In the first Monthly Market Commentary of the year, Raymond James European Strategist, Jeremy Batstone-Carr, looks back on the largely positive start to the year for many of the world’s leading markets, the struggles of the Chinese economy, and areas for investors to consider for the coming months.

The Week In Markets – 20th January – 26th January

Storm Isha and Storm Jocelyn battered the UK this week, with winds of up to 99mph being recorded. The storms brought disruption to travel, with much of the country operating under weather warnings. Investors in Chinese equities will have felt like they have been through a storm of late, however, there were signs of blue skies ahead after government intervention this week.

Chinese authorities stepped in this week with a raft of measures aimed at supporting the economy and improving stock market confidence. They cut the bank reserve rate by 0.5% in a move that should see around $140bn injected into the economy. The cut was the biggest in over two years. The Chinese regulator also sought to limit short-selling of Chinese stocks, as well as highlight future plans to support the real estate sector. There is an expectation that this change in tact from China could see further stimulus measures over the near-term. The announcements had the desired impact with Chinese and Hong Kong indices staging strong rallies in the second half of the week, lifting benchmarks from multi-year lows.

While the world’s second largest economy appears to be stalling the world’s largest economy, the US, reported stellar Q4 growth, exceeding expectations. The economy grew at an annualised pace of 3.3% in Q4. This strong growth rate, occurring at a time when inflation was falling, has helped further fuel the soft-landing narrative. US equity markets continued to advance this week, reaching new all-time highs, driven by the mega-cap names. The US small cap index remains well below highs; the strength of the US economy has the potential to lead to a recovery in smaller companies.

Staying with the US it looks as though it will be Trump vs Biden in the leadership race to be the next US President. We saw Ron DeSantis drop out of the presidential race and endorse Trump, who has also defeated Nikki Haley in the New Hampshire primaries.

At a company level we saw Q4 results from some of the large US companies. There were disappointing results from Tesla, whose stock price dropped over 10% on the news. While chipmaker Nvidia can seemingly do no wrong, others in the sector are not enjoying the same success – both Texas Instruments and Intel released underwhelming results with no expectation of a short-term turnaround.

The European Central Bank (ECB) maintained headline interest rates at 4.5% this week, which was expected. ECB President Lagarde continues to push back on the prospects of a spring rate cut – all eyes will be on Eurozone inflation next week to help gauge whether an imminent rate cut is likely.

There was positive news from the UK with better-than-expected services and manufacturing PMI data. The UK economy has shown resilience over the last 12 months and continues to muddle through, despite the pressure of interest rates at 5.25%.

In what has been a busy week we have seen Japanese inflation fall below target (2%), reaching two-year lows. This is despite interest rates still being held in negative territory in Japan. With little inflationary pressure, there is a diminishing likelihood of tightening of policy by the Bank of Japan.

The mixed start to the year for equity markets continues with regions such as Japan and the US performing very well, while China and Europe (including the UK) have been weaker. Bond markets in general have come under pressure as inflation and economic data have led investors recanting on the probability of rate cuts in the spring. Markets continue to be very short-term focused, with each data point or quarterly earnings report leading to volatility and shifts in sentiment. We continue to believe this short-term trend creates fantastic opportunities for long-term investors, who are willing to extend their time horizon.

Andy Triggs, Head of Investments

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 13th January – 19th January 2024

The Artificial Intelligence (AI) theme was a key driver of performance in 2023 with firms such as Microsoft and Nvidia battling to be the market leader of the technology. Both firms have greatly benefitted from the AI “bubble” and this week Microsoft overtook Apple as the world’s largest company by market capitalisation. Currently standing at a valuation of $2.9 trillion, the firm is the largest investor in the popular ChatGPT application and have been adding AI into Microsoft products such as Bing search engine.

