With the long-awaited UK Budget and the US election now upon us, Raymond James’ European Strategist, Jeremy Batstone-Carr, considers the potential effects of tax rises and increased public investment (as well as an increase in borrowing), along with some thoughts on the direction of the markets post-election.

Autumn Budget Newsletter 2024

The Week In Markets – 26th October – 1st November 2024

Today is the first day of November, an important month that will determine the US presidency with the election taking place next week. This week in the UK there was a significant event that most will have closely followed, the Autumn Budget 2024, where Chancellor Rachel Reeves became the first female in history to deliver the budget.

There was a lot to digest in the budget with larger than anticipated tax rises, spending and borrowing being announced in Labour’s first budget in over 14 years. There were increases to national insurance contributions for employers, hikes to capital gains tax rates and changes to inheritance tax treatment of pensions and farmland. The national living wage was raised, while there is going to be increased spending on education and the NHS, amongst other things. The Labour government has pushed the growth agenda although the picture painted by the Office for Budget Responsibility (OBR) suggests growth will be largely unchanged over the five-year period following the budget announcement. Reaction in UK markets will be slightly concerning for the Chancellor. The yield on government bonds rose towards the latter part of the week. This was likely due to the OBR’s expectation that the budget will increase inflation, while issuance of government bonds will need to increase to finance the budget. Sterling weakened on Thursday, falling below 1.29 against the USD and moving to 1.18 versus the Euro. It’s worth stressing that these moves in bond and currency markets are much more muted than immediately after Liz Truss’ mini budget.

Eurozone inflation figures were released on Thursday with headline inflation rising 30bps (0.3%) to 2% and core inflation (excludes food and energy prices) rising 10bps (0.1%) to 2.7%. European Central Bank (ECB) President Ms Lagarde was vocal on the importance of caution when deciding further interest rate cuts and with services inflation at 3.9% the ECB may pause their rate cutting journey. The Eurozone’s labour market also remains tight with unemployment still at all-time lows of 6.3% in September.

There has been a “sign of life” for Germany’s economy as GDP rose in Q3 by 0.2%, meaning they narrowly escaped a recession. Economic growth was driven by government spending and resilient retail sales growth that stood firm at 1.2% for the month of September. Germany has been battling high energy costs for households and businesses and weakened demand for exports. Inflation in Germany rose in the month of October to 2% and reiterates the ECB’s case for caution in order to avoid a re-acceleration in inflation.

US Personal Consumption Expenditure (PCE) is the US Federal Reserve’s preferred measure of inflation and for the month of September PCE was 2.1%, down from 2.3% in the previous month. With inflation close to the US Fed’s target, we may well see another 25bps (0.25%) rate cut this month, however markets are worried about the potential rise in inflation that we could see at the end of the year caused by the US election.

US Non-farm payrolls are released at the beginning of every month and October’s data, released today, disappointed. Market expectations were that 133,000 jobs would be created however we have now seen this number come in at 12,000. It is extremely likely that hurricane Milton caused severe disruptions to the survey, with many workers temporarily off payrolls. Unemployment stayed firm at 4.1% and wage growth remained strong at 4%.

Supermicro is a US firm that designs and builds servers and storage systems for AI data centres. The company was firmly on the AI gravy train with their share price reaching a high of $114 in March 2024, however it has all seemed to unwind very fast. This week Ernst & Young, the audit firm who were hired just months ago, have resigned as they were “unwilling to be associated with the financial statements prepared by management”. There is often no smoke without fire as Supermicro are still yet to release any financial statements and are now reportedly under federal investigation. Shares fell on Wednesday by 33% on the news.

The US election is likely to dominate news flow next week with the potential for volatility across asset markets. History has shown that markets can perform well over the long-term, regardless which political party is in the White House.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 19th October – 25th October 2024

After recently making new all-time highs, it’s been a slower week for US equities, with major benchmarks falling slightly. Tesla on the other hand has had a storming end to the week after declaring positive earnings per share growth alongside Elon Musk announcing that a cheaper electrical car model was on schedule for launch next year. This led to Tesla’s share price rising 22% on the day. The meteoric rise meant that Elon Musk’s net wealth increased by $34 billion in a single day, given his large shareholding in Tesla. Even before this rise he was considered the world’s richest person, and his position was strengthened after the large rise on Thursday.

