The Month In Markets - January 2025

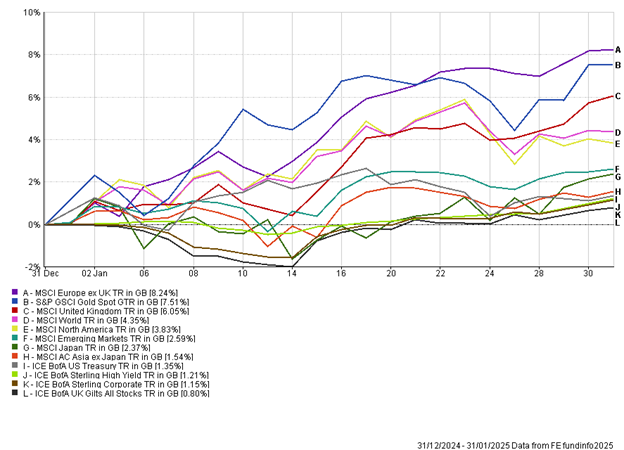

So much for a quiet start to the year! We’ve had Trump’s inauguration, threats to the artificial intelligence status quo, and quietly flying under the radar, UK large cap equities hitting all-time highs.

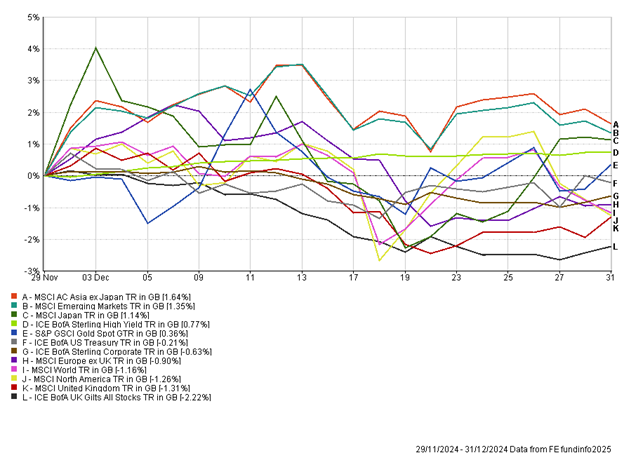

January was a month of two halves, with the first part characterised by the reemergence of inflation concerns, putting pressure on fixed income assets, while the second half of the month saw strong performance from a range of assets as softer inflation data supported markets.

As we started 2025, the market had become very pessimistic about the prospect of deep rate cuts in the US and UK. Recent data suggested that inflation could reaccelerate and as a result central banks would have to be mindful of releasing interest rates too soon. While only a few months ago there was talk of up to six interest rate cuts from the US and UK in 2025, by mid-January this had fallen to only one to two cuts. This created a headwind for fixed income assets and more rate-sensitive equities (small cap), leading to a challenging first two weeks of the year. The US inflation story was being driven by a strong economy with robust labour markets and wage growth. Here in the UK, there was less optimism around the strength of the economy, however, there were serious concerns that Labour’s autumn budget would lead to higher inflation as businesses raised prices to compensate for their extra national insurance bill. Companies such as Next and Sainsbury’s made strong statements around pricing, directly linking this to their increased National Insurance costs.

The mood shifted on 15 January when both US and UK inflation figures were released, with both numbers coming in below expectations. Suddenly, interest rate cuts were back on the table, with the view that the Bank of England would now be able to cut interest rates during the first week of February. Importantly, services inflation showed significant progress, something the BoE have been watching closely. Falling interest rates should support the consumer; UK mid-cap equities (which are more domestically focused) had fallen at the start of January but enjoyed a strong recovery in the second half of the year due to increased hope around the consumer. The same story was true in the US; the interest rate-sensitive, small-cap index rallied off the back of weaker inflation data.

By the end of the month, the UK large-cap index was making new all-time highs. It’s hard to say what the main driver behind this was, however, with around 75% of revenues coming from overseas, the index is truly international in nature. The unloved UK market was outdone in January by another unloved market – Europe. Perhaps asset allocators have updated their strategies for 2025 and redistributed capital into these lagging areas, where valuations are extremely depressed and offer attractive potential returns for long-term investors. The European Central Bank (ECB) has certainly been more accommodative than the Bank of England, with the ECB cutting interest rates in January, reducing the main refinancing rate to 2.9% – the rate was 4.5% back in May 2024. The expectation is for monetary policy to remain supportive in the Eurozone, and this has pushed up equity valuations.