UK inflation has been on a sharp decline from its high of 10.4% in February 2023, however for December 2023 (data released on Wednesday) we saw headline inflation rise for the first time in 10 months. Surprising economists, CPI rose to 4% from 3.9% and was higher than the expectation of 3.8%. Core inflation (excludes food and energy prices) froze at 5.1%. Following the last Autumn statement, there was a rise in tobacco duty at the end of November and this has been reported as the key driver of inflation, adding 0.1%. Intriguingly, only 12.9% of the UK population (aged 18 and above) smoked cigarettes over the past year, a record low proportion as the UK Government continue to tackle smoking prevalence.

Finalised inflation data from the Eurozone was released late Wednesday morning. Headline inflation as expected rose from November’s 2.4% to 2.9%. Core inflation fell in line with market expectation to 3.4%. The European Central Bank (ECB) stood firm on their decision to pause interest rates as they did not expect inflation to fall as quick as investors had hoped. Wages in the eurozone have now been singled out as the largest risk to the fight against inflation as market expectations for 2024 are 4.3%. As wages increase, costs for firms increase and this cost is then passed through to the price of goods and services, hence pushing up inflation.

Germany are leading exporters of machinery and vehicles however prevalent inflation, high energy prices and falling global demand has led to the economy contracting -0.3% over 2023. Europe’s largest economy did manage to avoid a recession as GDP over Q4 2023 was flat, recovering from the negative print in Q3. Economists do not have an optimistic tone on 2024 for the country as they estimate energy prices will have to halve in order for the country to regain competitiveness, something that is seen as unlikely to happen.

UK retail sales were released just this morning and the falls were alarming. Retail sales (year-on-year) for December fell -2.4%, a large deviation from investor expectations of 1.1%. Month-on-month, for December, they fell -3.2%, well below expectations of -0.5%. This is the worst monthly drop (excluding the pandemic) since 2008 and again the fear of a recession in the UK has risen as we await Q4 2023 figures. British luxury brand, Burberry, have announced a fall in operating profits amid slowing luxury demand – further signs of consumers pulling back on non-essential goods. The sharp drop in figures is likely to be taken as good news to investors, sales are dwindling due to the restrictive monetary policy, and this makes the chances of interest rates cuts occurring more likely.

If we look across the Atlantic to the US, retail sales tell another story as sales rose in December (month-on-month) 0.6%, above forecasts of 0.4%. This was boosted by increases in car sales and online purchases. The US economy is still strong, unemployment remains low, and wages are now rising above inflation. All this has made investors question whether the expectation of interest rate cuts starting in March 2024 was a little premature. As a result of this, we have seen weakness in the US bond market along with small cap equities, which are often the most interest rate sensitive parts of the market. Fed Governor, Christopher Waller, said the US Fed would be “moving carefully and methodically”, not giving away any indications on monetary policy.

Data from China this week showed their recovery from COVID-19 continues to be bumpy. While the economy grew by 5.3% in 2023, growth in Q4 was very lacklustre, as the effects of the re-opening of the Chinese economy wain. The COVID-19 bounce is well and truly over, which could lead to limited growth in 2024 for the world’s second largest economy. Youth unemployment data, which hasn’t been shared for six months was now reported and showed youth unemployment at a little over 14%, lower than the high of 21% in June 2023. While China’s outlook is more precarious than it has been in many years, the stock market has heavily discounted this, with equity markets down over 50% for the last three years.

The bumpy start to 2024 continued this week with a mix of data helping to muddle views about inflation and interest rates. Focusing on single data points can be limiting; it is often better to focus on the trend. We continue to see the trend in inflation as lower, and this should be supportive for a wide range of asset classes in 2024.

Nathan Amaning, Investment Analyst.

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 6th January – 12th January 2024

This year’s political merry-go-round has already begun in France as we saw ex-Prime Minister Elisabeth Borne resign after meeting with President Macron. She has been succeeded by 34-year-old educational minister, Gabriel Attal. Macron was instrumental in the move, aiming to sway voters five months before the country’s parliament election.

Mr Attal was a firm favourite for the role as he’s been described as a “baby Macron” with comparisons made in terms of ambition and strong media presence. He has stood firm on tough decisions during his time as educational minister and Macron certainly trusts him to reunite his party that has become fractured after unpopular pension changes and more recently, strict immigration laws.

