There are many planned elections across the globe this year, but a change of political leadership in Haiti was not planned. However, Prime Minister Ariel Henry has announced his resignation. Mr Henry has led the country on an interim basis since July 2021 but over recent weeks pressure from heavily armed gangs, who have demanded his resignation, has grown. A “transition council” is set to be put in place to replace Mr Henry and restore order in the capital, Port-au-Prince.

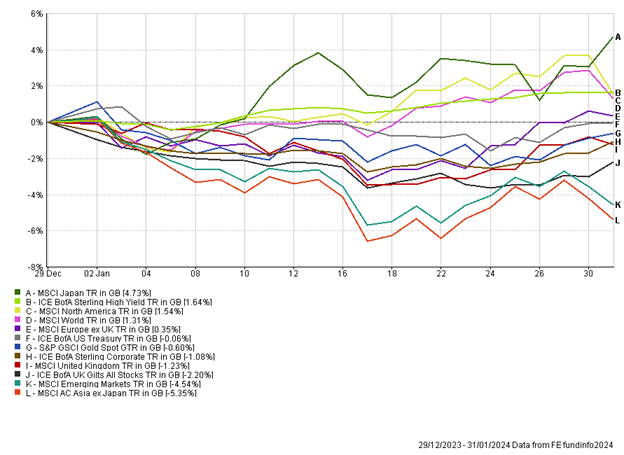

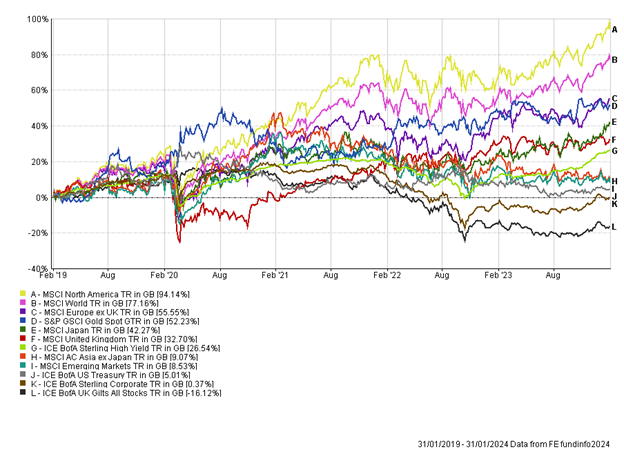

Looking up the North Atlantic Ocean to the US, inflation figures for February were announced this week. Headline inflation (year-on-year) ticked up to 3.2%, coming in greater than market expectations of 3.1%. Core inflation (excludes food and energy prices) fell from the previous month to 3.8% but still came in higher than expected. Inflation is certainly sticky in the US as higher costs in oil and shelter (rent) contribute to the rise in inflation. The inflation data is likely to deter the US Fed from any imminent rate cuts and the market moved their expectation of a first rate cut towards the summer. In response to a “higher-for-longer” narrative US and global bonds sold off.

Retail sales in the US fell over the month of February to 0.6%, rebounding less than the expected 0.8%. With inflation appearing to remain sticky, there are signs of slowing consumer spending over this first quarter of the year. Sales at petrol stations rose 0.9% reflecting a higher price at the pump, however online sales, personal care and health sales all fell. The number of Americans applying for new unemployed benefits also fell as weekly jobless claims came in at 209k from the previous 210k. Revisions of data points are certainly happening at a greater occurrence, as a revision to the previous weekly jobless claims showed laid off workers are finding work quicker and not spending a significant time on benefits.

In the UK, GDP data for January (month-on-month) was positive at 0.2%, boosting the hope that the UK recession is already over. Data from the Office for National Statistics (ONS) showed that a 3.4% jump in retail spending was the main contributor to growth. There was also a pickup in housebuilding to start the year as construction output saw a 1.1% jump. The UK will remain in a technical recession until GDP figures for Q1 24 are released, however the positive start to the year in terms of economic growth is certainly welcomed.

Japanese car manufacturer Toyota Motors has enjoyed huge success recently and this week agreed to give factory workers their biggest pay rise in 25 years. Toyota are not the only company doing this as Panasonic, Nippon Steel and Nissan also agreed to meet union demands of meaningful monthly pay increases. Japan Prime Minister, Kishida, who made a point to end weak wage growth in the hopes of boosting consumer spending, will be pleased union talks were positive. It is key that the wage growth momentum trickles down from large firms to the small and mid-sized firms in order to help boost spending in the domestic economy.

The Bank of Japan (BoJ) are also watching the wage growth cycle closely as they meet at the beginning of next week to discuss the potential end of negative interest rates that have been in place over the last nine years.

The impact of sticky US inflation led to a small pull back in both bond and equity markets. Commodity prices have ticked up on the back of a stronger economy, with crude oil rising above $80 a barrel this week and both the copper and silver price performing well. In general equities exposed to energy and mining performed poorly in 2023, however, they appear well placed to benefit from any signs of persistent inflation and have been the bright spot this week. Our resource exposure in portfolios is based on long-term views of scarcity of supply, with improving structural demand, however, the asset class also provides us with an inflation hedge and helps offset some of our growth focused equity positions, such as technology.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.