The US Fed beige book, published eight times a year, gathers economic information from each of the 12 Fed districts giving the US Federal Reserve a detailed outlook ahead of their policy meeting. It found the US economy growing modestly, manufacturing weakness had become more widespread across the districts and wage growth showed signs of cooling. The US Fed will meet again on the 7th of November as policymakers appear to be cautious in their approach to reducing interest rates; a 50bps rate cut may not be as likely at this meeting.

“Gold Glitters” is the new catchphrase in markets as gold prices reached another record high. Gold has been spurred on by rising geopolitical events and concerns around the increasing US fiscal debt with analysts predicting that gold prices could even hit $3000 per ounce next year. The upcoming US election has betting markets swinging frequently with Trump and Vice President Harris battling for Presidency which has also strengthened the case for Gold. In what is expected to be a closely fought battle, the latest polling and betting markets are beginning to point towards a victory for Trump.

The Bank of Canada (BoC) was one of the first major banks to cut interest rates earlier this year in June and has now cut rates four times in a row. On Wednesday there was a larger than usual change as they cut by 50bps (0.5%) to take interest rates down to 3.75% as Governor Macklem insisted “It has been a long fight against inflation, but it’s worked”. The BoC want to see a pickup in demand as sales at business have been sluggish and consumer confidence is hurting growth, but they need to be careful in order to “stick the landing” and maintain stable, low inflation.

In the UK, the buildup towards the Autumn budget on the 30th is getting tense as markets are uncertain what the Labour party are set to implement. Chancellor Rachel Reeves seemingly has the impossible task of keeping everyone happy and with UK public borrowing over the first six months coming in above forecasts by £7bn that challenge has just got harder. Reeves has stated she wants to increase spending to improve UK infrastructure which would potentially mean a hike in taxes in the form of capital gains, dividends and/or inheritance tax. We look forward to reporting on the outcome in the next weekly.

The UK’s Purchasing Managers Index (PMI) for October disappointed on Thursday as manufacturing PMI fell to 50.3 and services PMI fell to 51.8, despite both measures expected to stay flat from the previous month. We’ve now seen falling inflation and wage growth in addition to declines in PMI, the view is that the Bank of England will continue on their rate cutting path with a 25bps (0.25%) cut a near certainty at the next meeting.

In summary, it has been a week of mixed macroeconomic data, although companies such as Tesla have defied this with fantastic earnings report. Portfolios have continued to benefit from the momentum in gold, which is a key position in portfolios. Diversification within portfolios is core to our investment philosophy and allows us to capitalise on opportunities created across different asset classes.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 12th October – 18th October 2024

We woke to major news from domestic shores on Wednesday. Not only had England men’s football team announced the appointment of a new permanent manager, but UK inflation fell to 1.7%, the lowest level in three and half years and below the official 2% inflation target. Football fans will be hoping the new manager, Thomas Tuchel, will bring in a new brand of attacking football, while lower than expected inflation should allow for a new era of lower interest rates for the UK economy.

There were question marks around when the Bank of England (BoE) would next lower interest rates, however the inflation data has led to an interest rate cut being nailed on at the next meeting on 7th November. There is also the possibility for a further cut during December. Not only did headline inflation fall, but core (which excludes food and energy) was lower than expected, as was services inflation, falling below 5% for the first time since May 2022. All this data should empower the BoE to take action and reduce rates imminently.

The European Central Bank (ECB) has its foot firmly on the easing accelerator as they delivered their third successive interest rate cut on Thursday. Economic growth in the Eurozone is stalling, with Germany in particular struggling. This coupled with falling inflation, last reported at 1.7%, has given the ECB scope to continue to lower interest rates in an effort to support the broader economy.

Chinese equities have sold off over the course of the week as investors have soured on the potential impact of the stimulus measures announced at the end of September. There has most likely been an element of profit taking by investors, with the main Chinese equity index rallying over 30% following the stimulus announcements. In terms of economic data, Chinese inflation was released on Monday morning, and showed that the country continues to flirt with deflation. Headline inflation was only 0.4% year-on-year and will continue to alarm policy makers who will be keen to avoid a deflationary slump.