In the UK, the pinch of higher interest rates continues to hurt households as 39% more households in December 23 were unable to pay their energy bills. Energy bills initially jumped in February 2022 when Russia invaded Ukraine, and consumers became constrained by 14 consecutive interest rate hikes taking interest rates to 5.25%. Over the 2022 winter period into 2023 spring the UK government subsidised energy bills, however this has since been scrapped taking its toll on more households. We’ve previously written on the falls seen in oil and gas prices, but this has not yet fed through to regulated household energy tariffs. More pleasing for the UK was the release of GDP data on Friday morning which showed the UK economy grew 0.3% on a monthly basis, higher than anticipated.

We’ve seen markets accelerate through the last couple of months in 2023 and portfolios have enjoyed the “Santa Rally”, but this year has so far been more subdued. US inflation data, released on Thursday had potential to re-ignite asset markets. However, there was a mixed reaction in markets as headline inflation came in at 3.4% (year-on-year), a rise from the November figure of 3.1% and market expectations of 3.2%. Core inflation fell to 3.9% which wasn’t quite the drop expected as markets forecasted 3.8% but was a slight drop from the previous figure of 4%. Shelter (rents) continues to be the key driving force behind the high inflation data. However, there is still the very real prospect for rental inflation to soften over the coming months, which will help bring inflation closer to target, and would likely be well received by markets.

Weekly jobless claims, also out on Thursday, came in lower than market expectations at 202,000. March is the month investors have placed their bets for central banks to begin rate cuts, however the data points are proving there is no sign of weakening in the labour market at the start of this year.

In the UK we narrowly avoided weeklong tube strikes this week however this has not been the case in Germany. Europe ‘s largest economy is battling travel disruption on many fronts as not only did train drivers call a three-day nationwide strike, but farmers have lined hundreds of tractors outside Berlin’s Brandenburg Gate in a bid to pressurise the government into scraping plans to cut farmer subsidies. Strikes are one of a growing list of problems for Chancellor Olaf Scholz’s government that is already facing a declining economy and the headwind of high interest rates.

While much of the developed world continues to tackle elevated inflation, China is continuing to struggle with persistent deflationary pressures. Data released this week showed prices fell (deflation) by -0.3% over the year. The producer price index (PPI) which measures factory gate prices dropped by -2.7%, a 15th consecutive decline, highlighting that downward pressures on prices are unlikely to dissipate in the near term.

A bright spot this week has been the Japanese stock market. Tokyo core CPI data showed inflation at 2.1%, falling from the previous month and highlighting inflation is well under control in Japan. This coupled with low interest rates and low equity valuations helped spur the Japanese equity market higher. The Nikkei 225 (Japan index) is trading at levels not seen since February 1990 and has already rallied 7% in January alone.

Markets continue to wrestle with views on inflation and interest rates. After a couple of months of very soft data, Thursday’s US inflation print has made investors question whether falling inflation is still such a sure bet. The trend certainly appears to be lower for inflation, but whether we will see six interest rate cuts in the US this year remains to be seen. As always we will be active in our exposure and stay diversified in our approach.

Nathan Amaning, Investment Analyst.

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

2024 Outlook

The Month In Markets – December 2023

The Month In Markets - December 2023

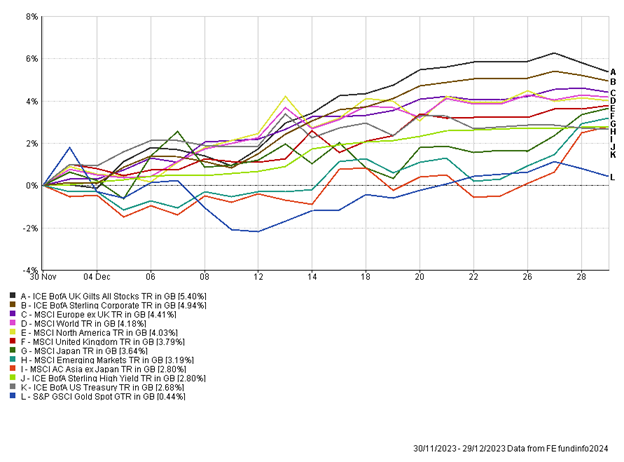

Markets resembled a see-saw for much of 2023, rising up one month, only to fall back down the following month. However, after strong moves upwards in November, markets did not see-saw down to earth, but extended gains to finish the year off strongly.

