The Month In Markets – February 2023

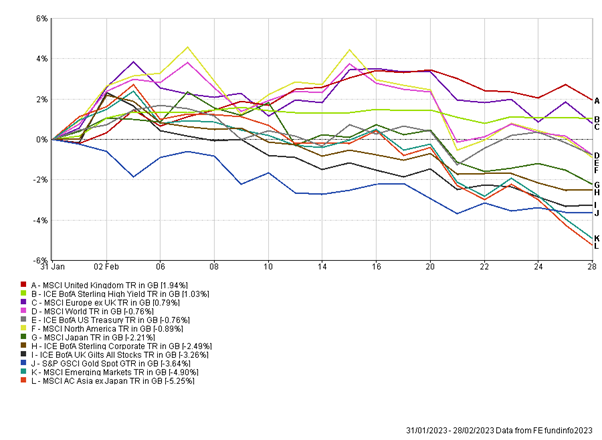

The strong start to the year failed to gain traction in February with most asset classes suffering declines. Strong economic data and surprising inflation led investors to question the latest narrative of a “Goldilocks” investment environment and start to consider a “higher for longer” interest rate environment.

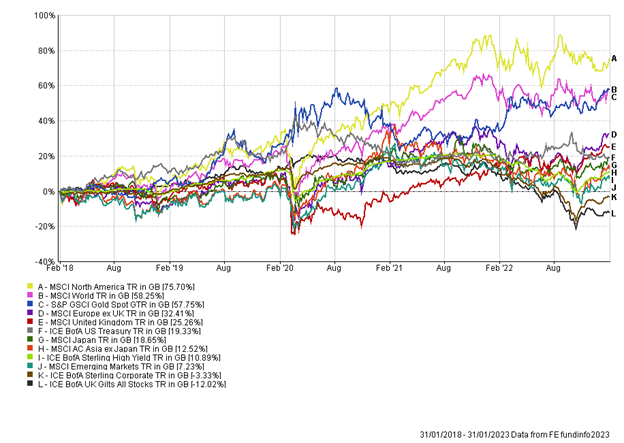

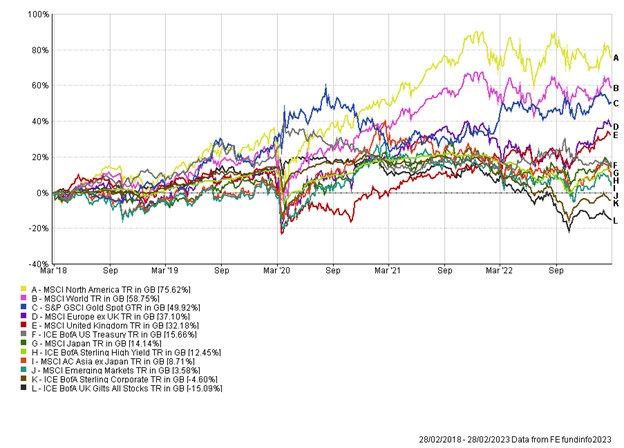

Before we discuss the likely reasons for the market movements in February, it is worth considering investment timeframes, and the perils of being too short term. Writing these monthly pieces is a reminder to me about the difficulties with investing and why it is important to take a long-term perspective. It feels like each month there is a new story for investors to focus on and a change in market direction and leadership. If we were to follow the short-term noise we would continually be buying at recent highs and selling at recent lows. The two very different market conditions in January and February this year are evidence of this in action. Often the world is not as bad, or indeed not as good as the short-term noise suggests, and for those long-term investors, willing to look through the noise, there can be significant long-term rewards. It is always worth remembering the quote from Warren Buffett – “The stock market is a device for transferring money from the impatient to the patient”.

And so, to February. The optimism of January, driven by expectations of falling inflation and a stronger-than-expected economy, made way to a view of inflation re-accelerating and central banks being forced to take interest rates higher, and keep them there for longer. The “Goldilocks” narrative of January was soon replaced with the “higher for longer” narrative for February.

