The Month In Markets - March 2024

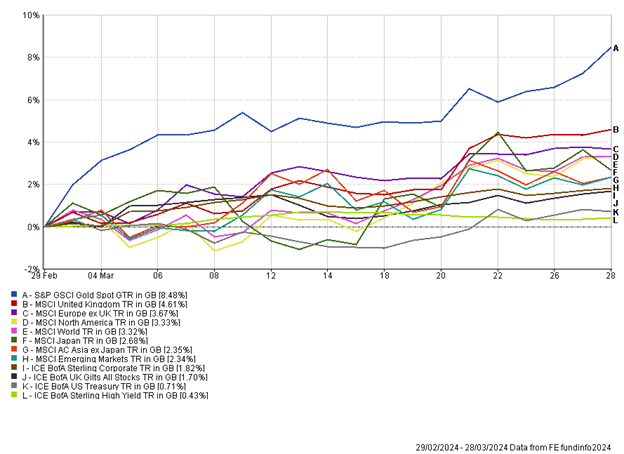

March was a strong month for a range of assets and brought to a close a pleasing first quarter. The positive momentum, particularly in equity markets, came off the back of elevated returns in the final two months of 2023.

There was somewhat of a reversal in equity leadership this month, with recent laggard, the UK, appearing as the top equity market during the month. UK corporate and government bonds outperformed their global peers as well, marking a strong month for UK assets.

The UK Spring Budget was in the spotlight at the start of the month, however, it was a fairly bland budget truth be told, although the lack of surprise was well received by markets, particularly the bond market, which is still carrying the scars of the now infamous mini budget in September 2022. Perhaps more powerful for UK assets was a combination of falling inflation and strong corporate activity.

Headline UK inflation fell more than expected to 3.4% and more importantly the outlook for the coming months is that inflation will be at, or even below, the 2% target. After being an outlier to the upside for much of 2023, the UK could in fact have sustained lower inflation than our developed market peers as we look forward to the remainder of this year (and into 2025). With inflation falling to target, the Bank of England (BoE) should soon be able to ease monetary policy which should support all UK assets. Economic data during the month showed that the UK economy is now likely already out of a technical recession. Labour markets are still strong, with the average worker now benefitting from a real pay rise, with wages growing faster than inflation, but importantly not at unsustainable levels which could cause inflation to spike once more. It’s been extremely unfashionable to be positive on the UK, however, we can make a very plausible argument for UK equities and bonds at this point in the cycle.

Mergers and acquisitions (M&A) activity in the UK market carried on at pace during March, with five listed companies bid for. The largest bid by size was Nationwide’s £2.9bn offer for Virgin Money. Over recent months we have seen a wide range of buyers for UK assets, including foreign and domestic private equity, as well as foreign and domestic corporates. The heightened activity, with bid premiums ranging from 12% – 61% in March helped boost UK equity indices. During the month ITV sold its 50% stake in Britbox to BBC studios for £255m cash and said they would return the proceeds through a share buyback plan. We are witnessing a considerable amount of share buybacks from UK listed companies. With depressed equity valuations, buyback programs can create significant long-term value for shareholders.

Stepping aside from the UK, global equity markets continued to advance. There were signs of leadership change; for many months it has been the “magnificent seven” mega cap names in the US pushing markets higher, but we are now seeing increased breadth in equity markets and some of the unloved areas beginning to advance. We see this as a healthy trend and one that favours our diversified approach.

Japanese equities had another impressive month, building on very strong performance in January and February. There is considerable momentum in the market, with allocators increasing weightings to the region. The Japanese Yen has weakened significantly over recent months and that has helped support the earnings of the large overseas exporters within the index. During March there was a landmark change in monetary policy with the Bank of Japan (BoJ) increasing interest rates for the first time in 17 years, taking interest rates out of negative territory. There is growing confidence that the Japanese economy is on a stronger footing and that the deflationary risks the country has faced are receding. The initial interest rate rise is likely to be followed by further interest rate hikes later in the year, although the BoJ will proceed with caution.

While the BoJ were raising rates we witnessed the first major central bank cut rates, with the Swiss National Bank surprising markets and reducing their headline interest rate by 0.25%. So far Europe, the US and UK have continued to hold rates steady, although we could see the first cuts occur over the summer months if inflationary pressures subside.

Gold hit new all-time highs during March with the spot price rising above $2,200 an ounce. It appears that many central banks are increasing their allocations to physical gold, potentially at the expense of US government bonds. There has also been a big pick-up in demand for gold from China. With the Chinese real estate market facing significant headwinds, many Chinese investors are moving away from this asset class and storing their wealth in gold.

Gold wasn’t the only commodity rising in March, with the oil price ticking up over the month. This helped support the oil sector, boosting share prices. Sustained rises in commodities such as oil could cause problems for the inflation doves; the huge spike in oil in 2022 was one of the big drivers of inflation.

Overall, a strong month and a strong quarter for capital markets and our investment portfolios. It was pleasing to see a broadening out of equity market performance from simply large-cap technology focused companies to other parts of the market, such as resources and financials. Our diversified, valuation sensitive approach ensured we held exposure to some of these unloved areas that rebounded. Gold is an asset we hold across all portfolios and was a big contributor during the month. We continue to see good long-term value in large parts of the equity market and are also finding compelling ideas in the fixed income market, with positive real yields now available. The strong run over the last five months has rewarded investors handsomely and provided returns significantly above those available on cash.

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

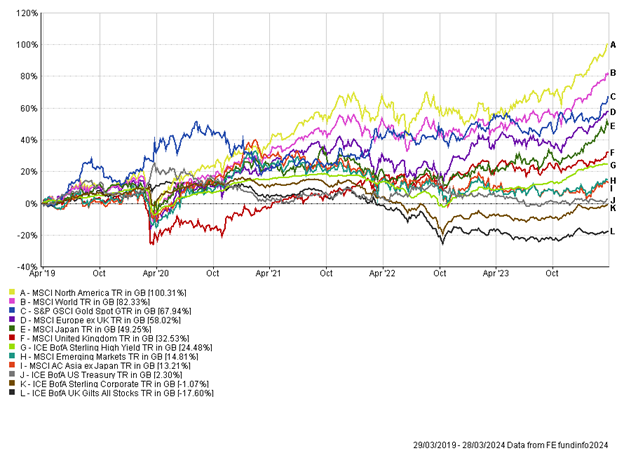

Appendix

5-year performance chart