The Month In Markets – March 2023

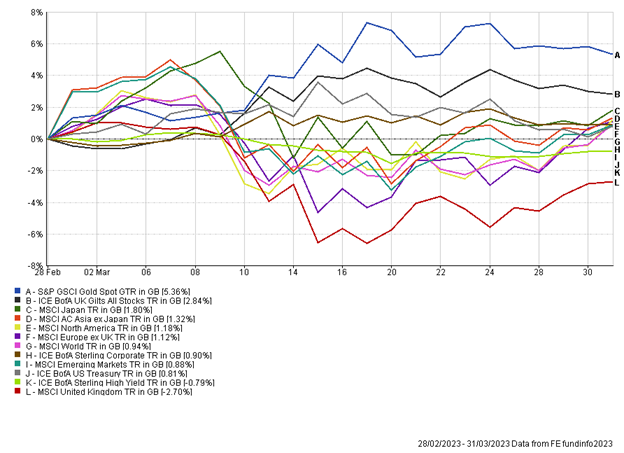

Returns for March feel relatively benign given the news flow over the month, where a full-blown banking crisis was only narrowly averted. Despite these major worries, key equity markets were able to post positive returns for the month. The main winners during the month, however, were gold and government bonds.

As discussed last month, markets have whip-sawed of late, see-sawing between differing views and outlooks for the global economy. This month the views ebbed back to one of lower interest rates and weaker economic growth, a view that intensified with the collapse of a prominent US bank.

However, at the start of the month we had US Fed Chair, Jerome Powell, address the markets, indicating that interest rates would likely need to be higher than previously anticipated. These remarks were just a few days before the run-on Silicon Valley Bank (SVB) and indicate that the US Fed was unaware of some of the second-order effects of their aggressive interest rate hikes.

There have been a lot of column inches dedicated to what went on at SVB so we will not attempt to cover it all in detail here. However, in its most simplistic form, banks are not offering customers attractive rates on their deposits. As a result, customers have been withdrawing their deposits and investing in short-term government bonds and money market funds, which offer them higher rates of return for comparable or even lower risk. In SVB’s case most of their customers were venture capital (VC) businesses. These businesses were burning through cash and with funding proving much more difficult for VC firms currently funds were being depleted rapidly. As a result of a declining deposit base, SVB was forced to sell supposedly “held-to-maturity” bonds to meet withdrawals. Given the sharp decline in bond values in 2022 this meant crystallizing significant losses; in SVB’s case around $2bn. The knock-on effect meant investors and customers became nervous about SVB’s future given these heavy losses. In a world of mobile banking, it is very easy to move money and as a result deposits left the bank at a startling rate. It is estimated that $48bn was withdrawn from SVB on Friday 10th March at a rate of $4.8bn an hour!

The concerns were not just contained to SVB, with the banking sector in general coming under pressure, the lower quality and smaller banks hit the hardest. In Europe, this latest concern appeared to be the straw that broke the camel’s back for Credit Suisse. After operating for more than 160 years, the Swiss Bank required emergency intervention from the Swiss regulator and was acquired by rival bank UBS, for what appears on paper to be a very attractive deal.

So, what does this banking scare mean for markets? One of the main implications is that investors have now once again priced in lower terminal rates (once expected to get close to 6%) and moved towards expecting interest rate cuts to begin by the end of the year. The probability of recession has increased as banks are now likely to be stricter with their lending standards (given their lower deposit base). Lower credit growth will make it difficult for consumers and businesses to operate and therefore consumption, spending and investment should slow.

Lower growth and lower interest rates have provided support to government bonds, which performed strongly during March. It’s been pleasing to see negative correlations between equities and bonds return, as it aids portfolio construction and our ability to diversify risks in portfolios.

Gold had a stellar month, with the price responding favourably to expectations of lower interest rates. Our view on gold is that the price is largely driven by real yields; when they fall, gold does well (and vice-versa). We witnessed real yields fall significantly during March, so it’s no surprise to see gold at the top of the charts for the month.

Even though the banking difficulties originated in the US and fed through to a European bank, the UK equity market bore the brunt of the pain. The UK index’s composition in relation to other markets is the main cause of this. Banks make up a sizable component of the UK market with the financial sector representing approximately 17.5% of the UK large cap index, therefore when the banking industry was hit, the UK stock market got a bloody nose. Energy was the other area that suffered significantly during March. Again, this is a meaningful sector in the UK market. This month (and year) has felt like a significant reversal in comparison to 2022 where energy and banks were some of the best performing sectors.

The UK government bond market wobbled last year, driven by rising interest rates and a badly received mini-budget. The banking sector has shown fragility this year in response to increased rates. Will there be another domino to fall under the impact of higher interest rates? And if so, which sector will sway first? Commercial real estate? Residential housing? Both historically struggle with higher interest rates. Or will we see central banks blink and begin to bring rates down in order to prevent more pain in the economy?

The events of March have strengthened our view that being cautious in positioning is the correct approach. We continue to hold assets such as gold and government bonds in portfolios to help offset some of the equity risk. While we did not know SVB would collapse and banks would come under pressure, our investment approach ensures we are well diversified and hold a range of assets in client portfolios to give help us perform in a range of market conditions.

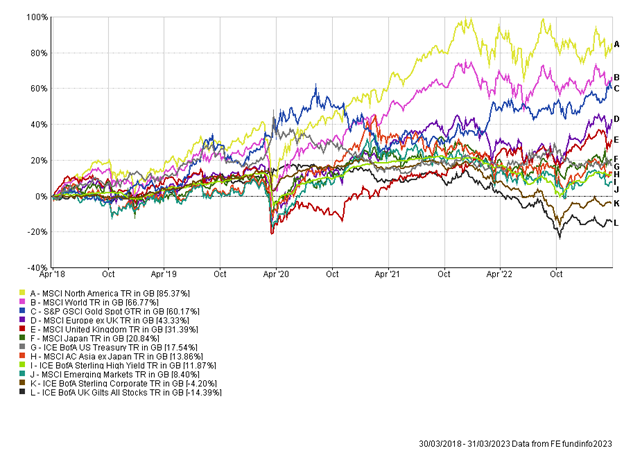

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Andy Triggs

Head of Investments, Raymond James, Barbican