As we enter the month of February, the weekly update would usually begin with an interesting fact about the month. However, this time, we start with a significant announcement made by President Trump over the weekend. Beginning from the 4th of February, a 25% tariff was set to be imposed on all goods imported from Canada and Mexico, and a 10% tariff imposed on all imports from China.

Trump’s tariffs were perceived as strong bargaining chips and by Monday afternoon Trump had gained the upper hand. Following phone calls with both Mexican president Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau, he announced that the tariffs would be postponed for 30 days. Mexico agreed to send 10,000 soldiers to the border to prevent drug trafficking from Mexico to the US. Canada followed suit a few hours later with the implementation of a $1.3billion plan to reinforce the Canadian-US border with new transport, technology and extra personnel in order to stop drug trafficking and illegal migrants.

Markets sold off sharply at the open on Monday morning in response to the initial news with equity markets falling almost 2% and the US Dollar strengthening. Trump also hinted that the EU would be next to face tariffs but did not specify a timeline, while the UK was set to potentially be “spared”. Fund managers have called Trump’s period in power “chaos” but on the other hand, he seems to be fulfilling his promises.

That’s enough Trump talk, but we do remain in the US as Alphabet (Google’s parent company) released their Q4 2024 earnings on Tuesday. Earnings per share rose to $2.15 but fell short on revenue at $96.47billion. Capital expenditure, which leaned heavily towards “technical infrastructure” rose to $14.28billion. Cloud revenue growth disappointed as it decelerated in Q4, rising 35% in Q3 but only 30% in Q4 to $12billion. Alphabet shares fell almost 8% on the day, but CEO Sundar Pichai spoke confidently following the earnings releases about the opportunities ahead, stating capital expenditure would rise by $75billion in 2025 to “accelerate progress”.

We’ve had the first US Non-farm payrolls print of the year, with 143,000 jobs created in January. There were strong payroll figures to end 2024 with 261,000 jobs created in November & 307,000 jobs in December. Market expectations were for a slowdown to 170,000. The unemployment rate also moderated to 4% from 4.1% the previous month. With soft labour figures for the month, the US Federal Reserve will certainly consider the data; however, they have signalled they will act cautiously given the uncertainty around government policies.

It was a unanimous decision on Thursday in the UK as all nine monetary policymakers agreed to cut rates. The Bank of England (BoE) cut rates by 25bps (0.25%) to 4.5%, marking just the third cut since August 2024. Despite a slight resurgence in inflation over Q4, December’s inflation figure bucked the trend, falling to 2.5%. Growth in the UK has been weak, which is why members Catherine Mann and Swati Dhingra favoured a larger cut of 50bps (0.5%) to 4.25%. Governor Bailey stated that the BoE would “monitor the UK economy and global developments very closely”. Markets reacted positively, with the FTSE 100 up over 1% for the day and the more domestic FTSE 250 up over 1.5%. The large cap index has once again made new all-time highs this week, although more domestically facing equities are lagging, despite a recent resurgence.

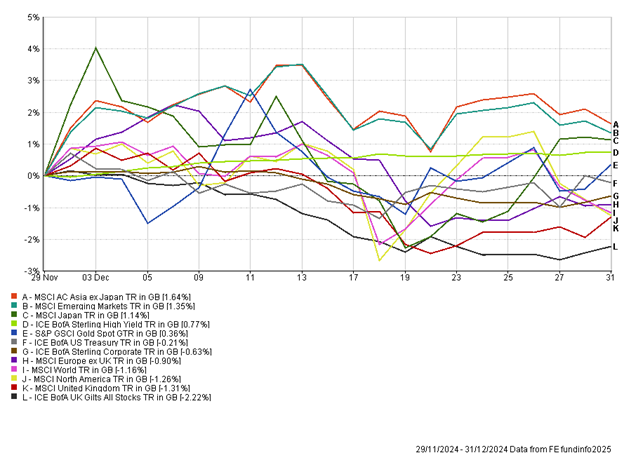

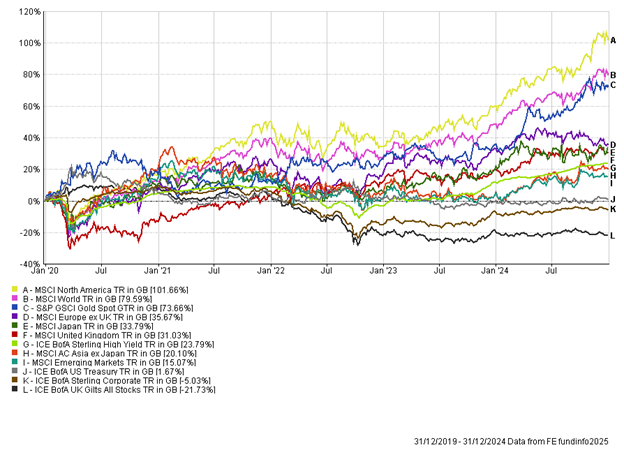

In a week full of ups and downs, gold prices rose to a new all-time high of $2,895, driven by safe haven demand following the tariff situation earlier this week. Investors flock to gold as a hedge against market volatility and economic uncertainty. Other safe haven assets such as government bonds have also enjoyed a better time of things of late, in part driven by more dovish positioning from central banks, coupled with increased geopolitical uncertainty, pushing investors to perceived safer assets.

News flow for 2025 has appeared very challenging, yet we have seen a range of equity markets pushing higher. It’s a reminder of the dangers of trying to time markets. Portfolios remain well diversified both at an asset and country level, which we think is the prudent approach over the coming years.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.