US retail sales were strong for September, with the data beating expectations. The data points to a resilient consumer and may deter the US Fed from cutting rates too aggressively. In the aftermath of the data US government bond yields rose (prices fell), moving above 4% on the US 10-year bond. This was a role reversal to the UK 10-year government bond, which performed well this week with the 10-year UK government bond yielding less than its US counterpart.

The race to the White House continues to intensify as the 5th November looms closer. In what is expected to be a very tightly contested race, Donald Trump moved ahead of Kamala Harris in the betting markets this week. This contradicted recent polls which showed Kamala Harris as the most likely future President. Despite the uncertainty over who will be the future leader, US equity markets continued a recent strong streak, pushing higher. After underperforming over the summer months, the large cap tech and artificial intelligence (AI) stocks pushed higher. Nvidia, has hit a new all-time high this week, after breaking levels last seen at the end of June 2024.

Company results linked to AI and chip manufacturing provided mixed messages. The Dutch behemoth ASML released its results this week and provided a weaker outlook for 2025, leading to a 15% drop in its share price. To add to its woes, the quarterly results were published early, in an error. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, released strong Q3 earnings and pointed to a bright outlook for its business, due to soaring AI-demand.

Gold has continued to advance this week, once again making new all-time highs. Silver, also advanced, reaching $32 an ounce. This is still considerably lower than its level in 2011 when it reached $50.

With developed market equities grinding higher and UK government bonds performing well on the back of softer inflation it was a pleasing week for portfolios, making new highs for 2024. Portfolios remain well diversified which we think is sensible given the elevated level of uncertainty at a macro level.

Andy Triggs, Head of Investments

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

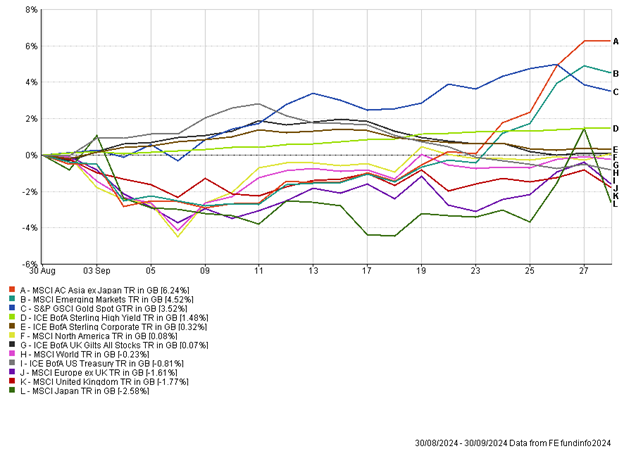

The Month In Markets – September 2024

The Month In Markets - September 2024

After a steep rally at the end of the month, emerging markets and Asian equities were the standout performers for September, led by explosive performance from Chinese stocks.

China’s central bank surprised markets by announcing its most extensive stimulus package since Covid. The authorities deemed the intervention necessary in order to try and prevent an economic slump and persistent deflationary spiral taking hold in China. Recent economic data has been disappointing, and the property market slump has shown little signs of recovery. The hope is that the stimulus measures will boost economic activity, stabilise the property market and boost liquidity into the stock market. The impact in the stock market has been felt immediately, with an exceptionally strong five-day trading period which saw the headline Chinese index advance around 25%. On the final day of September, the market rallied over 8%, with a record amount of trading as investors aimed to get invested before the market closed for “Golden Week”. The excitement witnessed in the world’s second-largest economy spilt over into the Hong Kong market, which advanced nearly 12% over the final days of September. Hong Kong has close economic ties with China and many mainland Chinese companies are listed on the Hong Kong index and as such is often considered as a proxy for China.

China represents around 33% of the emerging markets index and Hong Kong is a little over 3%, so the stellar performance of these markets had a notable positive impact on emerging market (and Asia) indices.

