UK and US by choosing Amsterdam as the primary listing for the ice cream company. Unilever own various brands, including Dove soap and TRESemmé hair products. However, their earnings report underwhelmed on Thursday, followed by weak forecasts for the first half of 2025, causing a 6% share drop on the day. Chancellor Rachel Reeves did meet with Unilever last September in a bid to convince them that the UK was the correct destination for listing, but did not convince them to have their primary listing in the UK. There is still optimism that the UK will be able to convince fashion retailer Shein to list on the London stock exchange for around £40billion.

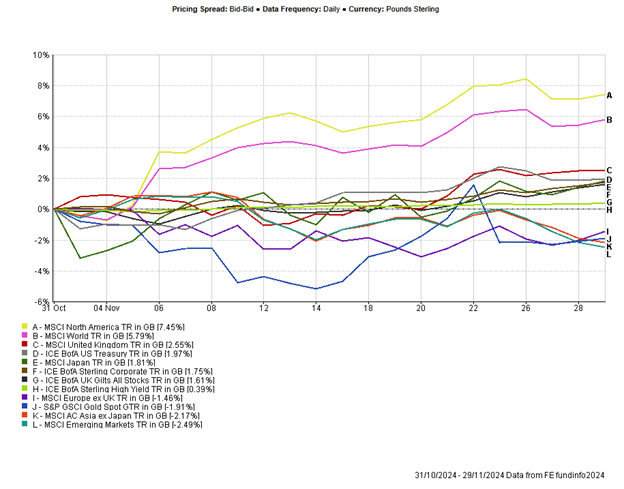

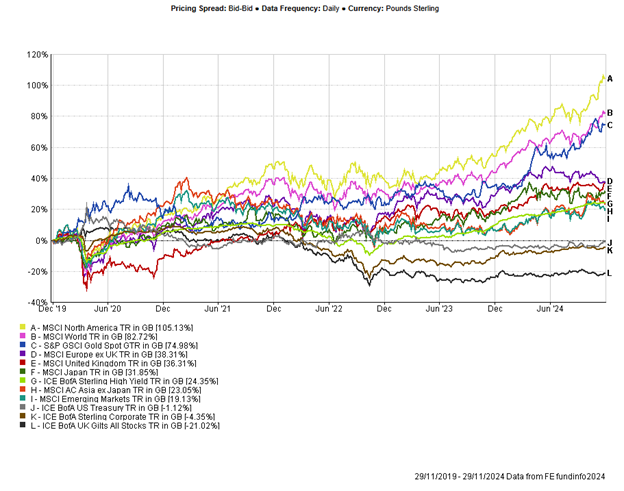

US inflation was the most significant data point of the week for markets, and it continues to run extremely hot. If we think back to the September reading, inflation was on the mend and down to 2.4%, but it has since reaccelerated, hitting 3% in January. Core inflation (excluding energy and food costs) rose to 3.3% year-on-year. Standout sector increases include the price of used cars, medical care commodities and airline fares, which have been consistently rising. President Trump has called for the US Federal Reserve to cut rates; however, they are cautious to act as Trump’s tariffs and immigration policies have the potential to be inflationary. Markets have forecast that we will not see the first rate cut until September this year. US equity markets reacted negatively to the news, with the S&P500 falling over 1% on the day, although it recovered these losses by the end of the week.

US Retail sales were released this afternoon, rounding up disappointing data points for the US. Retail sales (month-on-month) for January fell by -0.9%, following a revised December figure of 0.7%. It’s tough to pinpoint the exact cause of such weak sales, as poor weather conditions hit parts of the country and consumers were expected to pull back spending following the Christmas period. US government bond yields fell (prices rose) on the news, as investors digest whether the potentially slowing consumer could force the US Fed to cut rates.

It will be the UK’s turn to hold their breath next week as inflation, wage growth and retail sales figures are all set to be released. Within portfolios, gold has remained a key contributor as market uncertainty continues to drive investors towards the safe haven asset. European equities have also quietly continued to perform this year, as President Trump spoke of a potential peace deal between Russia and Ukraine.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.