The one-month return for US equities was very strong in absolute returns, yet it lagged behind the UK and Europe. We witnessed incredible volatility in the tech sector towards the end of the month, with the emergence of Chinese artificial intelligence (AI) DeepSeek threatening to shake up the AI stack. Their cutting-edge AI technology was developed on a shoestring budget, leading to concerns about the competitiveness of US firms going forward, including the expected high demand for the latest microchips. AI darling Nvidia, which had earlier in the month reached a market capitalisation of $3.7 trillion, becoming the world’s largest company once again, saw $590 billion in value wiped off in a single day. This was the largest ever one-day loss in terms of company value. It’s hard to know exactly how good DeepSeek is, but it has certainly created an air of uncertainty around AI leadership. Given that many US tech companies are highly valued, the sector can’t really afford any missteps.

It seems amazing to think this all went on and we still haven’t covered Trump’s inauguration! Trump was officially sworn in as the 47th US president on 20 January. He immediately signed a raft of executive orders, focusing on topics such as border security, economic policies and government transparency. Equity and bond markets responded positively to his inauguration, even as concerns around potential tariffs and their inflationary impact increased. Historical stock market returns have shown that the US president has little bearing on returns, although given some of Trump’s unorthodox plans, there could be a higher risk premium attached to the US market going forward.

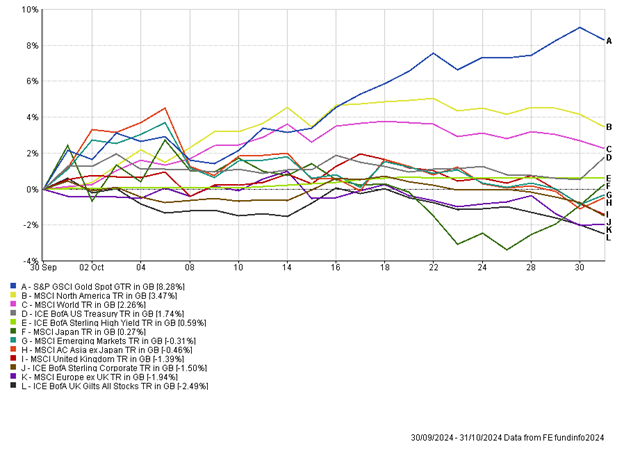

Gold had a positive month, approaching all-time high prices last seen prior to the US election result. Various factors are supporting gold, including increased demand due to geopolitical tensions, inflation concerns, central bank policies and government budget deficits. We have seen elevated central bank buying of gold throughout 2024 and there is no reason to believe this demand will diminish in 2025.

One may be surprised that January was such a strong month in markets, given the events that took place. This highlights the challenges of investing and the danger of trying to time the markets. The antidote for us is a well-diversified portfolio with limited risk concentration, which can perform in a wide range of outcomes.