Stock market gains in December are often referred to as the “Santa Rally”. Investors had clearly been well behaved this year and avoided being on the naughty list; they were rewarded with handsome returns across equity and bond markets this December.

The rally in markets appears to have been driven by continuing conviction in the view that inflation is fast approaching target in developed markets and soon central banks will be able to cut interest rates which should help support the consumer and corporates alike. The key has been the change in expectation – over the summer months, bond and equity markets were pricing in a much more challenging environment; one of high interest rates and stubborn inflation. A combination of economic data and central bank rhetoric has helped changed the narrative recently.

Markets were supported by pleasing inflation data from developed markets during December (data covers November). Here in the UK, inflation came in at 3.9%, much lower than expected. The UK has closed the gap in recent months with its peers, after being a clear outlier with elevated inflation. Across the pond, US headline inflation was 3.1%, while Eurozone inflation was 2.4%, only marginally above the 2% target. Within the Eurozone, countries such as Italy are now flirting with deflation. This data will make it challenging for the European Central Bank to persist with holding interest rates in restrictive territory as we head into 2024.

Alongside inflation data, the US Federal Reserve, Bank of England (BoE) and European Central Bank (ECB) all met to set interest rate policy with all three central banks continuing to hold rates at current levels. Accompanying the meetings were press conferences, with US Fed Chair Jerome Powell appearing particularly dovish, mentioning the prospect of the first interest rate cut. His contemporaries, Andrew Bailey (BoE) and Christine Lagarde (ECB), attempted to deliver a much firmer message that their fight with inflation was not yet over, and the prospect of rate cuts was premature, however, the market did not take note and continued to believe the data would dictate rates cuts in the first half of 2024.

The labour market continued to paint a rosy picture, with unemployment remaining low across developed markets while wage growth is now outpacing inflation in most major markets.

This cocktail of data helped provide markets with the sense of a dramatically improving picture for 2024; low probability of recession, falling inflation and falling interest rates. It was enough for asset prices to continue their march up from November, with almost all assets advancing, a complete reversal of 2022 when assets all fell together.

UK fixed income assets, including government bonds and corporate bonds performed exceptionally well in December. This was driven by falling interest rate expectations, with the more interest rate sensitive (typically longer-maturity) bonds seeing the biggest gains. Global bond markets in general continued to make handsome gains following positive moves in November. The major global bond index had its best two-month period since 1990.

Most major equity markets made gains during the month, with small and mid-cap stocks generally leading markets higher. Within the UK, the large cap equity index delivered circa 4%, while the more domestically focused mid-cap index advanced over 9%. Small and mid-cap equities are viewed as more interest rate sensitive; these stocks struggled in 2022 and for much of 2023, but the big shift in inflation and rate expectations led to large gains towards the end of the year. The same was true in the US, with the Russell 2000 (US small cap index) following up a strong November with a stellar December, making it one of the best two-month periods on record.

It’s interesting to note that most of the equity gains were driven by a ‘re-rating’, that is stocks becoming more expensive, as opposed to expectations of higher profits and earnings in 2024. We still see continued value in many equity markets, with the potential to re-rate further, but are also mindful of pockets of the equity market which are now looking expensive.

The rally in Q4 was broad-based with equities and bonds advancing together. While much of 2023 was bumpy, by year-end most asset markets were at year-to-date highs. The same was true for our portfolios, which rallied strongly towards the end of 2023. While cash rates have been at their highest levels for many years, our portfolios still managed to outperform a typical one-year fixed rate deposit. History has repeatedly shown that over the long-term cash as an investment lag both bonds and equities and we continue to believe this will be the case going forward.

