This week has been a busy one for markets as we’ve seen the French President call for a snap parliament vote, manifestos released by the Conservative and Labour parties, as well as key UK & US data points.

On Wednesday, UK GDP (year-on-year) for April was reported at 0.6%, falling from the previous month’s figure of 0.7%. If we consider month-on-month data for April, GDP flatlined and this was the Labour party’s main point of attack on Rishi Sunak, claiming growth had stalled and there was nothing further the Prime Minister could do to counter this. The miserable weather has not been helping the UK economy, negatively impacting sectors such as manufacturing, construction and retail with April being reported as the wettest April since 2012.

There were further labour market data releases as UK unemployment for April unexpectedly rose to 4.4%. Wages including bonuses remained hot at 5.9%, despite the market forecasting a drop to 5.7%. The Bank of England will meet next Thursday to set rates; however, it is almost a certainty there will be no cut in the interest rate given elevated wage growth. This will be the final meeting before the upcoming General Election on 4th July.

The Conservative party have launched their 2024 election manifesto with policies including the return of the Help to Buy scheme, increasing the number of Doctors and nurses, increased defence spending and the abolition of national insurance for self employed workers. Two days later, Sir Keir Starmer announced the “pro-business” Labour manifesto, which included cutting hospital waiting lists, £1.8bn to upgrade ports and build supply chains, building 1.5 million new homes in the next five years and creating £8.6bn in tax revenue by abolishing the non-dom loophole. These weeklies will remain impartial to both parties, however the credibility of both manifestos has been questioned. Both parties will consider that unfunded tax cuts could cause another run-on Sterling and volatility in the gilt market.

Rounding up the UK, Raspberry Pi, known for designing single-board and modular computers, decided to IPO on the London stock exchange. Raspberry Pi has had a fantastic first week as a UK listed business, with the share price trading around £4, having listed at £2.80. This listing comes as a huge success for the London stock exchange which has recently suffered from other large companies choosing to list abroad. Deals like this could prompt firms to stay on the domestic market and even attract foreign company listings.

In Germany, we have seen the final figure for May’s inflation reported at 2.4%, a rise from the previous month’s figure of 2.2%. Around Europe it was expected that inflation would pick-up before falling to target later in 2024. Energy and food prices have been falling since the start of the year, so the pick-up was attributed to the end of the subsidised national transport scheme.

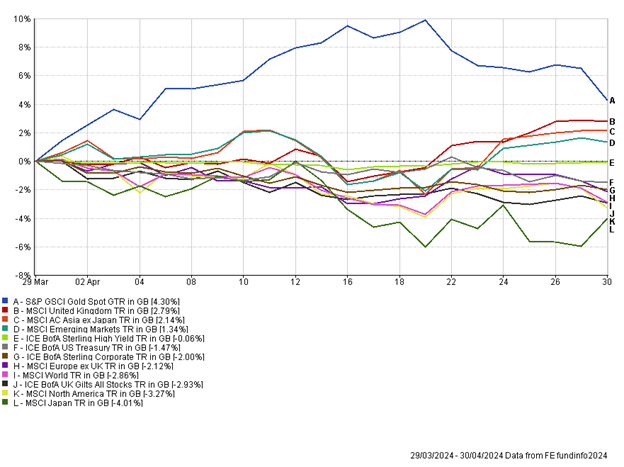

US markets were boosted with a pleasant surprise as inflation figures for the month of May fell. Headline inflation (year-on-year) fell to 3.3% and core inflation (excludes energy and food prices) fell to 3.4% from the previous month’s 3.6%. This has boosted equity markets with the S&P 500 and Nasdaq index up 1.7% and 3% for the week respectively. Like clockwork, the US Federal Reserve meeting was scheduled later that day and to no surprise, interest rates were held at 5.5%. Fed Chair, Jerome Powell, accepted that the most current data shows easing in inflation but stated the Fed wanted to “gain further confidence” before cutting rates. Markets are now pricing in just one rate cut for the year which could occur in a meeting before the US election in November.