Andy Triggs

Head Of Investments, Raymond James, Barbican

Appendix

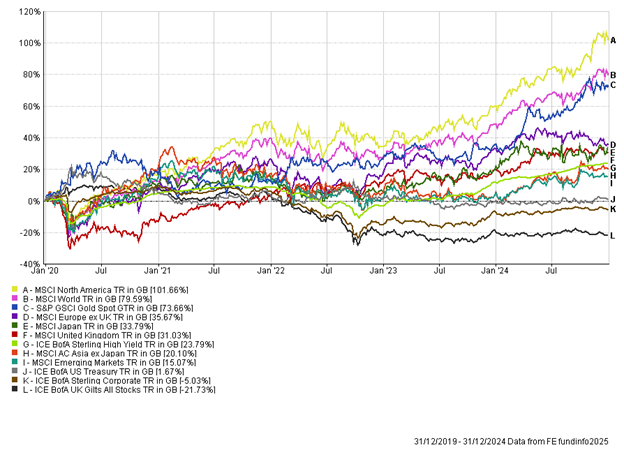

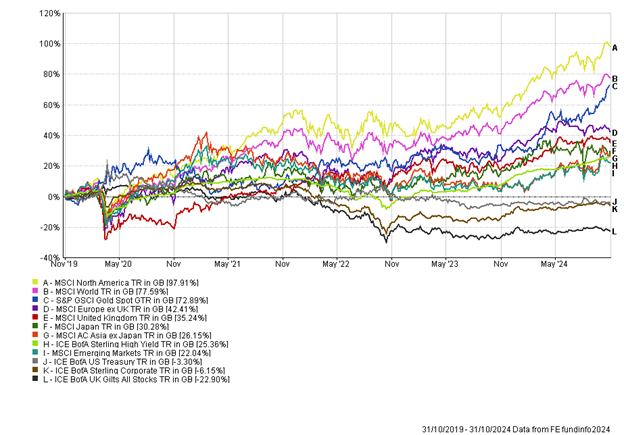

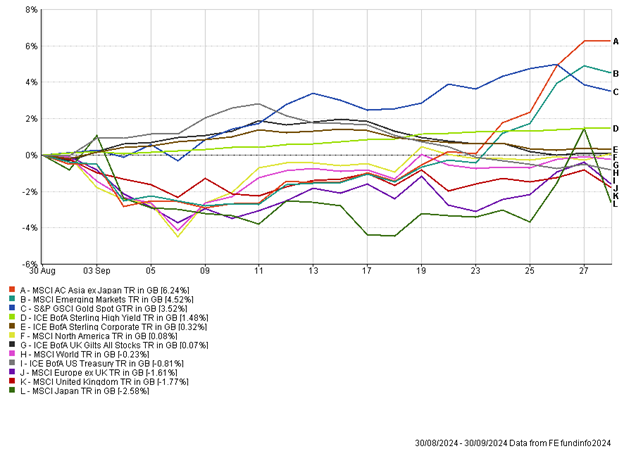

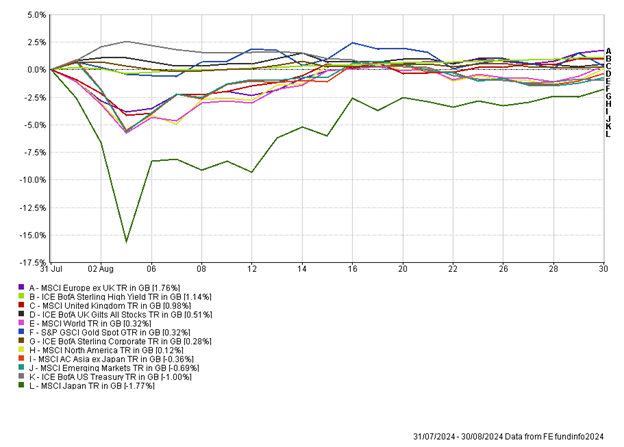

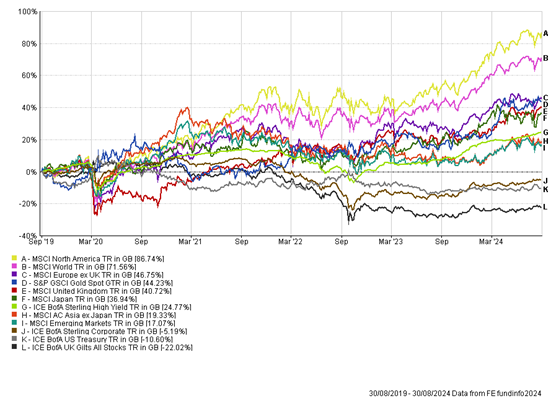