US Inflation data came in at 6.4% (year-on-year). This was ahead of expectations (which were 6.2%) and only slightly lower than the previous month’s 6.5%, indicating the pace of change was slowing. This data challenged the view that inflation was on a clear path lower and called into question whether the US Fed could ease up on their fight against inflation. We witnessed a rise in bond yields (fall in price) as investors priced in higher US interest rates later this year. As was the case last year, higher expected interest rates negatively impacted equities, with some of the bond proxy stocks being hit hardest.

European inflation data, released at the end of the month, confirmed that the battle against inflation may not yet be over. Surprising jumps in both French and Spanish inflation data led investors to price in a higher terminal rate for European interest rates (moving from 3.5% to 4%). Higher interest rates, kryptonite for bonds, led to rising government bond yields (falling prices). The yield on the 10-year German bund hit 2.70%, the highest since 2011. Less than a year ago the same 10-year bund had a negative yield!

During the month of February economic data releases broadly came in ahead of expectations, indicating that the US and global economies were more resilient than expected. Again, this helped to feed the new narrative that the work of central banks may not yet be over, and a period of higher rates for longer may now be upon us. US Non-Farm Payrolls data, one of the most watched data releases, highlighted extreme strength in the labour market. The previous six months had seen a slowing pace in job hiring in the US and this was expected to continue into January. The consensus view was for around 185,000 jobs to be added to the economy. The official number was above 500,000! This strong hiring in January points towards tightness in the labour market, which is likely to continue to put upward pressure on wage inflation. Here in the UK the labour market also remains tight, while wage inflation has recently been exceeding expectations. After the Bank of England raised interest rates by 0.5% at their previous meeting, they are now expected to carry on further and increase rates by an additional 0.25% at their next meeting (taking rates to 4.25%).

In the previous monthly piece, we commented on some of the drivers of the stronger-than-expected economy and these factors are likely to have continued to support the economy in February. As a reminder, these were plummeting gas prices in Europe and more generally cheaper energy prices globally, and the re-opening of China and rebound in economic activity currently underway in the world’s second largest economy.

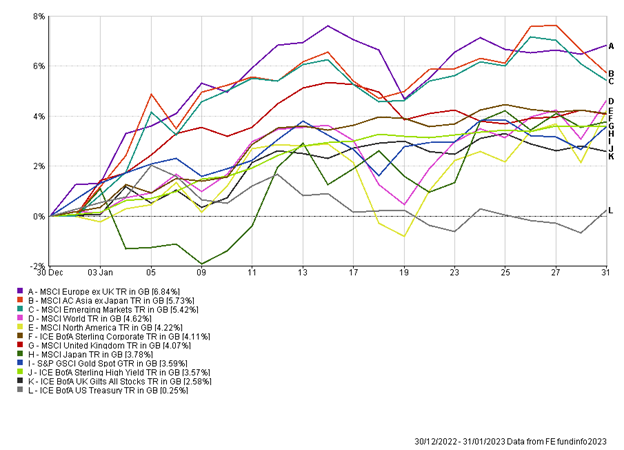

The swing in sentiment in February generally led most asset classes lower, in complete contrast to January when almost all assets rose in value. As has been highlighted already the oscillating nature of markets in the short-term can lead one to overtrade and continually chase their tail in search of returns. We think the probability of success, or at least repeated success, is extremely low from taking such short-term views.

We are taking note of the recent data, but as the saying goes, one swallow does not make a summer. Our bigger-picture thinking still leads us to be cautious about the global economic outlook. We are mindful that it will take time for the impact of higher interest rates to feed through to the economy. Remember 12 months ago the US Fed hadn’t even begun to raise interest rates!

With higher expected returns on defensive assets, such as cash and short-dated government bonds, we believe we are being paid to be patient, a scenario we have not really experienced over the previous decade.

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Andy Triggs

Head of Investments, Raymond James, Barbican