The Month In Markets – November 2024

November may have been the most important month of the year, as on the 5th, US voters chose between Republican Donald Trump and Democrat Kamala Harris for the presidency. Ultimately, Trump won, amassing 77 million votes the second-highest tally in American history.

Term two of Trump’s presidency could be unpredictable, as he declared he pulled off “the greatest political movement of all time”. The presidential inauguration will be held on 20th January 2025. However, Trump got straight to work nominating cabinet picks for the Senate and appointing White House advisors. A high-profile selection is hedge fund manager Scott Bessent, who will serve as Treasury Secretary and execute his 3-3-3 plan: cutting the budget deficit to 3% of GDP, boosting GDP growth to 3% through deregulation, and increasing US energy production by 3 million barrels of oil a day. Later in the month, Trump set markets on alert as he stated his intention to impose 25% tariffs on Mexico and Canada as well as additional tariffs on China. Markets believe this strong stance is a ploy to prioritise America in trade talks but if imposed the tariffs will likely have inflationary impacts.

While the US election took centre stage, there was a raft of economic and corporate data during November. The US Federal Reserve’s preferred measure of inflation, personal consumption expenditure (PCE) increased 0.2% (month-on-month) and rose to 2.3% (year-on-year). Core PCE (excludes food and energy costs) showed an even stronger reading at 2.8% (year-on-year). Inflation is still within reach of the 2% target and as such, bets are still on that the US Fed will continue its rate-cutting path when they meet for the final time this year in December.

It was corporate earnings season as Nvidia, the world’s largest company, showcased impressive growth. They announced record revenues of $35bn and net profit margins of 55%, up 7.9% from the previous year. The continued strong performance highlights Nvidia’s dominance in artificial intelligence (AI). However, markets were slightly concerned with the delayed timing and performance of their new Blackwell GPU chips, which were rumoured to be overheating. The company quickly addressed these worries, stating all design issues had been resolved and that demand for the chips has exceeded their expectations.

In the UK, the Bank of England (BoE) cut interest rates by 25bps (0.25%) to 4.75%, marking its second cut of the year. The decision was almost unanimous among policymakers with an 8-1 vote in favour of the cut. The decision was driven by the positive fall in inflation to 1.7% in September. Inflation figures for the previous month revealed an expected spike to 2.3% following the increase in the energy price cap by 10% to £1,717 on average. Given the recent pickup in inflation and the expected inflationary impact of the Autumn Budget, the market is not anticipating a rate cut at the next BoE meeting.

The Labour governments budget was announced on the 30th of October, but the effects were felt before and after as speculation over which taxes would be increased led to UK businesses and consumers to hold back on spending. UK businesses will bear the brunt of increased national insurance tax. Retail sales suffered in the build up to the budget as they fell to -0.7%, however we can expect to see a rebound as consumers took advantage of Black Friday shopping on the last Friday of the month.

Over the month, Japan’s economy showed signs of a modest recovery. Q3 GDP was positive at 0.2%, the second consecutive positive quarter and inflation fell to 2.3% (year-on-year). The Japanese government also announced a significant stimulus package worth $140bn which includes energy & fuel subsidies in addition to cash handouts for low-income households. Japan’s Prime Minister, Mr Shigeru Ishiba, who has only been in power since 1st October, has made a bold promise to spend 10 trillion yen through to 2030 to boost Japan’s semiconductor and artificial intelligence sectors, helping the nation regain its technology edge.

Bitcoin made the most remarkable move over the month, gaining nearly 40% and closing at highs of $99,000. The rally was kickstarted by Trump’s strong views on deregulation and also his comments on potentially creating a bitcoin reserve. A new DOGE team has been created, not the cryptocurrency but the Department of Government Efficiency, led by the richest man in the world, Elon Musk. The primary goals are to reduce wasteful government spending and eliminate unnecessary regulations.

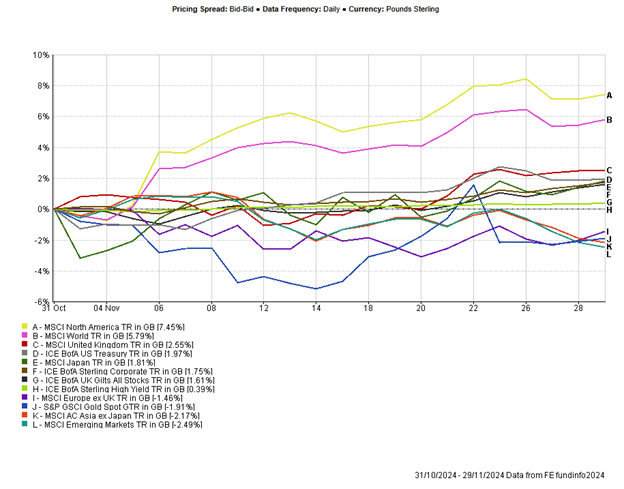

To summarise the month of November there was a range of political and economic developments that shifted markets. US equity markets benefitted the most as Russell 2000 (US Small Cap) rose almost 11%. The US Federal Reserve and Bank of England both cut rates, but markets are split on whether both central banks (or just one) will make the final rate cut of the year in December.

Nathan Amaning

Investment Analyst, Raymond James, Barbican

Appendix

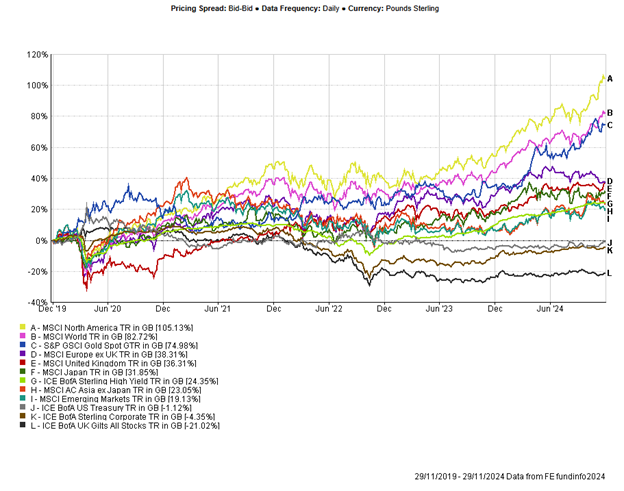

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.