We would like to thank everyone for their support in 2023 and wish you all a Happy New Year!

Andy Triggs

Head of Investments, Raymond James, Barbican

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

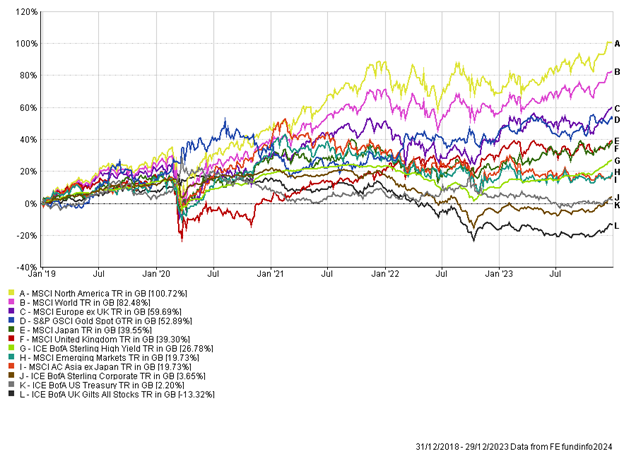

Appendix

5-year performance chart

The Week in Markets – 2nd January – 5th January 2024

Happy New Year and welcome to the first weekly note of the year. The current high interest rate environment looks to have led to people trading down as discount grocery stores Aldi and Lidl ran up their best ever trading day on Friday 22nd December. It is estimated that half a million shoppers switched permanently from the mainstream Tesco and Sainsbury to the discount stores. Tesco are set to release reports on how they fared over the Christmas period.

It is difficult to sit at the start of the year and forecast what is going to happen. However, that doesn’t stop us from making predictions and planning for a variety of different outcomes. Will inflation remain sticky or fall to the 2% target? Will central banks cut rates more than expected? Will we see the long and variable lags of monetary policy? Will we avoid a recession? Will potential elections influence markets? All valid questions that only time will answer.

On Thursday afternoon, labour leader, Sir Kier Starmer gave his first speech of the year. In his speech “Project Hope” he set out five main missions which include getting Britain building houses again, to decarbonise UK energy by 2030 and getting the NHS back on its feet. Election years can have significant impact on investor sentiment so it will be important to stay on top of the political landscape this year.

Halifax bank reported UK house prices (year-on-year) rose for the first time in eight months as prices were 1.7% higher than the previous December. This has been due to a tight sellers’ market with not as many houses up for sale. In this higher interest rate environment mortgage rates have surged, and activity has fallen. However, as we have seen the pause in interest rates and investors flirting with the idea rates will be cut soon, buyers and sellers have begun to return to the market. The feeling is that as more people come to market, house prices could fall within the 2% to 4% mark and with mortgage rates continuing to drop, buyer confidence should increase, seeing more movement in the housing market.

US job openings was the first insight of the year into the labour market, with openings falling to 8.79m in November. This will be encouraging for the US Federal Reserve as a sign that the labour market is cooling and strengthen investor expectations of rate cuts later this year. Another positive sign for the US Fed is that the number of people quitting their jobs fell to 3.47m, the lowest level since February 2021. With less people quitting and job-hopping this should help ease wage growth.

We then received mixed market messages this afternoon as December US Non-Farm Payrolls data was released and surprised as 216,000 jobs were added to the economy. This came in largely above market expectations of 170,000. The strength of the number of jobs added to the economy should keep pressure on wages and bonds yields rose on the back of the data as investors mulled over whether an expected six interest rate cuts in 2024 was too optimistic.

The Eurozone may be in bigger trouble than first anticipated as business activity contracted in December. Purchasing Managers Index (PMI) is an index that indicates the direction a sector is heading (whether contractionary or expansionary), and the services PMI is currently still in the contractionary zone at 48.8. This could point towards a recessionary period as growth struggles continue; Q4 2023 GDP data could be negative as it was in Q3 2023.

