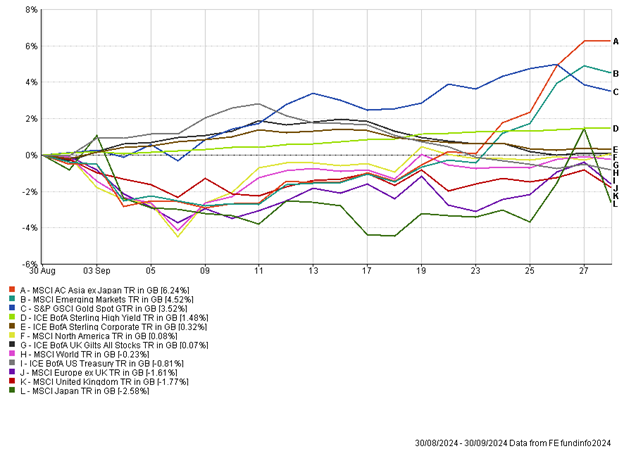

The Month In Markets - September 2024

After a steep rally at the end of the month, emerging markets and Asian equities were the standout performers for September, led by explosive performance from Chinese stocks.

China’s central bank surprised markets by announcing its most extensive stimulus package since Covid. The authorities deemed the intervention necessary in order to try and prevent an economic slump and persistent deflationary spiral taking hold in China. Recent economic data has been disappointing, and the property market slump has shown little signs of recovery. The hope is that the stimulus measures will boost economic activity, stabilise the property market and boost liquidity into the stock market. The impact in the stock market has been felt immediately, with an exceptionally strong five-day trading period which saw the headline Chinese index advance around 25%. On the final day of September, the market rallied over 8%, with a record amount of trading as investors aimed to get invested before the market closed for “Golden Week”. The excitement witnessed in the world’s second-largest economy spilt over into the Hong Kong market, which advanced nearly 12% over the final days of September. Hong Kong has close economic ties with China and many mainland Chinese companies are listed on the Hong Kong index and as such is often considered as a proxy for China.

China represents around 33% of the emerging markets index and Hong Kong is a little over 3%, so the stellar performance of these markets had a notable positive impact on emerging market (and Asia) indices.

Aside from China, the other major news during September came from the US, where the US Fed cut interest rates for the first time in over four years. While it was widely telegraphed that an interest rate cut was coming during the September meeting, the magnitude of cut was unclear. The central bank was bold and delivered a 50bps (0.5%) reduction to the headline interest rate. Following the Jackson Hole speech by Fed Chair Jerome Powell it became clear that the US Fed were keen to support the labour market and the cut highlights this. There are also concerns of an economic slowdown and flagging consumer and as such it was deemed necessary to reduce interest rates. With US inflation falling to 2.5%, not too far from target, there was little deterrent for the central bank. Government bonds reacted favourably to the outsized drop in interest rates with the yield on the benchmark US 10-year government bond yield falling as low as 3.6% during September. The news also led to a weakening US Dollar. During the month sterling reached levels not seen since early 2022, touching 1.34 against the dollar.

Despite the US cutting rates, the Bank of England (BoE) decided to pause, keeping rates at 5%, having reduced at the August meeting. UK headline inflation data came in at 2.2%, however the services component was 5.6%, a troubling number for the BoE. Services inflation is widely considered as more persistent than goods inflation because it is less dependent on global events and more influenced by domestic costs. With eight of the nine voting members deciding to keep rates at 5%, it’s clear that the BoE will want to see further progress on inflation before lowering rates once more.

Staying with the UK, the equity market disappointed during the month. It seems some of the euphoria around the change of government has soured, with investors waiting to see how bad the news will be from the well-publicised UK Budget at the end of October.

Gold once again made new all-time highs, approaching $2,700 an ounce, a 25% rise in 2024. It has been hypothesised that Chinese investors have been increasing exposure, diverting money from the property market to physical gold. It’s clear global central banks have also been accumulating more of the asset class, potentially at the expense of their US Treasury bond holdings. Physical gold has been a mainstay in portfolios for many years, with the holding being the biggest contributor over the last 12 months.

Oil, which is sometimes referred to as black gold, hasn’t enjoyed the same success as gold in recent months. During September US Crude oil fell to new one-year lows, touching $66 a barrel. Despite tensions in the Middle East, there are limited immediate supply issues and there is the prospect of Saudi Arabia increasing production later in 2024. At the same time we’ve seen a slowdown in the global economy, raising concerns about the demand outlook. Lower oil prices should help support the consumer and put downward pressure on inflation. Despite a weaker oil price many of the major oil companies continue to trade on very attractive free-cash flow yields and pay handsome dividends.

September could be a pivotal month where the largest economy in the world cut interest rates and the second largest economy in the world unleashed huge stimulus plans. This has the potential to support risk-assets going forward, especially if the interventions help stimulate real GDP growth. Outside of equities, government bonds continue to offer positive real yields, however, one needs to be mindful of the inflation outlook and manage duration (interest rate sensitivity) carefully.

Andy Triggs

Head of Investments, Raymond James, Barbican

Appendix

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.