The Month In Markets – October 2022

If the UK was the problem for September, China was the problem child during October, with concerns around the world’s second largest economy dragging down Emerging Market and Asian benchmarks. As investors, the recent country specific woes of the UK and China are evidence as to why we try to diversify portfolio risk not just by asset class and sector, but importantly, also by country.

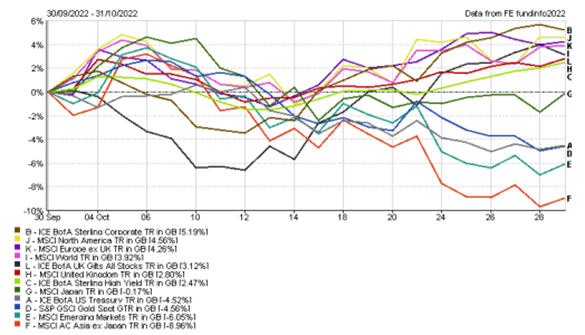

For those that regularly read these monthly pieces, you may notice that the best performing index from the chart above, ICE BofA Sterling Corporate (UK investment grade bonds), was in fact, the worst performing index in September. UK government bonds, which fell around 10% in September, also rebounded to end October up over 3%. It is a timely reminder about the risks of performance chasing and simply selling losers and buying winners. It also highlights why we think periodic rebalancing of portfolios is important. This process allows for natural profit taking from the better performing assets and allocating proceeds to the laggards within portfolios. The value of rebalancing really kicks in during extreme volatility.

So what caused the reversal in UK bonds? A big part of it was the changing political landscape. We began the month with Liz Truss as Prime Minister and Kwasi Kwarteng as Chancellor, and ended the month with Rishi Sunak as PM and Jeremy Hunt as Chancellor. The new PM and Chancellor appear to be much more focused on balancing the UK books and have ultimately reversed all of the mini-budget tax cuts, hinting that taxes may in fact rise. This more responsible fiscal approach was well received by markets, the result being a fall in borrowing costs for the government and a rebound in GBP, particularly against USD, with sterling strengthening over 3% during October. It is unlikely to be plain sailing for the new PM; the more fiscally responsible path he and Hunt are pursuing is likely to be a headwind for economic growth. Spending cuts and higher taxes will hurt the consumer. The main positive for growth is that with falling borrowing costs we may see mortgage rates begin to come down, and while they will still be considerably higher than in recent years, they should at least be lower than was forecast under Liz Truss’ watch.

As well as a change in UK political risk, there was also likely some mispricing opportunities that enticed investors to allocate to areas such as sterling corporate bonds. Many pension schemes faced solvency issues following on from the mini-budget and had to sell assets in order to raise cash and meet margin calls. Sterling corporate bonds were caught up in the fire sale, and we believe the huge selling pressure created mispricing opportunities for long-term investors. Part of the moves in October will have been driven by buyers stepping in, taking advantage of the forced selling and picking up high quality bonds at multi-year high yields.

While UK and developed markets in general had a positive month, the big laggards were Emerging Markets and Asian equities, which were dragged down by China. Towards the end of the month, it was confirmed that Xi Jingping, leader of the Chinese Communist Party secured a third five-year term, discarding with previous custom in which his predecessor stood down after 10 years. What spooked markets was an apparent change in Xi’s approach from the previous 10 years. In appointing his inner circle, the seven-strong Standing Committee is made up of his close allies, which means Xi will have little push back against any of his policies. These allies have also replaced more market-friendly, open-economy committee members. There is concern that over the next five-year term Xi will be less market friendly in his approach. The Covid-Zero policy is one example of this, or his new focus on “Common Prosperity” – an attempt to redistribute wealth which could lead to more regulation on certain sectors and industries. The Hang Seng Index (Hong Kong) fell over 6% on the news of Xi’s re-appointment, the largest one day fall since 2008, with the index returning to levels seen in April 2009. The Chinese currency also retreated, falling to 14-year lows versus the USD.

There were also immediate concerns about China’s economy, with the country delaying the release of third quarter GDP. The official data was released eight days late, and while it was higher than expected, investors doubted the credibility of the data given the unprecedented delays in it being released.

During the month we had the release of Q3 earnings and there were some interesting trends coming from the US. The mega-cap tech companies such as Microsoft, Meta (facebook), Alphabet (Google) and Amazon all released disappointing results which led to big pull backs in share prices. During the initial COVID-crisis these companies were major beneficiaries, and their share prices did exceptionally well. However, it appears in this more traditional slowdown their business models will not be immune to the headwinds with growth rates and revenues likely to slow.

The month in general had a wide range of dispersion in returns between asset classes and geographical regions. If diversification is not sufficient investors can be caught out by the heightened volatility and country specific risks that we have witnessed in September (UK) and October (China). Our approach of seeking genuine diversification in portfolios should provide a high probability of avoiding the worst outcomes in markets. As we have written about previously, we believe not losing in the short-term leads to winning in the longer-term.

Andy Triggs

Head of Investments, Raymond James, Barbican

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.