Eurozone inflation as predicted by ECB President, Christine Lagarde, rebounded to 2.9% (year-on-year) in December. It was anticipated that the rise would occur due to the change in the energy price base, but core inflation (excluding food and energy) dropped to 3.4% in December from 3.6% the previous month. This strengthens the ECB’s decision to continue to hold rates firm.

The Santa Rally certainly delivered in the closing month of 2023, however, the first week of 2024 has been subdued. The tech-heavy NASDAQ 100 has just seen five back-to-back days closing down. The last time this event occurred was in December 2022, and following this the NASDAQ 100 went on to post stellar gains in 2023. We continue to stand by our beliefs on diversification within portfolios, allowing us not to be caught out by short term volatility. After such a strong end to the year, it is natural that there is an element of profit taking and rotation of out last year’s winners. We continue to see great value in many areas of the equity and fixed income markets and believe the backdrop of declining inflation, mild growth and an end to high interest rates should be supportive for asset markets.

Nathan Amaning, Investment Analyst.

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

Raymond James, Barbican Newsletter

After an indecisive election campaign, the Prime Minister, despite his previous role as Chancellor of the Exchequer, was surprised to realise that the Conservatives just didn’t have the numbers to form a majority government. In an unexpected turn of events, no other party was able to either, and so Labour were only able to form a minority government. Ramsey Macdonald’s 1924 government, supported by Asquith’s Liberals, only lasted nine months.

So much has happened in 2023 so, as we head into 2024 – an election year, both here in the UK and, of course, the USA – now may be a good time to ensure we plan for every eventuality. While each person will have individual needs and this newsletter is not meant in any way as advice, it would be useful to give consideration to the following areas to ensure they are not forgotten.

Lifetime allowance

In a surprising announcement by Jeremy Hunt, in order to encourage doctors to continue working, in his 2023 budget scrapped the lifetime allowance. Scrapping the limit on how much pension one can build up tax efficiently (currently £1,073,100 and originally meant to rise in line with inflation), potentially means greater planning flexibility not just for doctors but everyone addressing their future retirement. The simultaneous increase in annual allowance from £40,000 per annum to £60,000 has also enabled many to fund more into pensions than they were able to previously. As pension funding sometimes involves using allowances from previous tax years, this is an area to ensure you allow enough time to consider before the tax year end.

Flexible ISAs

Not all ISAs are the same. While everyone is probably aware that they can fund £20,000 into their ISAs, one of the areas we are still surprised by is how many individuals have not got flexible ISAs. A flexible ISA will allow you to withdraw monies from your ISA during a tax year and, provided it is replaced in the ISA within the same tax year, the allowance is protected. Shouldn’t all ISAs be flexible? We would be happy to check if any that we do not look after on your behalf offer this important facility.

Also, if you haven’t funded your ISA this tax year, please do get in touch. This is a ‘use it or lose it’ allowance and so don’t leave it too late.

State pension entitlement

Entitlement to the full State pension is now based on a contribution record of 35 years of qualifying NI payments. If you had a career break or worked abroad you may find that you do not have enough for the full state pension. You are able to buy extra years to close this gap and at present you can go back as far as 2006 to top-up your entitlement in some of those years. However, this is changing from 2025 (from when you will only be able to go back six years) meaning this could be an important time to review your entitlement.

The first step is to check your current entitlement: https://www.gov.uk/check-state-pension

Only top up if you will get more pension. Speak to us if you need any help.

Welcoming new members and wishing adieu to one

It is now four months since we moved into our new office at 90 Basinghall Street. We are already at home here and the coffee machine and water fountain are working hard to keep both clients and staff properly caffeinated and hydrated. It has been wonderful too to welcome new members to the team:

James Hawkes is a welcome new addition to our Investment Committee. He worked with many of the team until 2015 when he joined Coutts, where he is now a Senior Multi-Asset Portfolio Manager. His expertise within asset allocation, portfolio construction and fixed income investing makes him a great fit for our Investment Committee.

We also have a number of new staff on the team:

Judith Parr, Aneeka Patel, and Nader Razak are Financial Planners and bring a wealth of experience to their roles with Raymond James Barbican. With the joining of Khaya Nyathi, our support team have found a wonderful new signing and the fact that he plays football so well is also a boon for our five-a-side team.