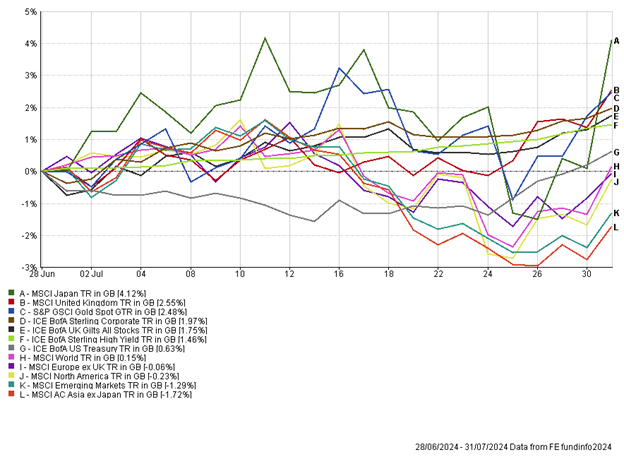

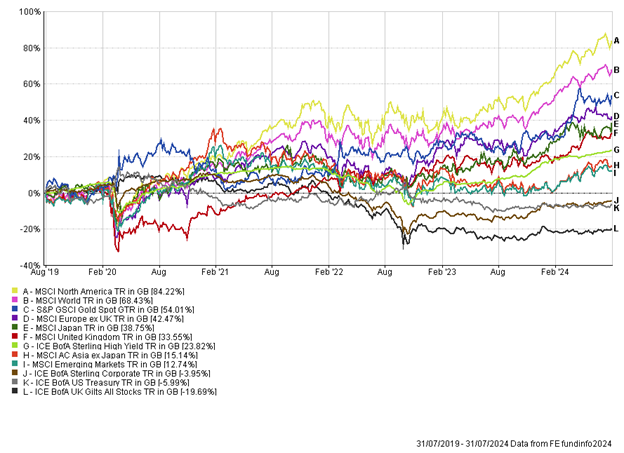

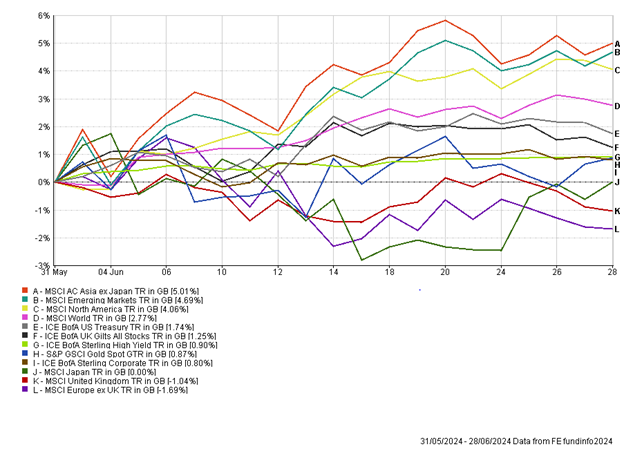

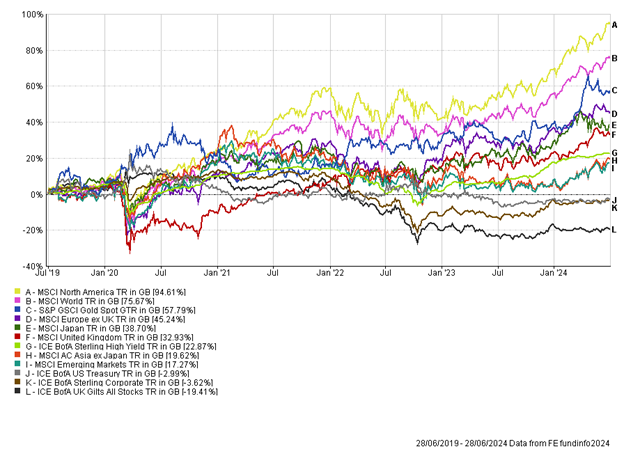

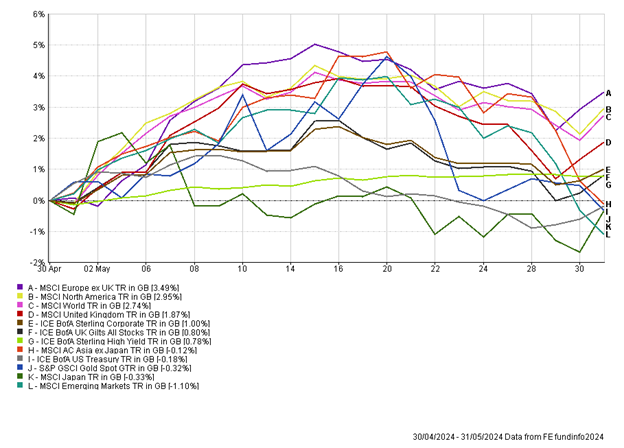

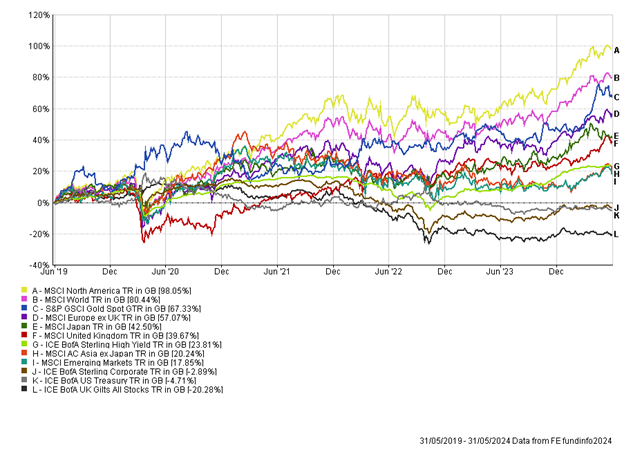

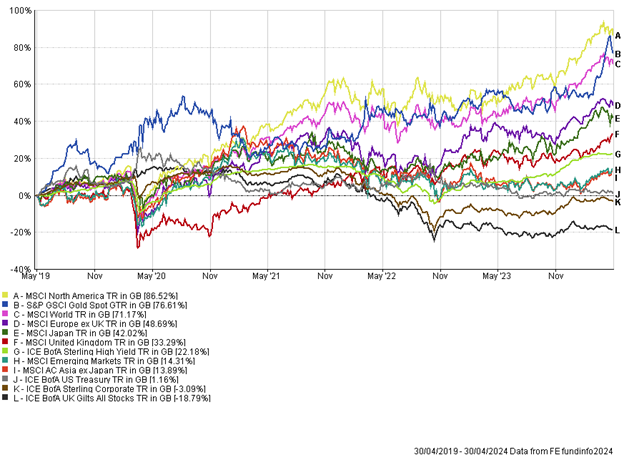