Aside from China, the other major news during September came from the US, where the US Fed cut interest rates for the first time in over four years. While it was widely telegraphed that an interest rate cut was coming during the September meeting, the magnitude of cut was unclear. The central bank was bold and delivered a 50bps (0.5%) reduction to the headline interest rate. Following the Jackson Hole speech by Fed Chair Jerome Powell it became clear that the US Fed were keen to support the labour market and the cut highlights this. There are also concerns of an economic slowdown and flagging consumer and as such it was deemed necessary to reduce interest rates. With US inflation falling to 2.5%, not too far from target, there was little deterrent for the central bank. Government bonds reacted favourably to the outsized drop in interest rates with the yield on the benchmark US 10-year government bond yield falling as low as 3.6% during September. The news also led to a weakening US Dollar. During the month sterling reached levels not seen since early 2022, touching 1.34 against the dollar.

Despite the US cutting rates, the Bank of England (BoE) decided to pause, keeping rates at 5%, having reduced at the August meeting. UK headline inflation data came in at 2.2%, however the services component was 5.6%, a troubling number for the BoE. Services inflation is widely considered as more persistent than goods inflation because it is less dependent on global events and more influenced by domestic costs. With eight of the nine voting members deciding to keep rates at 5%, it’s clear that the BoE will want to see further progress on inflation before lowering rates once more.

Staying with the UK, the equity market disappointed during the month. It seems some of the euphoria around the change of government has soured, with investors waiting to see how bad the news will be from the well-publicised UK Budget at the end of October.

Gold once again made new all-time highs, approaching $2,700 an ounce, a 25% rise in 2024. It has been hypothesised that Chinese investors have been increasing exposure, diverting money from the property market to physical gold. It’s clear global central banks have also been accumulating more of the asset class, potentially at the expense of their US Treasury bond holdings. Physical gold has been a mainstay in portfolios for many years, with the holding being the biggest contributor over the last 12 months.

Oil, which is sometimes referred to as black gold, hasn’t enjoyed the same success as gold in recent months. During September US Crude oil fell to new one-year lows, touching $66 a barrel. Despite tensions in the Middle East, there are limited immediate supply issues and there is the prospect of Saudi Arabia increasing production later in 2024. At the same time we’ve seen a slowdown in the global economy, raising concerns about the demand outlook. Lower oil prices should help support the consumer and put downward pressure on inflation. Despite a weaker oil price many of the major oil companies continue to trade on very attractive free-cash flow yields and pay handsome dividends.

September could be a pivotal month where the largest economy in the world cut interest rates and the second largest economy in the world unleashed huge stimulus plans. This has the potential to support risk-assets going forward, especially if the interventions help stimulate real GDP growth. Outside of equities, government bonds continue to offer positive real yields, however, one needs to be mindful of the inflation outlook and manage duration (interest rate sensitivity) carefully.

Andy Triggs

Head of Investments, Raymond James, Barbican

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

The Week In Markets – 5th October – 11th October 2024

It has been an interesting week in markets with increased focus on the escalating tensions in the Middle East. The US was also preparing for Hurricane Milton, which hit the state of Florida on Wednesday night, severely flooding homes and businesses and leaving more than 2million people without power.

The biggest data release of the week was the announcement of US inflation for the month of September. There was less emphasis on labour market data this week due to hurricane Milton’s impact, therefore investors were keeping a closer eye on inflation and were ultimately disappointed. Headline inflation (year-on-year) was 2.4%, falling from the previous figure of 2.5% but not as far as market expectation of 2.3%. Core (excluding food and energy) inflation also came in slightly ahead of expectations. This data, alongside last week’s strong labour market data, further reduces the chances of aggressive interest rate cuts from the US Fed. Bond markets sold off on the news, with the yield on the 10-year US government bond approaching 4.1%, nearly 0.5% higher than the September lows.

In the UK there has been a lot of speculation over Labour’s first budget later this month and what policies they may or may not be able to implement. We had fresh GDP data this Friday morning and over the month of August the economy grew 0.2%. This is a win for the Labour government as economic growth has been labelled a top priority, although over the months of June and July the economy flatlined. Prime Minister Starmer will host an international investment summit next week with the hope of attracting foreign investors.

