Happy New Year and welcome to the first weekly note of the year. The current high interest rate environment looks to have led to people trading down as discount grocery stores Aldi and Lidl ran up their best ever trading day on Friday 22nd December. It is estimated that half a million shoppers switched permanently from the mainstream Tesco and Sainsbury to the discount stores. Tesco are set to release reports on how they fared over the Christmas period.

It is difficult to sit at the start of the year and forecast what is going to happen. However, that doesn’t stop us from making predictions and planning for a variety of different outcomes. Will inflation remain sticky or fall to the 2% target? Will central banks cut rates more than expected? Will we see the long and variable lags of monetary policy? Will we avoid a recession? Will potential elections influence markets? All valid questions that only time will answer.

On Thursday afternoon, labour leader, Sir Kier Starmer gave his first speech of the year. In his speech “Project Hope” he set out five main missions which include getting Britain building houses again, to decarbonise UK energy by 2030 and getting the NHS back on its feet. Election years can have significant impact on investor sentiment so it will be important to stay on top of the political landscape this year.

Halifax bank reported UK house prices (year-on-year) rose for the first time in eight months as prices were 1.7% higher than the previous December. This has been due to a tight sellers’ market with not as many houses up for sale. In this higher interest rate environment mortgage rates have surged, and activity has fallen. However, as we have seen the pause in interest rates and investors flirting with the idea rates will be cut soon, buyers and sellers have begun to return to the market. The feeling is that as more people come to market, house prices could fall within the 2% to 4% mark and with mortgage rates continuing to drop, buyer confidence should increase, seeing more movement in the housing market.

US job openings was the first insight of the year into the labour market, with openings falling to 8.79m in November. This will be encouraging for the US Federal Reserve as a sign that the labour market is cooling and strengthen investor expectations of rate cuts later this year. Another positive sign for the US Fed is that the number of people quitting their jobs fell to 3.47m, the lowest level since February 2021. With less people quitting and job-hopping this should help ease wage growth.

We then received mixed market messages this afternoon as December US Non-Farm Payrolls data was released and surprised as 216,000 jobs were added to the economy. This came in largely above market expectations of 170,000. The strength of the number of jobs added to the economy should keep pressure on wages and bonds yields rose on the back of the data as investors mulled over whether an expected six interest rate cuts in 2024 was too optimistic.

The Eurozone may be in bigger trouble than first anticipated as business activity contracted in December. Purchasing Managers Index (PMI) is an index that indicates the direction a sector is heading (whether contractionary or expansionary), and the services PMI is currently still in the contractionary zone at 48.8. This could point towards a recessionary period as growth struggles continue; Q4 2023 GDP data could be negative as it was in Q3 2023.

Eurozone inflation as predicted by ECB President, Christine Lagarde, rebounded to 2.9% (year-on-year) in December. It was anticipated that the rise would occur due to the change in the energy price base, but core inflation (excluding food and energy) dropped to 3.4% in December from 3.6% the previous month. This strengthens the ECB’s decision to continue to hold rates firm.

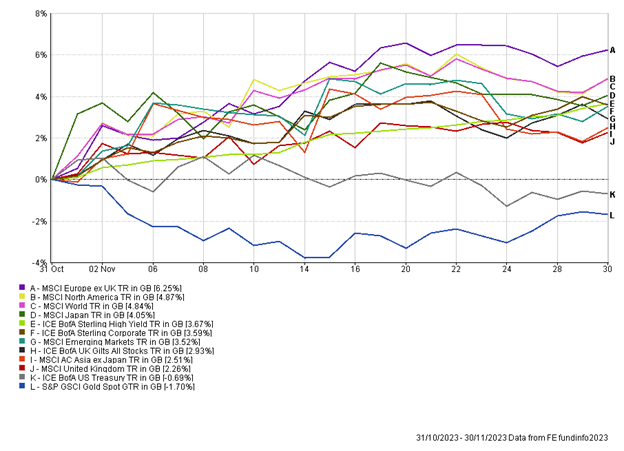

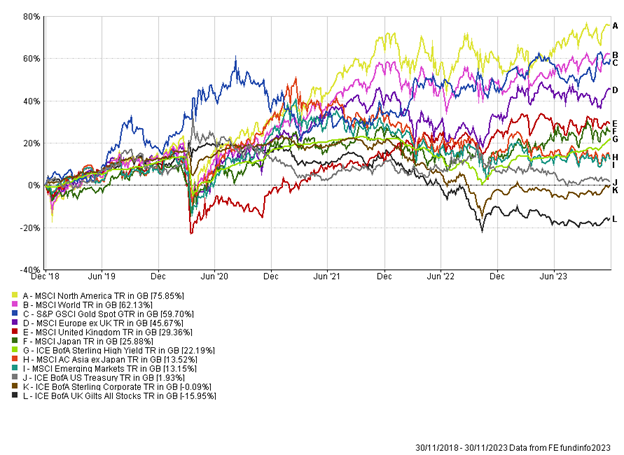

The Santa Rally certainly delivered in the closing month of 2023, however, the first week of 2024 has been subdued. The tech-heavy NASDAQ 100 has just seen five back-to-back days closing down. The last time this event occurred was in December 2022, and following this the NASDAQ 100 went on to post stellar gains in 2023. We continue to stand by our beliefs on diversification within portfolios, allowing us not to be caught out by short term volatility. After such a strong end to the year, it is natural that there is an element of profit taking and rotation of out last year’s winners. We continue to see great value in many areas of the equity and fixed income markets and believe the backdrop of declining inflation, mild growth and an end to high interest rates should be supportive for asset markets.

Nathan Amaning, Investment Analyst.

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.