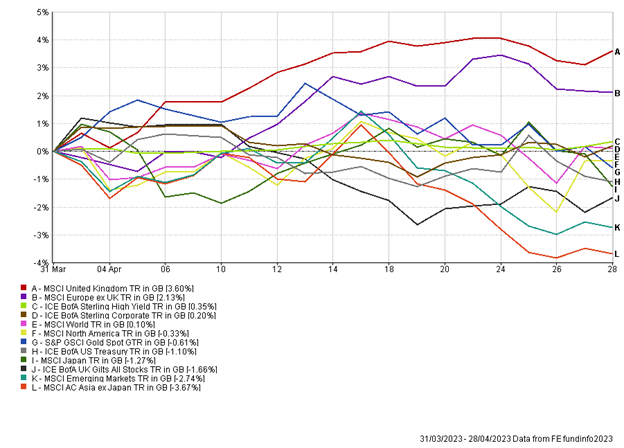

The Month In Markets – April 2023

Last month’s concerns around the banking sector appeared to dissipate for much of April, leading to a relatively calm month in terms of news flow. The regular readers will note that the UK equity market was the best performer during the month, in complete contrast to last month where it was the worst.

We will start with the UK equity market, which rebounded after a difficult March. We’ve witnessed markets whipsaw month-to-month over the last year or so and this was another continuation of that theme. Oil and gas, led by Shell and BP, posted strong gains over the month, while banks such as Lloyds also had strong returns. These sectors had suffered in March.

Alongside a rebound in some of the larger UK listed equities, we also witnessed a pick-up in mergers and acquisitions (M&A) activity. We have heard many of the UK fund managers we meet reference the fact that the UK equity market is cheap and a likely consequence of this would be increased M&A activity. One of the trends of the M&A activity this year has seen foreign private equity firms bid for UK assets. A combination of a weak UK currency and low valuations make our assets very attractive to foreign buyers. Private equity in general is still awash with cash and eager to deploy this. It’s not just private equity firms buying assets, as we saw Deutsche Bank bid for Numis, at a 72% premium. There is a clear short-term benefit, with share prices rising strongly on bid news. However, longer-term the benefits are less clear, with the UK losing some market leading businesses and investors missing out on future earnings and dividends.

UK inflation data released during April (March data) showed inflation at 10.1%, higher than expected. The news that inflation is not coming down as quickly as expected created a headwind for UK fixed income assets. The likely implication of higher inflation is that the Bank of England (BoE) will continue to raise interest rates. The expectation is now for another 0.25% increase at the next meeting in May.

UK inflation is currently an outlier, with inflation falling at a much faster pace in other developed economies. Inflation data for the US came in at 5%. The expectation is for inflation to continue to fall as components such as shelter (rents) begin to fall. Euro area inflation currently stands at 7%, having peaked at 10.6% in October 2022. While these figures are all still considerably above target, the market continues to expect inflation to fall this year. This should allow central banks to pause their interest rate hikes in the coming months and the market is even expecting rate cuts by the end of 2023.

Although not covered in the performance charts, we have continued to see US dollar weakness over April. The USD weakened by around 2% against GBP in April, and is now around 12% weaker since the 30th September 2022. Currency movements are notoriously hard to predict, but it is likely a combination of a stronger than expected UK economy (remember everyone was expecting a recession already), combined with the US banking woes, which will likely lead to lower growth and lower terminal interest rates, resulted in the weakening.

The US labour market has been exceptionally strong over the past 12 months. Over this period the jobs data continually surprised to the upside, exceeding economists’ predictions. The labour data in April, while still showing over 200,000 jobs added to the economy, did come in lower than expected. Whether this is a turning point remains to be seen. The jobs market is expected to cool throughout the year as the impact of higher interest rates should temper demand for goods and services.

Staying with the US, April saw many of the largest companies report their Q1 results. The banking behemoths, JP Morgan and Citi posted stellar results. It’s clear they are benefiting from the regional banking crisis and have seen a large inflow into their deposits as customers appear to have moved funds from the smaller banks into these large banks.

Emerging markets and Asia were some of the weaker markets during April. China, which is the largest country in both benchmarks posted mixed economic data during the month. Their post-COVID recovery appears lopsided, with their manufacturing sector falling back into contraction, while areas such as travel and shopping continue to do well. Since re-opening the economy towards the end of 2022, it’s clear consumers are keen to spend on experiences and services as opposed to purely goods.

Portfolio activity during the month was minimal, with one change occurring in the fixed income element of portfolios. We modestly increased interest rate sensitivity in the portfolios with the introduction of a UK gilt fund, and this was funded via the sale of a short-dated corporate bond holding. Following one of the most difficult years ever for government bonds, we believe opportunities have now been created for long-term investors and have therefore increased exposure. We also believe there is an additional portfolio diversification benefit and that government bonds will act as a good hedge to equities in the event of an economic downturn.

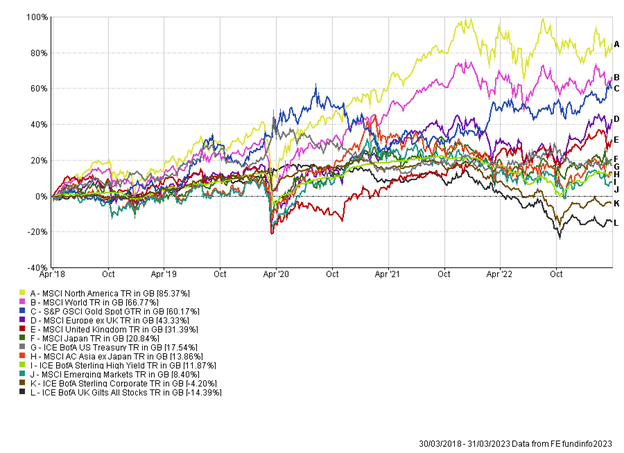

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Andy Triggs

Head of Investments, Raymond James, Barbican