Talking of good news, it is lovely to also welcome our newest, in every way, member to the team. Huge congratulations to Harry Robinson and all his family on the arrival of their new baby daughter and sister. We look forward to seeing them in the office soon.

One final thing to share, which is both good and a little sad. Nick Lowy has now retired and we will miss his sunny optimism in the office. We wish him and Alison a wonderful retirement and look forward to seeing them at the summer party and investment lunches.

As always, please do get in touch if there is anything we can help with and do let us know if there are others who you feel we could help. Irrespective of who is in Downing Street, we know that when it comes to our clients, they can count on us to make a difference.

With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

The Week In Markets – 16th December – 21st December 2023

There are just four days to Christmas Day, but celebrations have begun early as markets have continued to soar. Falling inflation within the Eurozone and UK has continued to spur markets on.

UK inflation was released on Wednesday, falling to 2-year lows. Headline inflation for November (year-on-year) fell to 3.9%, down from 4.6% the previous month. Core inflation (excludes food and energy prices) fell to 5.1%, beating expectations of 5.6% and October’s previous 5.7%. This strengthens the case for interest rate cuts by the Bank of England (BoE) next year and investors have begun to price rate cuts by the beginning of Q2 2024. UK government bonds, which have been unloved for much of the year, have performed very well over the last six weeks, and this week was no different. The yield on the 10-year UK government bond fell to 3.5%, after reaching 4.7% only weeks ago, as investors reacted to lower inflation and the expectation of rate cuts in early 2024.

Eurozone inflation for November was released on Tuesday, showing inflation is now only just above the 2% target. 2.4% was the final figure (year-on-year) which was in line with market expectations and a fall from the previous month’s 2.9%. European Central Bank (ECB) President, Christine Lagarde, has warned against investors celebrating too soon and pushed back on early interest rate cuts. However, the market has so far dismissed her comments, believing the ECB will be forced to cut rates early in 2024. The yield on the 10-year German Bund dropped below 2% this week.

Assessing Eurozone inflation at a country level, it is tough not to be optimistic with regards to inflation. Year-on-year inflation dropped in 21 of the EU’s member states and remained the same in three more. In the case of Italy, headline inflation (year-on-year) has dropped off a cliff since September, falling from 5.3% to 0.6% in November, again largely driven by energy. It appears that for certain nations, deflation could soon be more of a risk than elevated inflation.

US home sales have risen in November by 0.8% (month-on-month), breaking five consecutive monthly falls. The popular US 30-year fixed rate mortgage rose to a 23 year high of 7.8% in late October but has since dropped off to 6.6% as US treasury yields have fallen. The market expectation that interest rates will be cut in 2024 has also fuelled the housing market, however two thirds of home owners are currently locked into mortgages under 4%. This will mean mortgage rates will have to continue to fall before we see significant shifts in the housing market. US equities have continued to advance this week and bond yields fall, with the US 10-year yield now falling through 4%. The market is now pricing in six interest rate cuts in 2024.

In the US, two of Hollywood’s big five studios, Warner Bros and Paramount, have held discussions for a possible merger. The main motivation behind the deal is to combine the streaming services, Paramount Plus and Max (formerly HBO) in order to better rival Netflix and Disney Plus, who are dominating the streaming space. Netflix has recently cracked down on account password sharing, leading to more account openings and are up to 247.2m subscribers. The combination of Paramount Plus and Max subscribers would still be under 160m.

The strong moves in December have been pleasing to see, helping push portfolios to their highest levels in 2023. With plenty of cash still on the sidelines, M&A activity picking up and interest rate cuts potentially around the corner there is reason to believe this rally can continue into 2024.

This will be our last weekly round-up of 2023 and we would like to thank everyone for their support over the year.

Nathan Amaning, Investment Analyst.

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.