We spoke at length about China and the stimulus package put together by the Government which led to a huge rally in stocks. On Wednesday, the Shanghai composite index and CSI300 index both suffered their largest one-day losses in years as investors cashed in on profits and became concerned about the implementation of the measures. There is growing hope that there will be further announcements this weekend in regard to further stimulus in order to boost the economy and ultimately create investor confidence.

As we head towards the end of the year, the weather is certainly changing and Japanese brand Uniqlo are building their reputation as the place to shop for jumpers, gilets and fleeces. We won’t just talk fashion as on Thursday Fast Retailing, who own Uniqlo reported record net earnings for the third consecutive year, making over 3tn (£15.4bn) revenue. Founder, Mr Yanai, spoke saying he aims to make Fast Retailing the world’s largest fashion retailor as he continues to eye market share across Europe and the US, looking to overtake Inditex (Zara) and H&M.

US equities have regained their poise recently, led by the big tech firms, which have actually been underperforming the broader US market over the summer months. UK equities have been subdued, perhaps driven by budget concerns; investors may wait to see what is announced before deploying further capital to the undervalued market. The biggest headwind for portfolios this week was fixed income, which after a strong September, has had a difficult October. A combination of rising oil prices and stronger US economic data has led to interest rate cut expectations being pushed out, negatively impacting government bonds.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

Investment Strategy Quarterly – October 2024

Our latest Investment Strategy Quarterly gives you informed insights on what we might expect from the recent change in UK government, options to consider in the run-up to the US election, the cost of tariffs and the reliability of the inverted yield curve.

Read all this and more in Investment Strategy Quarterly: The Great American Road Trip.

The Week In Markets – 28th September – 4th October 2024

Last week we commented on Chinese stimulus measures and the positive impact it had on the country’s equity market. The excitement spilled over into this week with further stimulus proposals leading to a record breaking day on Monday for Chinese equities.

China’s sweeping stimulus package aims to lower borrowing costs, reduce reserve requirements for banks, boost the property sector and inject liquidity into the stock market. The latter was certainly achieved on Monday with a record amount of trading taking place in China and the main index rallying over 8% on the day. Investors were scrambling to place buys ahead of “Golden Week” in China, with the stock market closed from 1st October to 7th October. Monday’s bumper day now means that Chinese equities have rallied over 25% in less than 10 days. The Hong Kong index, which contains many Chinese companies has also experienced significant gains. The six-day winning streak ended on Thursday, however the market is back up over 2% on Friday. Time will tell if the stimulus package is enough to turn the tide in China.

In Europe the latest inflation data showed headline inflation at 1.8%, in line with expectations and below the 2% target. Having cut interest rates twice now, the inflation data may encourage the European Central Bank to continue to ease monetary policy.

There was limited data from the UK this week, however, Bank of England (BoE) Governor Andrew Bailey spoke on Thursday leading to weakness in sterling. Bailey hinted at more aggressive rate cuts should inflation continue to soften. There will be increased focus on UK inflation data which is released on 16th October. Continued progress towards 2% should raise the chance of another interest rate cut when the BoE next meet on 7th November. The prospect of more interest rate cuts led to a 1% fall in sterling against both the Euro and US Dollar.

Geopolitical tensions in the Middle East rose this week, leading to caution in equity markets. Oil rallied throughout the week, driven by heightened supply concerns. Brent crude oil dipped below $70 a barrel a month ago, however, has now risen back above $78 a barrel. The rising price did support equities such as BP and Shell in the UK, which had a strong week, after lacklustre performance for most of 2024. Higher oil prices put upward pressure on government bond yields, as a rising oil price is often inflationary. Central bankers will be watching developments closely and may be forced to temper future rate cuts should increasing oil prices lead to inflation spiking. While this is not our base case, it is important to monitor this and hold inflationary hedges, such as energy and gold in portfolios.

