As we delve deeper into December, it’s always interesting to learn facts about Christmas spending. Over the Christmas period, Brits eat approximately 175 million mince pies. The UK also uses over 220,000 miles of wrapping paper per year. Despite the cost-of-living crisis, spending is expected to rise to a total of £27.6bn fuelled by credit cards transactions.

In the UK, Nationwide house price data showed prices have surprisingly risen for the third month in a row. House prices in the UK surged over the Covid period as the pandemic led to more households looking for greater living space and moving homes. This was also fuelled by government tax incentives and (at the time) low interest rates. Fast forward to today and with mortgage rates considerably higher than two years ago, affordability has become tougher.

In the US, Spotify, the music streaming company, have announced further cuts to the workforce. They plan to lay off around 1,500 employees, this follows cuts of 600 employees in January and 200 in June. CEO Daniel Elk, admitted to over hiring over the past three years with the firm now expecting an operating loss over Q4. Spotify have big ambitions to reach one billion users by 2030 and part of the strategy included hefty podcast contracts for A-List celebrities such as Michelle Obama, Megan Markle and Prince Harry. Two major podcasts – “Heavyweight” and “Stolen” have already been told their contracts would not be renewed. Spotify users can almost certainly expect a price hike for streaming services!

November US Non-Farm Payrolls data was released this afternoon with 199,000 jobs added to the economy, coming in above market expectation of 180,000. This is a jump up from October’s figure of 150,000 and goes against the previous trend of a slowdown in hiring. The US labour market strength continues to surprise.

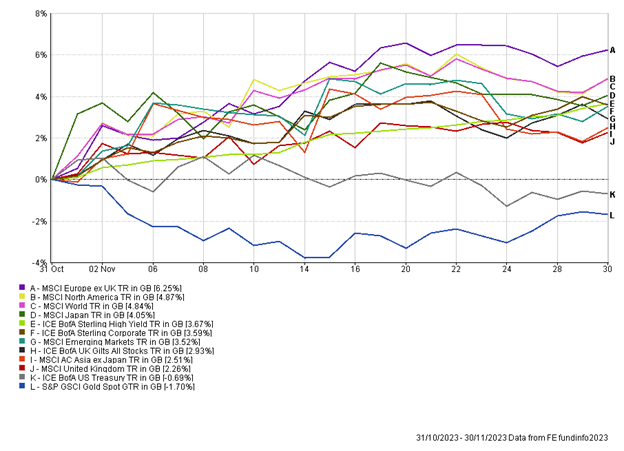

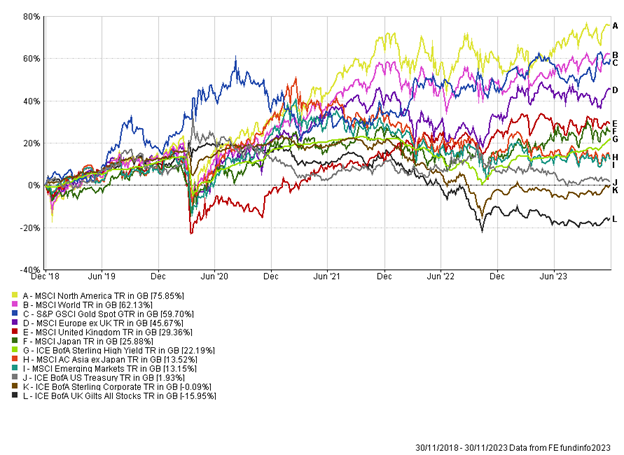

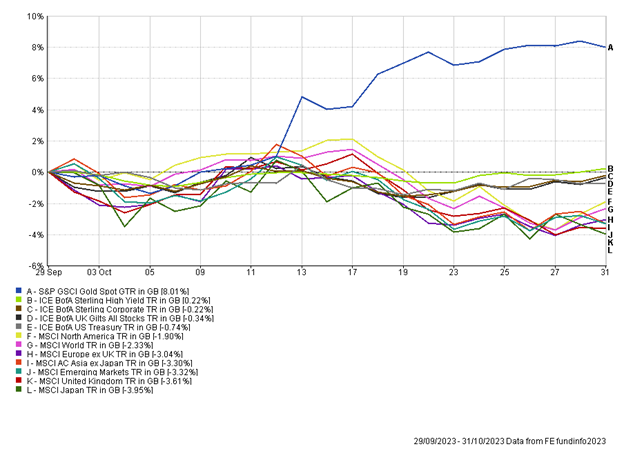

As we mentioned in the monthly note for November, consensus for developed markets have clearly shifted and this is becoming more evident as we saw the S&P 500 index close at a 12-month high level on 1st December, just shy of 4600. This is under 5% away from the all-time peak set in December 2021 and has been driven by the expectation we have seen the peak in rates, with potential cuts next year. We saw the US 10YR treasury hit 5% in October and since then the yield has dropped to 4.17%.

Euro zone inflation has followed the trend and tumbled down to 2.4% following ten straight interest rate hikes from the European Central Bank (ECB). This week ECB board member, Isabel Schnabel, gave a dovish speech, stating further interest rate hikes should be off the table. Just a month ago she had a different tune, with the view that one last hike was an option to tackle the last part of the inflation fight, but she has since switched her stance following the greater than expected drop in inflation figures. Bond yields have fallen reflecting this view as the Germany 10YR Bund fell to 2.16%, the lowest level in 6 months.

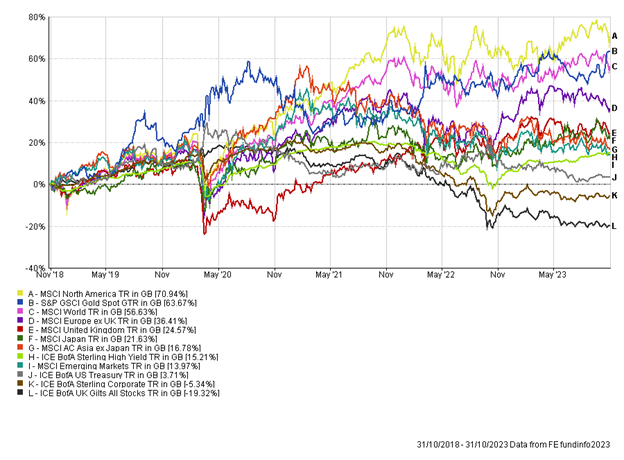

As we round up the weekly, it’s important to point out Gold reached an all-time high of $2,137, driven by a weakening dollar. Next week looks to be a busy week as US inflation and UK GDP data prints will be followed by the US Fed and Bank of England’s last policy meetings of the year. We continue to consider a wide range of asset classes to reduce portfolio volatility and capture investment opportunities. Diversification in asset class, style and management is key in order to navigate the markets.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.