The Week In Markets – 9th December -15th December 2023

It looks like the Santa Rally well and truly arrived this week, with big moves upwards in both equities and bonds. The key driver seems to be the belief that central banks have now come to the end of the rate hiking cycle and will “pivot” very shortly, beginning interest rates cuts in 2024. There has been a big shift in market narrative from the summer months when “higher-for-longer” was the clear message.

It was a busy week for central banks, however, before they met we did receive US inflation data on Tuesday, which came in at 3.1% (year-on-year), in line with expectations. This was a slight drop from the previous month’s figure of 3.2%. The data cemented the US Fed’s decision to hold interest rates. While this was expected, it was Fed Chair Powell’s statement that led to asset markets bouncing. It’s clear that the US Fed are now willing to cut rates in 2024, even if the economy is not in a recession, with the US Fed currently expecting to cut interest rates three times next year. The market went further than this, and after hearing the speech from Powell, quickly priced in six rate cuts in 2024. The expectation of lower rates, which will support both consumers and corporates sent the Russell 2000 (US small cap index) up over 3% on Wednesday, with a similar return on Thursday. The index is now at a 52-week high, having been at its 52-week low only 48 days ago! Nearly all equity markets joined the party, with the tech-heavy NASDAQ index reaching all-time highs, and the S&P 500 fast approaching its all-time high, which occurred on 2nd January 2022. Lower rates acted as support for bond markets; the US 10-year government bond yield dropped below 4% this week, having hit a 16 year high of 5% only weeks ago. In such a risk-on environment, coupled with lower interest rate expectations, we have seen the USD weaken against a basket of currencies, including Sterling, which is approaching 1.28.

Both the Bank of England (BoE) and European Central Bank (ECB) followed suit and held rates steady. However, there was a difference in commentary with both Andrew Bailey (BoE) and Christine Lagarde (ECB) stating they are yet to consider interest rate cuts. It appears the market isn’t convinced of this and are pricing in cuts starting next year. Weaker than expected UK GDP data on Monday highlighted that the lagged effects of higher rates are beginning to bite and supports the view that the BoE will be forced to cut rates to support the economy as we look into 2024. Much like the US, we saw bonds rally, with the UK 10-year government bond yield dropping as low as 3.7% this week. Equities advanced, with the more domestic focussed UK mid-cap index benefitting the most, rising over 3% on Thursday. In general, small and mid-cap equities are seen as more interest rate sensitive and therefore stand to benefit the most from lower rates going forward. While positioning here has been painful at times, it’s pleasing to see the recovery over the last six weeks.

It wasn’t just bonds and equities that performed well this week, we saw gold rebound after a lacklustre start to the week. The prospect of inflation with lower rates (falling real yields), coupled with a weaker dollar boosted the precious metal, with the price per ounce moving back above $2,000. Commodities such as copper also performed well on the back of a weaker dollar and the expectation of more supportive policy from developed market central banks.

Purchasing Managers’ Index (PMI) from Europe and the UK, released this morning, highlighted that most countries were seeing contraction in manufacturing and services sectors, once again pointing towards a slowing global economy. This will do little to dampen the views that interest rates will need to drop next year to help ease the strain on economies and support economic growth.

After months of oscillating markets, there has been a shift since the start of November, with the consensus now firmly pointing towards a peak in interest rates, with cuts just round the corner. In terms of inflation, the narrative is that the battle is largely won, the white flag has been waived, and we will approach the 2% target in 2024/2025. Indeed, Eurozone inflation is already at 2.4%, a whisker away from target. The positive correlation we have seen between bonds and equities has now worked in investors favour (as opposed to 2022), with both asset classes rising together. Within portfolios it’s been pleasing to see a broadening out of equity market participation with some of the small and mid-cap funds performing well. While it hasn’t always felt comfortable to be invested in 2023, portfolios are now at their highest levels for the calendar year.

Andy Triggs, Head of Investment & Nathan Amaning, Investment Analyst.

Risk warning: With investing, your capital is at risk. The value of investments and the income from them can go down as well as up and you may not recover the amount of your initial investment. Certain investments carry a higher degree of risk than others and are, therefore, unsuitable for some investors.