At a company level Apple announced new artificial intelligence (AI) features into its technology. The news sent Apple’s stock soaring, rising above $3 trillion in market cap, leapfrogging Nvidia in terms of size.

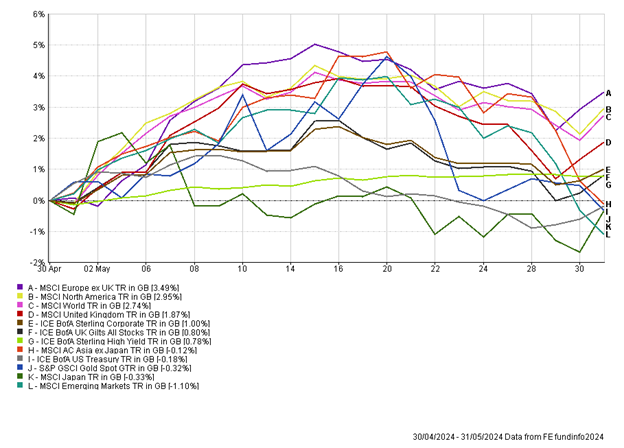

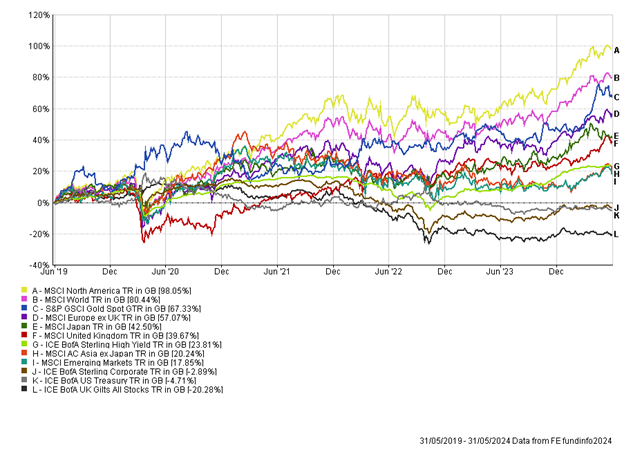

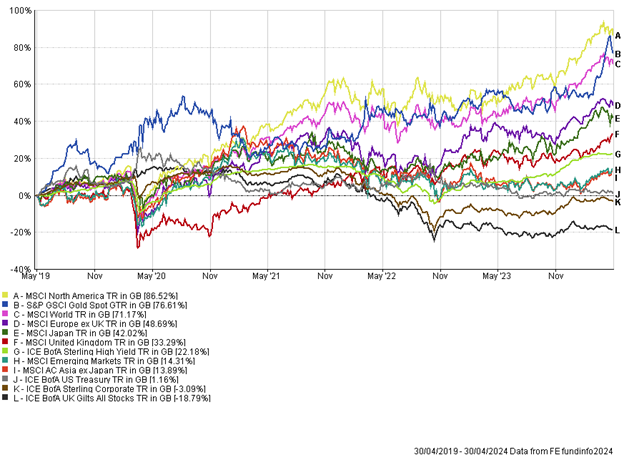

Weaker inflation and evidence of slowing growth was supportive for fixed income markets this week, with yields on government bonds falling (prices rising). These areas of portfolios have been laggards in 2024, so it was pleasing to see a rebound here. UK equities pulled back throughout the week, after a period of strength, while European equities also struggled. The bright spot was the US, where lower inflation data and the news of Apple embedding AI into their phones boosted indices. Next week we will have the latest UK inflation data, where it is expected to fall further and could potentially be at the 2% target. If markets gain confidence that inflation is being tamed then we could see strength in both equities and fixed income as lower interest rates get priced in.

Nathan Amaning, Investment Analyst

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.