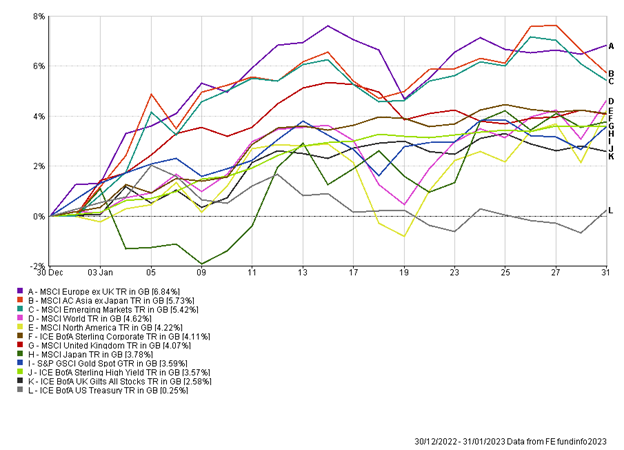

The Month In Markets – January 2023

The first month of 2023 has proved to be an extremely good month for equities and bonds across the globe. Many of last year’s laggards led the market higher, with the US tech-heavy NASDAQ index recording its strongest January since 2001.

It appears there were three main catalysts which spurred markets on in January which we will discuss in this note.

The first is China. The world’s second largest economy very recently emerged from strict COVID-19 lockdown measures. Almost overnight the zero COVID-19 approach was abandoned and the economy was reopened. The general consensus was for the lockdowns to persist well into 2023, however, civil uprisings appeared to force Chinese leaders into cancelling their lockdown measures. Having already witnessed developed markets reopen post COVID-19 there was a clear playbook to follow, and the expectation is that Chinese consumption will pick up dramatically which will be good for the Chinese and overall global economy.

The second catalyst is energy. As we headed into the winter months at the end of 2022 there was genuine concern that Europe would run out of gas, and that European and UK consumers were going to be facing months, and potentially years, of sky-high energy bills. As a result, markets were pricing in a very weak consumer and a recession across the UK and Europe. A combination of good fortune, through a mild winter, and good forward planning, through high levels of gas storage, meant the expected energy crisis never fully materialised. As a result, we’ve seen gas prices fall as demand has been lower than expected. It’s clear that the outlook for these economies is still concerning, however, with equities pricing in so much bad news already we saw a strong rebound in these markets.

The third driver of markets has been inflation. In truth, all the points discussed here are intertwined. China reopening is good for supply chains, which should ease some of the inflationary pressures, while lower energy prices will also lead to inflation falling. During January we received validation of this through US inflation coming in at 6.5%, continuing the recent downtrend. After reaching 9.1% in June 2022, inflation data has continued to come in at lower levels, giving investors’ confidence that we have turned a corner. European and UK inflation also appears to have peaked and fell from recent highs in January. If we have finally turned a corner with regards to inflation, then central banks should be able to be more accommodative in their monetary policy. It was no surprise therefore that sectors such as technology, which really struggled in a higher interest rate environment, rallied as markets priced in interest rate cuts for the end of 2023.

The more positive outlook not only boosted equity markets but also helped the higher (credit) risk areas of fixed income, with high yield bonds performing strongly. Falling inflation helped boost government bonds, while gold rebounded as real yields fell.

While energy, inflation, and China re-opening appeared to act as catalysts, it is also important to consider positioning and valuations. Fund manager surveys towards the end of 2022 highlighted very defensive positioning from managers, with high cash weightings and low allocations to risk assets. The more positive news flow therefore has driven significant flows back into equities this year, supporting prices. Valuations for most regions have also been trading below long-term averages. While valuation metrics are a poor predictor of short-term returns, they are a good explanatory variable for long-term returns. As such asset allocators with a genuine long-term view will have likely increased exposure in January.

The $64,000 question is whether this strong rally in asset prices is a classic bear market rally, or something more persistent. The simple answer is that no one knows, and making such bold calls is a dangerous game.

Our approach at this stage is to be very diversified in our positioning, even more so than usual. We are also trying to avoid the behavioural traps that strong market moves (both up and down) can cause. This is easier said than done but falling back on a process and the experience of our team and investment committee really helps. While some of the near-term noise has been very positive of late, there are still leading indicators (such as the yield curve and housing market) that necessitate us to proceed with caution.

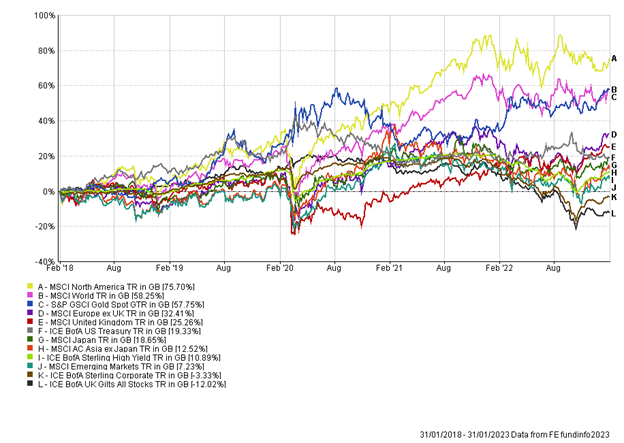

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Andy Triggs

Head of Investments, Raymond James, Barbican