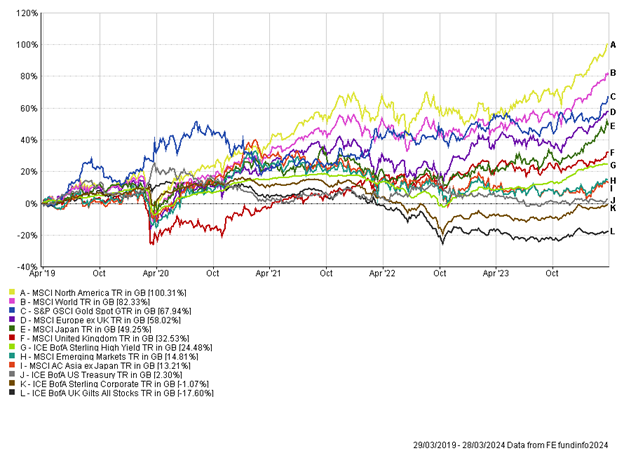

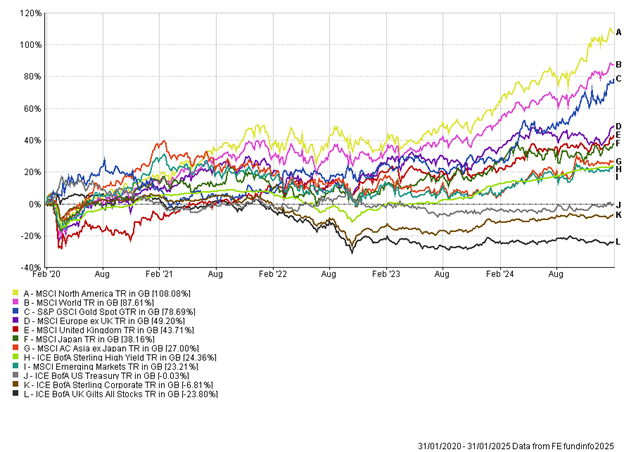

5-year performance chart

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results and forecasts are not a reliable indicator of future performance. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.