There was a raft of US jobs data this week, with both the Job Openings and Labour Turnover Survey (JOLTS) and the Non-Farm Payrolls data released. JOLTS data was higher than expected, a positive sign for the labour market, highlighting there is still demand for labour from businesses. Non-Farm Payrolls data, released this afternoon, surprised to the upside with 254,000 jobs added to the economy and unemployment surprisingly falling to 4.1%. This data will help ease fears of a deteriorating labour market and imminent slowdown in the US economy. The bond market sold off on the news, as there is now likely to be less need for aggressive rate cuts to help the economy, while US equity futures advanced ahead of the opening bell.

Monday’s move in Chinese equities was the single biggest daily move in 16 years. While the recent performance has been exceptional, rising 25% in a matter of days, the main Chinese equity index is still considerably below the peak in 2007. Outside of China it felt like markets were in a holding pattern, with investors unwilling to make big calls given the increased risk from the Middle East and upcoming US election. Despite what feels like an uncertain economic backdrop, equity markets have been remarkably robust. As always, the key is to diversify and balance risks, and ensure portfolios can perform and thrive in a variety of market conditions.

Andy Triggs, Head of Investments

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 21st September – 27th September 2024

It’s been a quieter week in terms of economic data, following on from last week’s bumper US rate cut, alongside the Bank of England’s decision to keep rates at 5%.

The week started with worse than expected manufacturing and services data from Europe, the UK and US. Germany and France are Europe’s two largest economies, yet both saw disappointing results, drawing conclusions that Germany could have fallen into recession over Q2 and Q3, with their manufacturing PMI falling to 40.3. It has been 47 days since the Olympics ended in Paris and the country’s services sector, which saw a spike during the Olympics, appears to have run out of steam, with composite PMI for September falling to 47.4, from 53.1 in August. The European Central Bank (ECB) cut interest rates for the second consecutive time on the 12th of this month, but we could see the level of cuts increase if the Eurozone continues to regress. Inflation data, released this morning, will likely support the ECB’s decision to cut rates, with year-on-year inflation coming in at 1.5% for Spain, while monthly inflation in France fell by 1.2%.

On Monday we also saw the Chancellor, Rachel Reeves, speak at the Labour Party’s annual conference and her words “tough decisions are needed” has built up even more anticipation ahead of the budget at the end of October. She announced the imminent appointment of a Covid corruption commission to seek to recoup over £600m of contracts the Conversative party had handed out and also pledged to set up free breakfast clubs in primary schools for the nation.

In the US, PCE inflation has been released this Friday afternoon and fallen to 2.2% (year-on-year). Core PCE (month-on-month) has also surprised at 0.1%, falling below market expectations of 0.2%. The data supports the recent 0.5% rate cut and could encourage the US Fed to stay on the rate cutting path.

The Swiss National Bank (SNB) concluded their meeting this week, cutting rates by 25bps (0.25%) for the third time this year to combat low inflation, with interest rates now settling at 1%. For the Swiss, their journey has been slightly different to other major countries as in April 2022, interest rates were negative at -0.75% before the SNB hiked to the 16-year high of 1.75%. The Swiss Franc has also risen on the back of falling inflation causing issues for Swiss exporters.

The biggest news this week has come out of China. The country has introduced another wave of stimulus in a desperate attempt to ignite economic growth and prevent their housing sector deteriorating further. China is set to miss their 5% target of economic growth, and this has prompted the action. So far, all stimulus measures have appeared weak, however, the latest moves, including cuts to borrowing rates and investing in the stock market do seem to appear bigger than previous attempts and will hopefully drive an economic recovery. The level of banking reserves required has been slashed to 9.5%; in 2011 the reserve requirements were 21%. The market so far seems to be impressed, with Chinese equities rising over 10% this week, after hitting five-year lows recently. Luxury goods companies, such as Burberry, which typically rely on the Chinese consumer, have seen their share prices rebound this week on renewed optimism about the Chinese consumer.

The Chinese stimulus boost has been felt around the world, with equities generally having a positive week. Bond yields have nudged higher (prices fallen) as a rebounding China is likely to come with an inflationary pulse. The big question is whether the stimulus measures are enough – changing the fortunes of the housing market in China is no easy task. Portfolios have benefitted from the rebound in China with our emerging markets and Asia funds performing best this week. Gold, an important asset class in portfolios, has once again made new highs this week and has advanced close to 30% in 2024.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.